S&P 500 Daily Perspective for Wed 14 Jun 2023

Bullish into Fed day, but inventories are looking extended on the long side

GDR Model Insights for the S&P 500

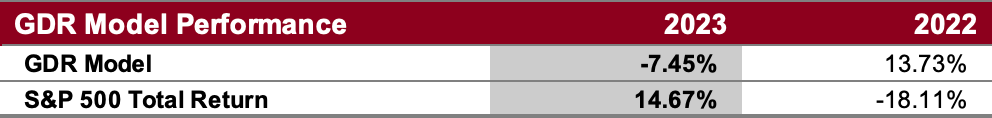

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

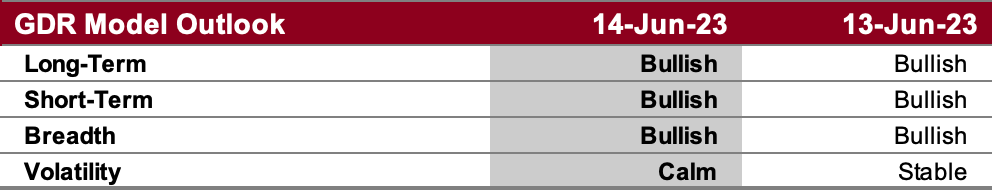

GDR Model Outlook

The GDR Model is now bullish following the recent breakout from consolidation.

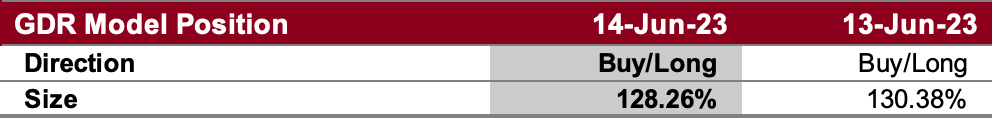

GDR Model Position

The GDR Model is currently holding a long position on the market’s strength.

S&P 500 Futures Market Profile Analysis

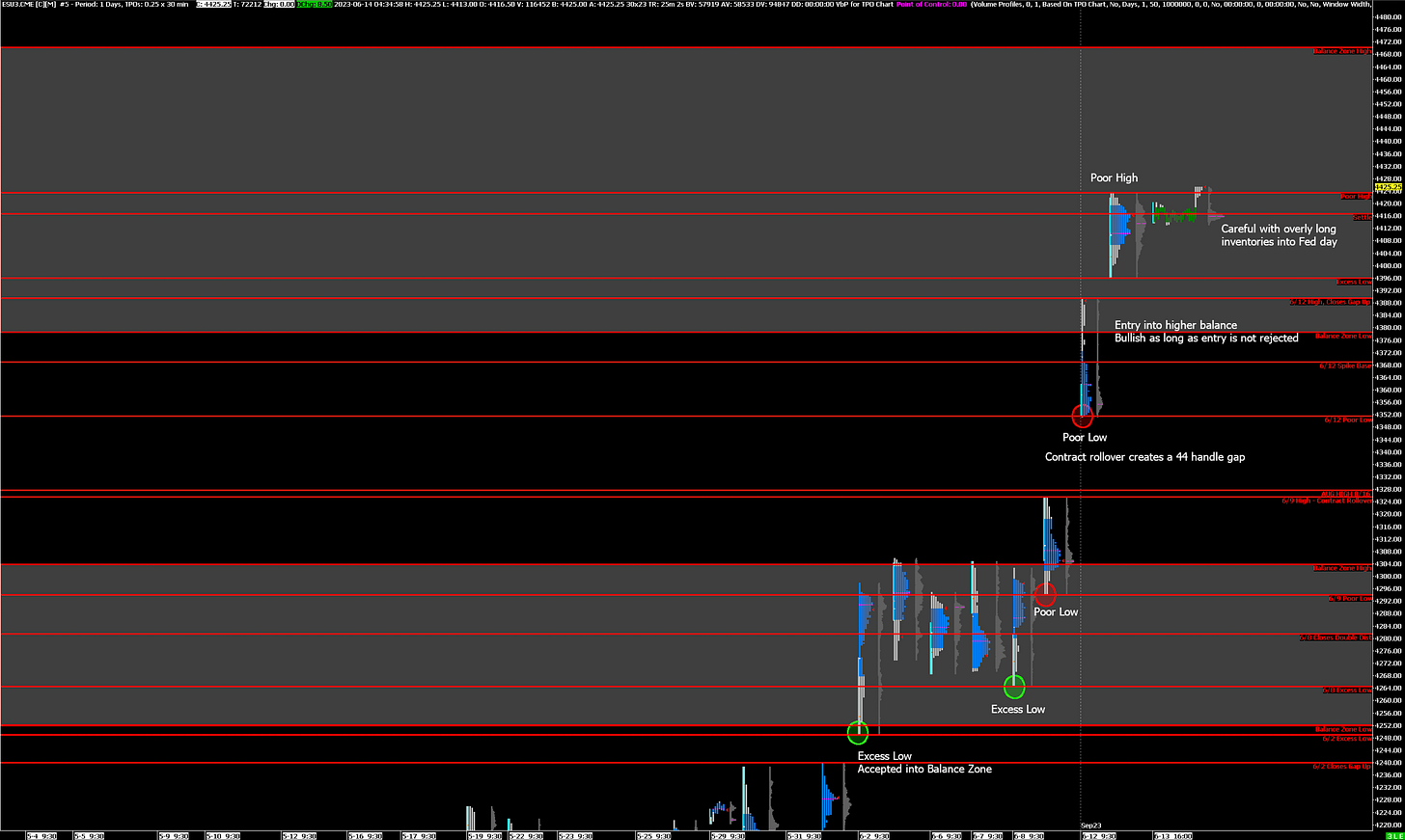

Near-Term Outlook: bullish, targetting top of balance zone

Alternate Outlook: liquidation break and increased volatility on Fed rate announcement

Key Levels

Bullish: 4424 (Poor High), 4470 (Top of Current Balance Zone), 4588 (April 2022 High)

Bearish: 4390 (Closes Gap Up), 4378 (Bottom of Current Balance Zone), 4369 (Spike Base)

Market Narrative

Yesterday the market continued its trend up and left behind a poor high. Typically poor highs suggest that weak-hands traders are dominating the market and decided to sell at an exacting level. Occasionally however - and it’s probably the case now - it can suggest overly long inventories. In these scenarios, inventories are overly long and the same weak-hands traders get too nervous to hold their positions through. Regardless of this nuance, a poor high still suggests an uncompleted auction to the upside so it is unlikely to stand for long.

Nevertheless, it’s still important to remember, inventories are overly long and the Fed’s announcement tonight can easily trigger a rebalancing. In this case, it can pay to be nimble and exit long positions on signs of weakness.

Economic Calendar

8:30am - PPI

2:00pm - Fed Interest Rate Decision

2:30pm - FOMC Press Conference

Later this Week: none notable