S&P 500 Futures Daily Insights for Tue 28 Feb 2023

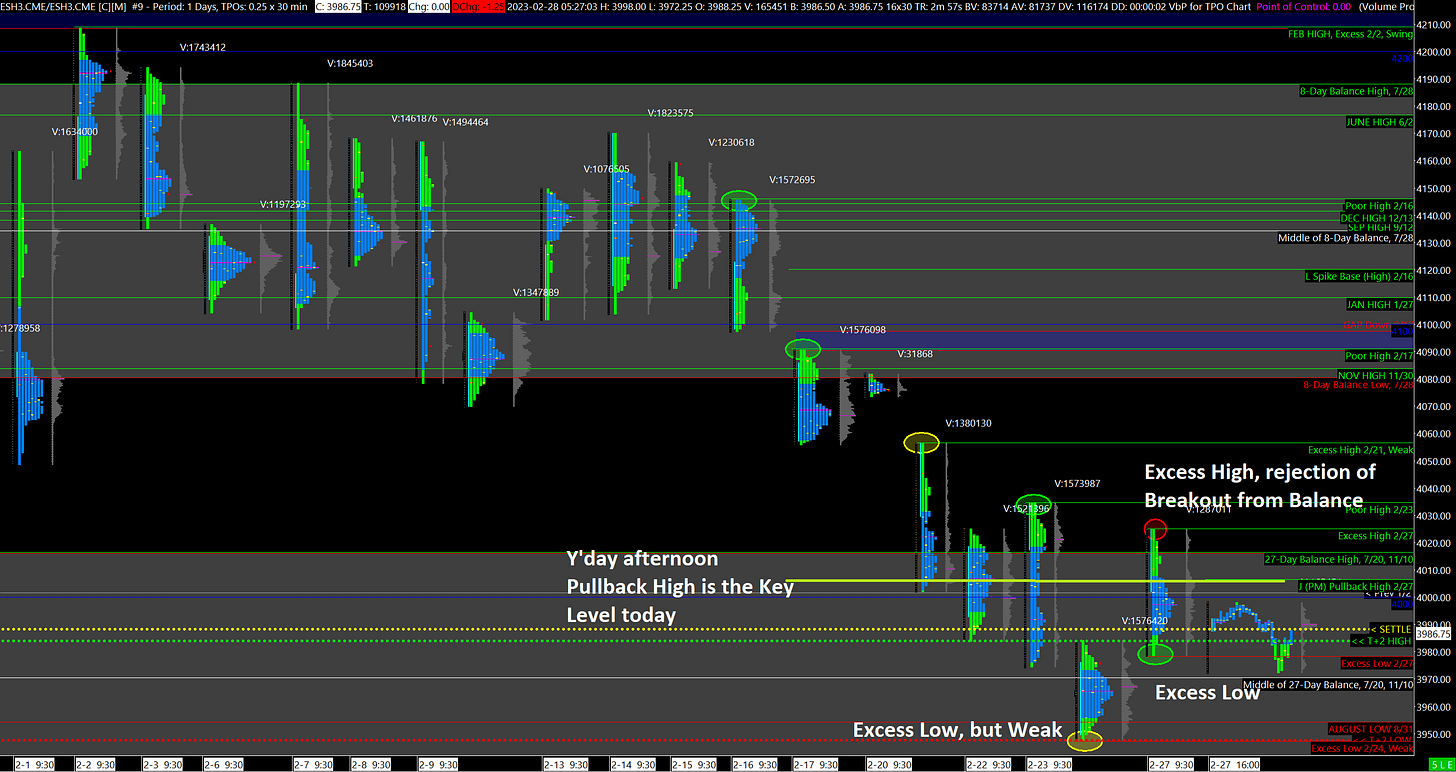

Accepted into Lower Balance Zone after Failed Breakout

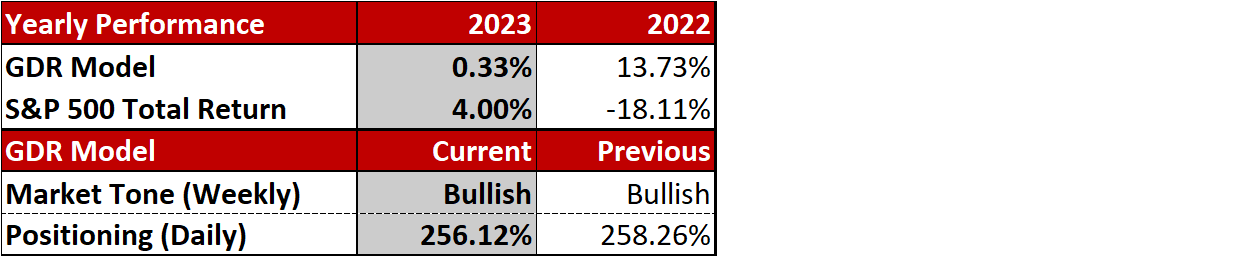

GDR Model Insights for the Current Week

S&P 500 Futures Market Profile Insights for Today

Near-Term Outlook: Accepted into lower Balance Zone

Yesterday the market attempted to breakout of the lower Balance Zone but was rejected, leaving behind an Excess High. However, the late day Spike Lower was also rejected and the ES closed within the Value Area. There are 2 potential likely scenarios coming into the open today:

Short-Term Balance: this is in effect if the ES opens within yesterday’s range, in which case the Short-Term Balance edges are yesterday’s High (4025) and Low (3978). In this scenario the key level is yesterday’s Pullback High from the afternoon at 4006. Trading and accepting through this level likely results in at least another attempted Breakout of the current lower Balance Zone.

Bearish: in effect if the ES opens below yesterday’s range, in which case Gap Rules will be in effect. If the Gap is not filled quickly then short-sell trades are more likely to be successful. Keep in mind that the 2/24 Low is Weak, so that could well be a target for shorts sellers.

Potential Market-Moving Events Today

08:30am - Goods Trade Balance, Retail Inventories

09:00am - S&P/CS HPI Composite

09:45am - Chicago PMI

10:00am - CB Consumer Confidence