S&P 500 Futures Daily Insights for Tue 15 Nov 2022

The week started out with a test to the developing GDR Bullish idea - the PPI release tomorrow will be critical

GDR Model Insights for the Current Week

GDR Model Performance (2022): +22.21%

Market Tone: Potential Transition to Bullish (previous week: Bearish)

Positioning: 0.00% Flat (previous day: 0.00% Flat)

Commentary: the week started out with the developing GDR Bullish idea being tested. This is normal in Transition phases… Stay tuned.

S&P 500 Market Structure Insights for Tomorrow

The key event tomorrow is the PPI data release at 8.30am. PPI is often seen as a leading datapoint for CPI and after the better-than-expected inflation numbers last week, the market is likely to pay close attention to PPI tomorrow for clues on what could happen next.

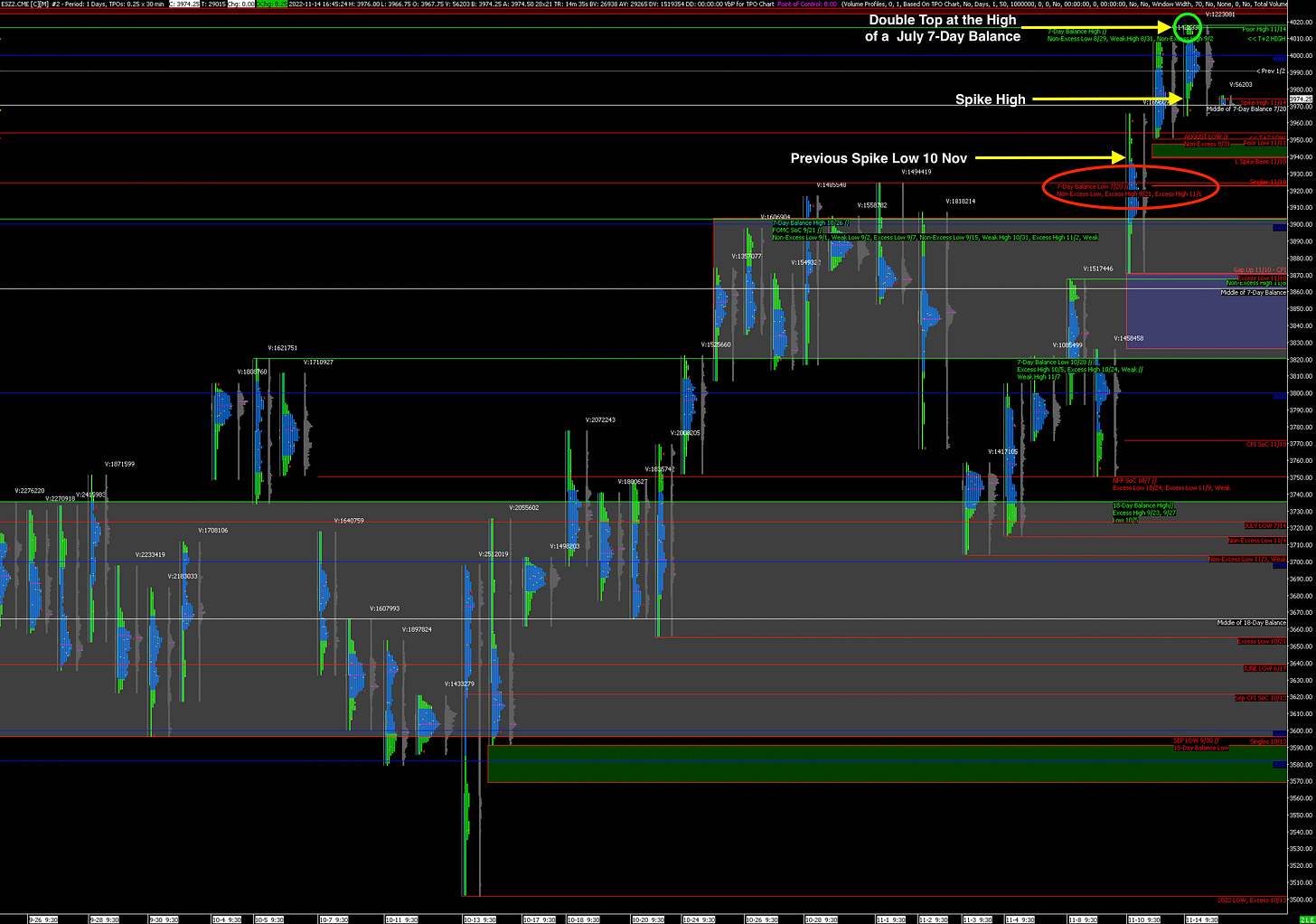

Today was an extremely low volume day compared with last Friday, which suggests participation was low. Further, the double top at today’s high along with the late day liquidation suggests that short-term weak-hands traders who don’t carry positions overnight dominated the market today.

Currently the most pressing structural spots are today’s double top (a poor high), and last Friday’s poor low. I would not be surprised to see both taken out following the PPI release tomorrow. Moreover, it’s best practice to bet on the prevailing trend, so if I had to guess I would expect the poor low from Friday to be taken out first, and then for the market to find the bid before heading higher to take out today’s double top. Keep in mind this is just probabilistic. Always stay open to all possible outcomes.

Potential Market-Moving Events Tomorrow

08:30am - PPI, NY Empire State Manufacturing Index