S&P 500 Daily Perspective for Mon 8 May 2023

Bullish to start the week, but with plenty of poor structure below

GDR Model Insights for the S&P 500

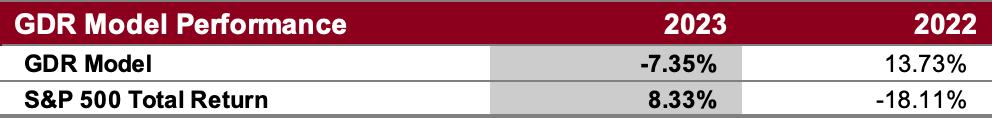

GDR Model Performance

Overall this year has been challenging for the Model’s style due to low confidence in the market.

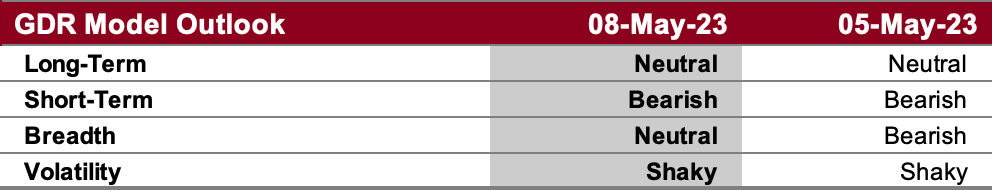

GDR Model Outlook

The overall Model improved a bit at the end of last week and is now Neutral to Bearish.

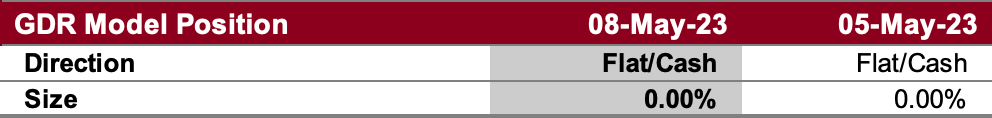

GDR Model Position

The model is still not committing to a position as there is not enough conviction. To say the market has been choppy would be an understatement, but the model is doing what it’s meant to do: stay out of the market when there is no clear established trend.

S&P 500 Futures Market Profile Analysis

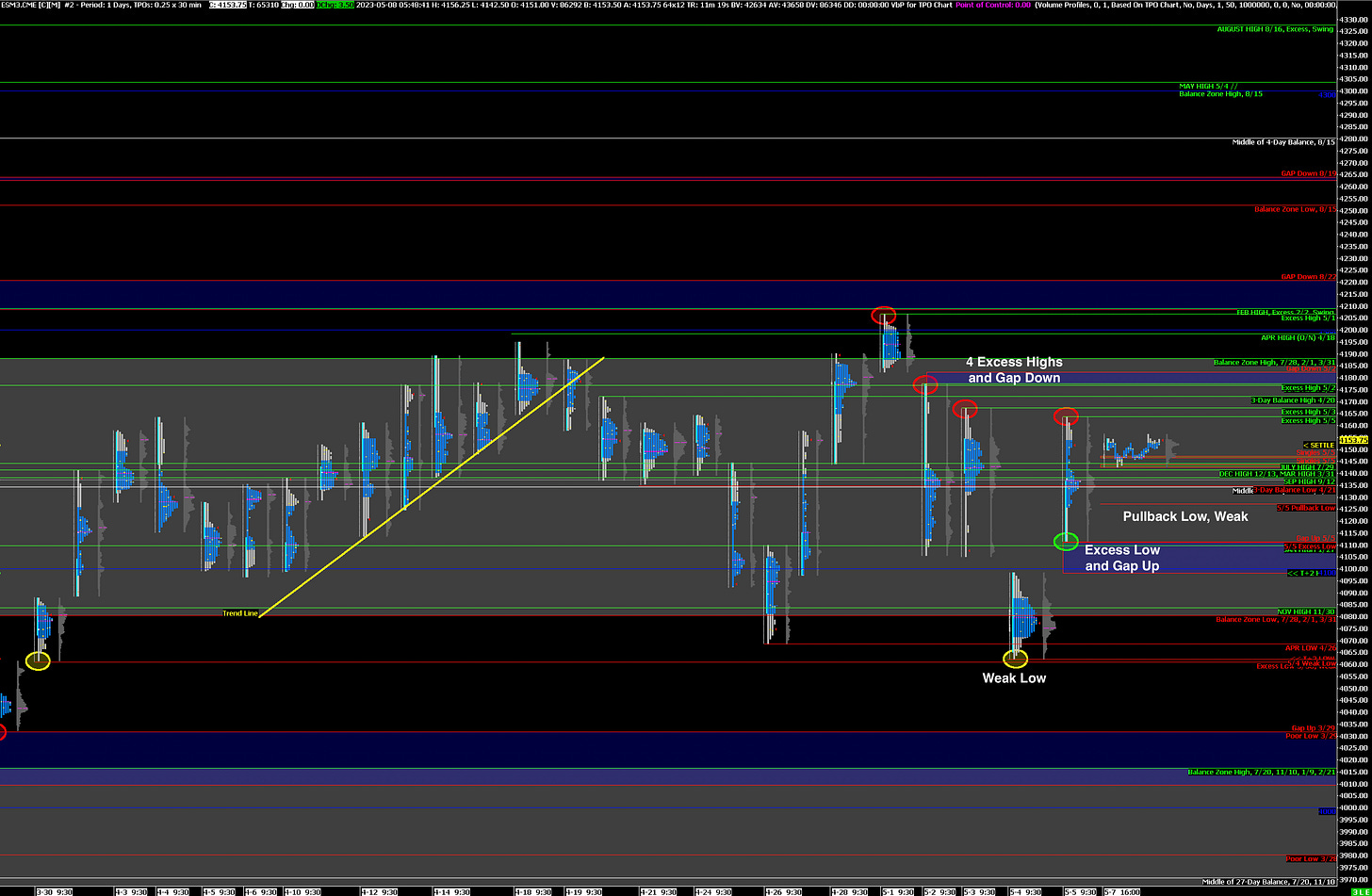

Near-Term Outlook: Bullish, targeting the top of current Balance Zone

Alternate Outlook: Y’day Excess High holds and market targets Poor Structure below

Bullish: 4164 (Y’day High), 4188 (Top of Current Balance Zone), 4221 (Closes Prev Gap Down)

Bearish: 4142 (Closes Y’day Double Distribution), 4127 (Y’day Pullback Low, Weak), 4098 (Closes Y’day Gap Up)

Market Narrative

Last Friday the market Gapped Up and continued on to a trend day up. It set a Pullback Low in the early afternoon - which is now a structural reference to the downside - before finishing the day higher. In the short-term the ES is now looking Bullish again with a potential target at the top of the Current Balance Zone around 4188.

Nonetheless, there is still plenty of Poor Structure below and the more recent swings up in the market are more reminiscent of laggard traders trying to belatedly jump on the wagon. Stay nimble and don’t underestimate the potential for sell-offs in this market.

Economic Calendar

Today - None

Later This Week: CPI (Wed), PPI (Thu)