S&P 500 Daily Perspective for Wed 2 Apr 2025

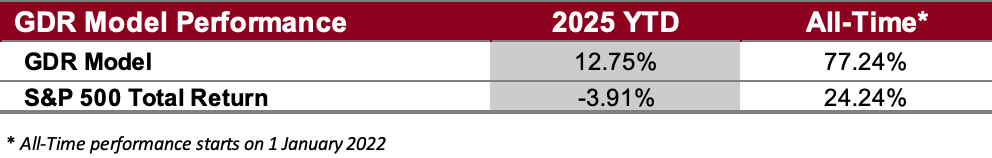

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

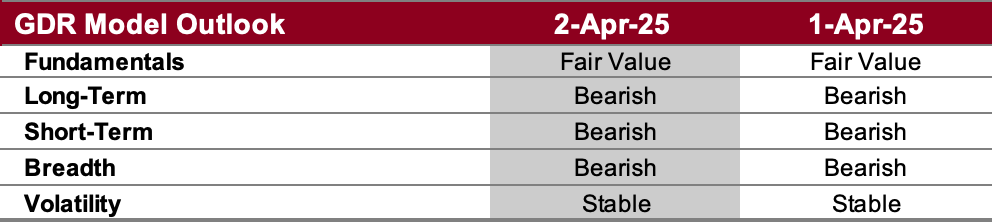

GDR Model Outlook

The GDR Model is bearish. The serious sell-off the model had been pointing towards for weeks is now well underway. The model’s components have aligned on the bearish side yet again.

Fundamentals Outlook (as of 27 Mar 2025): the model has adjusted valuations upward following the release of new data. Going forward GDR Model positioning should tilt more towards the long side, all else equal. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 28 Mar 2025): the long-term outlook remains bearish, and had a weak close to the week yet again.There has been persistent weakness over the long-term timeframe and the market is unlikely to fully recover until this weakness gives way to renewed strength.

Short-Term Outlook (as of 1 Apr 2025): the short-term outlook remains bearish. The market is showing weakness across the board now despite the modest recovery in prices.

Breadth Outlook (as of 1 Apr 2025): breadth remains bearish this is meaningful given that the model is in agreement throughout its components.

Volatility Outlook (as of 1 Apr 2025): the volatility outlook is back up to stable. The market has seemed a bit undecided lately, so this part of the model keeps going back and forth between stable and shaky. A stable outlook (or better) drastically limits the probability of a sell-off, while a shaky outlook (or worse) materially increases it.

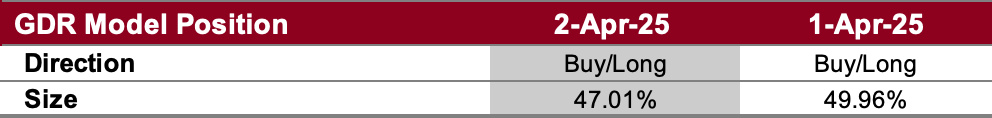

GDR Model Position

The GDR Model has a modest long position. Note that despite this, the model certainly doesn’t see the market as nearly strong enough to warrant a substantial long position.