S&P 500 Daily Perspective for Wed 13 Aug 2025

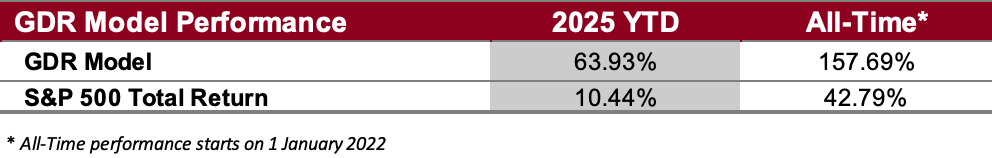

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

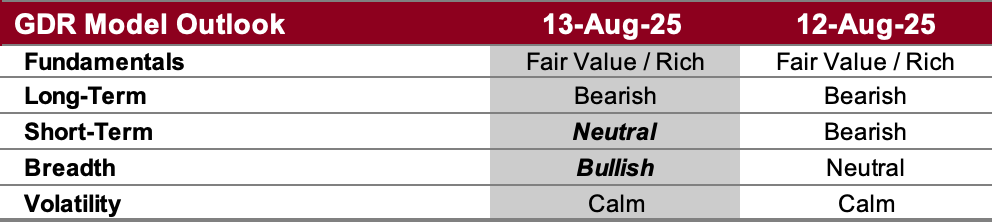

GDR Model Outlook

Overall Outlook (as of 12 Aug 2025): NEUTRAL. The market showed enough strength today to potentially shift the odds against a sustained sell-off. For that to actually happen, the market needs to sustain this strength for at least a few more days.

Fundamentals Outlook (as of 26 Jun 2025): Fair Value/Rich. The model has adjusted valuations slightly downward following the release of new data. Going forward GDR Model positioning should tactically tilt a little less towards the long side, all else equal. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

IMPORTANT NOTE: it’s unknown what the impact of tariffs on valuations (or what the ultimate level of the tariffs themselves) will actually be on valuations. Rather than make tariff-related assumptions to adjust the model accordingly, the Fundamentals Outlook will remain fully data-driven as it’s always been. All other portions of the model are entirely unaffected.

Long-Term Outlook (as of 8 Aug 2025): Bearish. The long-term outlook remains bearish and a meaningful sell-off is well within the realm of possibility. This is in spite of the market’s rally this week.

Short-Term Outlook (as of 12 Aug 2025): Neutral. The market showed notable strength today and the short-term outlook is upgraded back to neutral.

Breadth Outlook (as of 12 Aug 2025): Bullish. In line with today’s strong day, breadth is back bullish.

Volatility Outlook (as of 12 Aug 2025): Calm. The volatility outlook is back in calmer waters, which may get in the way of any serious sell-offs and will likely lift prices higher, if sustained.

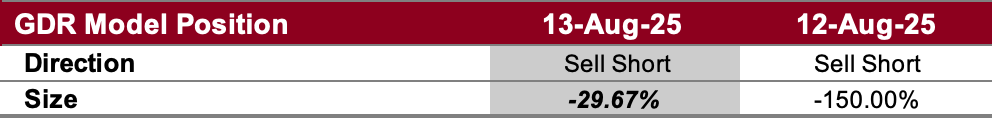

GDR Model Position

Following notable strength in the market today, the GDR Model has closed its short position.