S&P 500 Daily Perspective for Mon 24 Jul 2023

Back in short-term balance heading into one of busiest data weeks so far this year

GDR Model Insights for the S&P 500

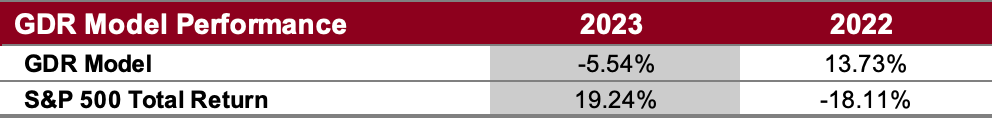

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

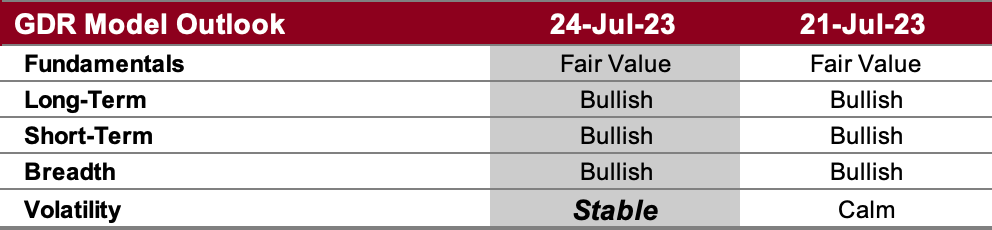

GDR Model Outlook

The GDR Model is bullish. Unless volatility starts to pick up this week, I’ll disregard the volatility outlook downgrade from Calm to Stable as it can mostly chalked up to monthly options expiration last Friday.

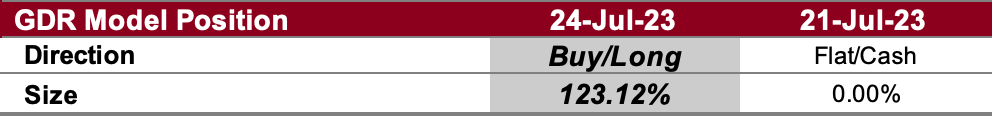

GDR Model Position

After a short break, the GDR Model is back to its long position as its outlook remains bullish across the board. This is a fairly bold position given all the critical data releases coming this week.

S&P 500 Futures Market Profile Analysis

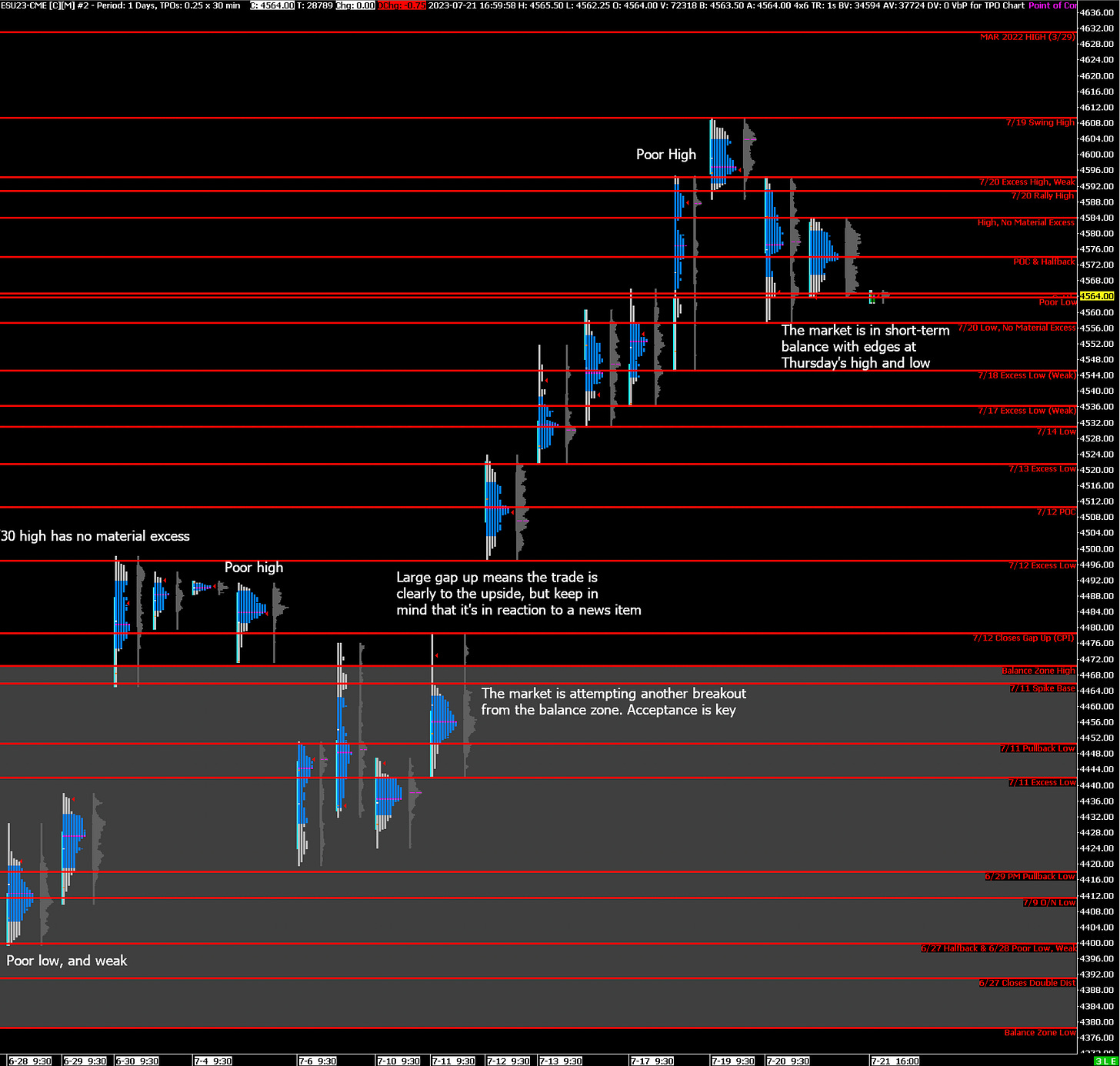

Near-Term Outlook: short-term balance, could go either way

Alternate Outlook: N/A

Key Levels

Bullish: 4584 (Y’day High, No Material Excess), 4591 (7/20 Rally High), 4594 (7/20 Excess High, Weak High)

Bearish: 4564 (Poor Low), 4557 (7/20 Low, No Material Excess), 4545 (7/18 Excess Low, Weak Low)

Market Narrative

Last Friday was an inside day compared with Thursday, meaning that Friday’s trading range falls entirely within Thursday’s. As such, the market is in short-term balance with edges on Thursday’s high and low. Balance trading guidelines apply going into today.

However, keep in mind that there is a fair chance that today’s trading sees further consolidation as it’s the only day of the week without multiple critical data releases.

Economic Calendar

9:45am - S&P Global Composite PMI

Later this Week: CB Consumer Confidence (Tue), MSFT 0.00%↑ Earnings (Tue), GOOGL 0.00%↑ Earnings (Tue), V 0.00%↑ Earnings (Tue), Fed Interest Rate Decision (Wed), META 0.00%↑ Earnings (Wed), GDP (Thu), PCE (Fri), XOM 0.00%↑ Earnings (Fri)