S&P 500 Daily Perspective for Thu 25 May 2023

Looking more bullish after liquidation day

GDR Model Insights for the S&P 500

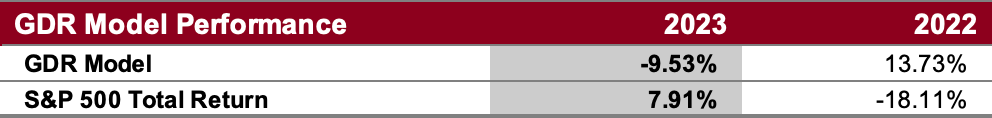

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

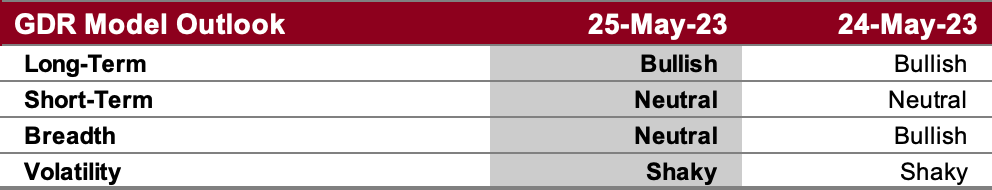

GDR Model Outlook

The overall GDR Model is mostly neutral to bullish. This could signal potential for a new uptrend, but it’s still not strong enough to confirm.

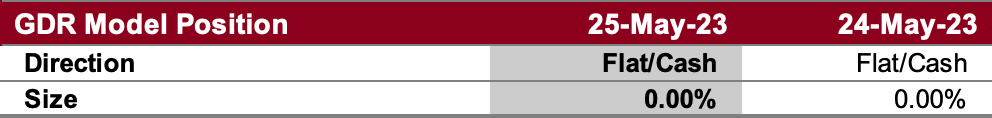

GDR Model Position

The GDR Model is back to cash. Since the recent update it’s now more defensive, opting to close positions when it detects weakness rather than holding onto them for longer. In other words, it’s a more nimble model now.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: bullish following liquidation day, trapped shorts near the low

Alternate Outlook: poor low left behind today serves as magned for further downside

Key Levels

Bullish: 4153 (Closes Gap Down), 4188 (Top of Lower Balance Zone), 4198 (Weak High, April High), 4226 (Poor High)

Bearish: 4114-4111 (Poor Low and Weak Low, Trapped Shorts), 4098 (Closes Prev Gap Up), 4080 (Bottom of Lower Balance Zone)

Market Narrative

The market opened on a gap down that failed to fill. As the market traded lower and repaired poor structure in the process, it failed to produce a material break. This suggests that today’s trading was mostly liquidation of old long positions, but there was no new money selling, which puts the market in a potentially bullish position.

Nonetheless, do note that today left behind a Poor Low, which is also relatively close to a previous Poor Low and Weak Low. The trapped short position around the day’s lows suggests it will likely take some time until we revisit the 4115-4110 levels, but do remain vigilant of shifting market conditions.

Economic Calendar

8:30am - GDP Q1 Revision, Initial Jobless Claims

10:00am - Pending Home Sales

Later This Week: PCE (Fri)