S&P 500 Daily Perspective for Wed 8 Jan 2025

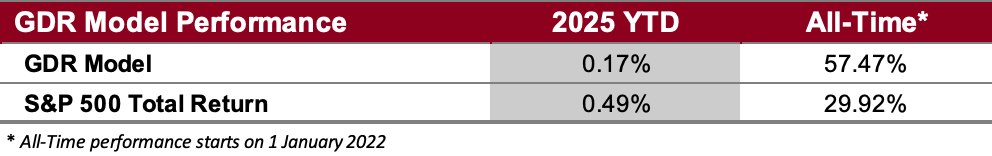

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated and a chart.

GDR Model Outlook

The GDR Model is neutral, but it has been inching towards bearish so far this week. Overall there is still a lot of indecision at this point.

Fundamentals Outlook (as of 17 Jun 2024): for the first time in a while the model showed stocks as being richly valued (i.e. overpriced). Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 3 Jan 2025): the market found strength again last week. The probability of a significant long-term sell-off has materially decreased.

Short-Term Outlook (as of 7 Jan 2025): the market has resumed its ways of starting the day with strength but proving unable to hold onto it through the end of the day. This has happened in 4 of the last 5 trading days.

Breadth Outlook (as of 7 Jan 2025): breadth has declined to neutral. This additional evidence of growing weakness in the market.

Volatility Outlook (as of 7 Jan 2025): the Volatility Outlook deteriorated further today and isn’t too far from a downgrade.

GDR Model Position

The GDR Model is effectively flat at this point as the market continues to show indecision on direction. However, the model is unlikely to enter a meaningful short position unless the Long-Term Outlook starts to decisively deteriorate.