S&P 500 Daily Perspective for Fri 2 Jun 2023

Bullish breakout, but beware of reaction to employment data today

GDR Model Insights for the S&P 500

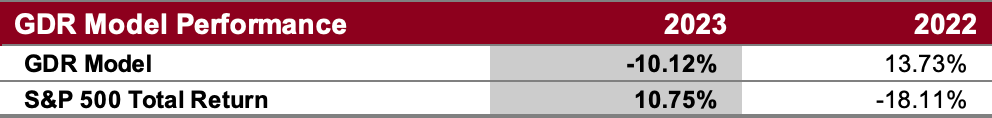

GDR Model Performance

The GDR Model returned -2.99% in May vs the S&P 500’s 0.43%, underperforming the index by 342 basis points. This year has been challenging for the GDR Model’s style due to low confidence in the market.

GDR Model Outlook

The GDR Model is back to neutral.

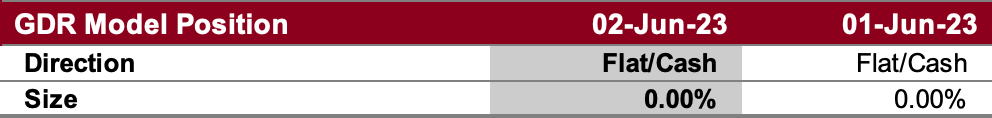

GDR Model Position

The GDR Model is in cash. Today’s market response to employment data can change that.

S&P 500 Futures Market Profile Analysis

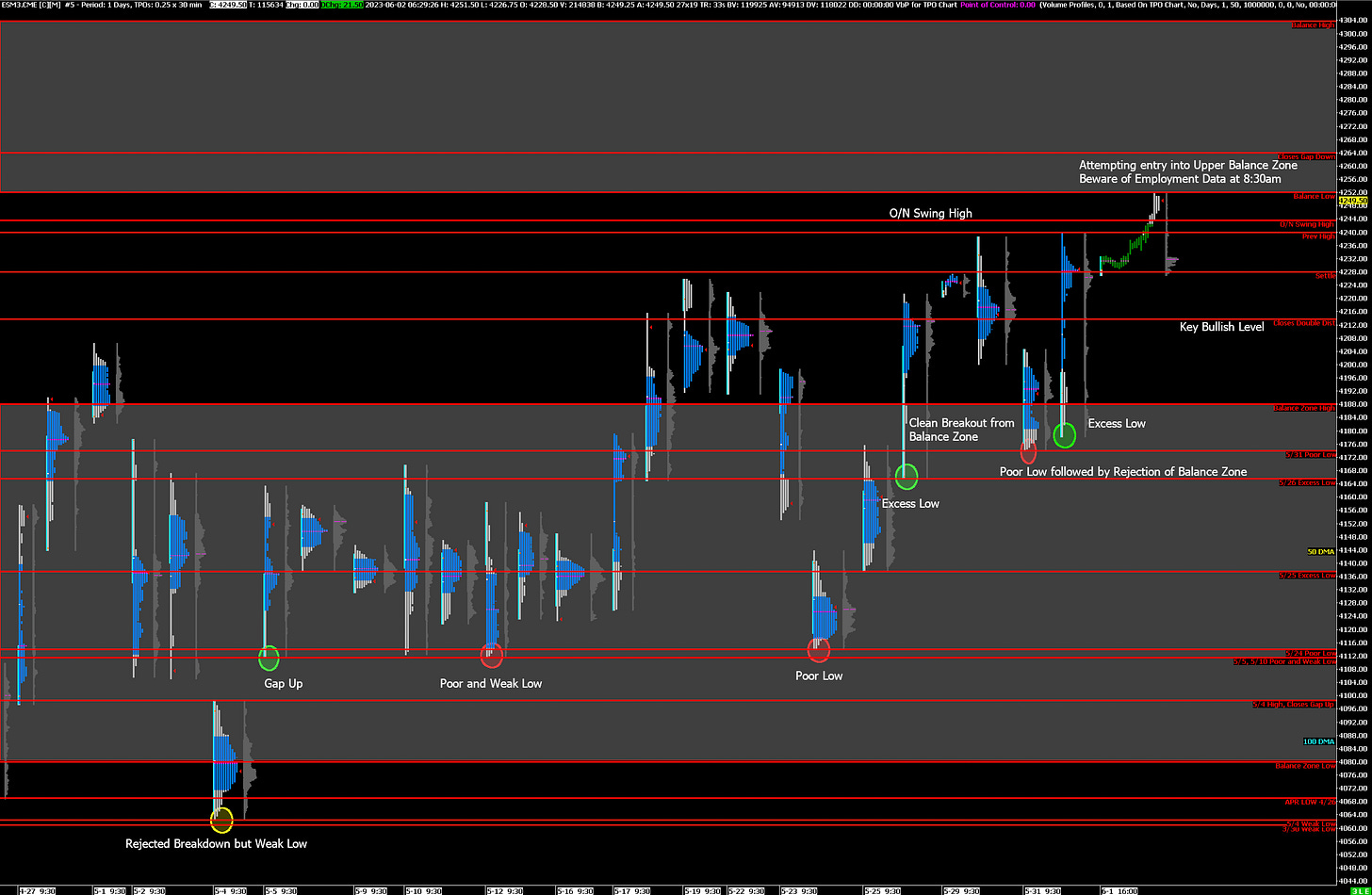

Near-Term Outlook: bullish breakout

Alternate Outlook: rejection of upper balance zone in reaction to employment data

Key Levels

Bullish: 4252 (Bottom of Upper Balance Zone), 4264 (Closes Gap Down), 4304 (Top of Upper Balance Zone)

Bearish: 4240 (Prev High, Closes Potential Gap Up), 4214 (Closes Double Distribution), 4188 (Top of Lower Balance Zone)

Market Narrative

The market rejected re-entry into the lower balance zone on Thursday and is currently breaking out to the upside. The ES is currently trading up against the bottom of a balance zone above and for a bullish trend to take hold it will be critical for it to trade into that balance zone and accept.

There is key employment data coming out this morning so the potential for volatility is heightened. Should the market react negatively, the bullish near-term outlook for the ES likely doesn’t change to bearish unless it trades and accepts below 4214.

Economic Calendar

8:30am - Nonfarm Payrolls

Next Week: none notable