S&P 500 Daily Perspective for Wed 26 Mar 2025

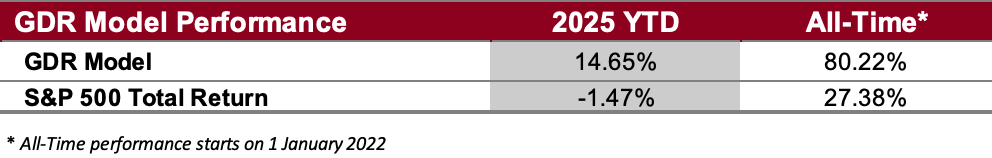

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

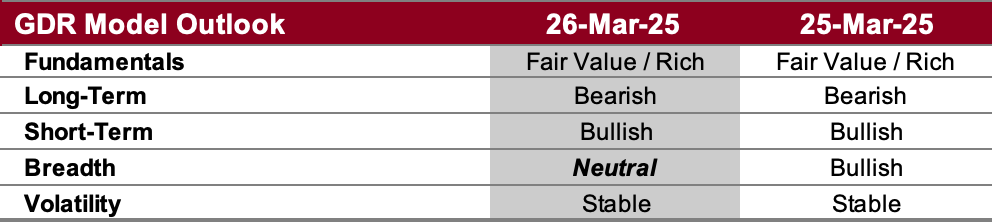

GDR Model Outlook

The GDR Model is neutral. The serious sell-off the model had been pointing towards for weeks is now well underway. However, the model currently points to indecision in the market so the chance of choppy price movements is higher than usual.

Fundamentals Outlook (as of 10 Mar 2025): the valuation portion of the model has dropped back down to fair value after many months, which implies valuations are more attractive now. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 21 Mar 2025): the long-term outlook remains bearish, and is back to a weak close.There has been persistent weakness over the long-term timeframe and the market is unlikely to fully recover until this weakness gives way to renewed strength.

Short-Term Outlook (as of 25 Mar 2025): the short-term outlook remains bullish and had a strong close today, however the market did weaken a pinch.

Breadth Outlook (as of 25 Mar 2025): breadth is back down to neutral. For now the impact on the overall read of the model remains minimal.

Volatility Outlook (as of 25 Mar 2025): the volatility outlook is stable. If volatility continues to compress then further upside will begin to look like the path of least resistance.

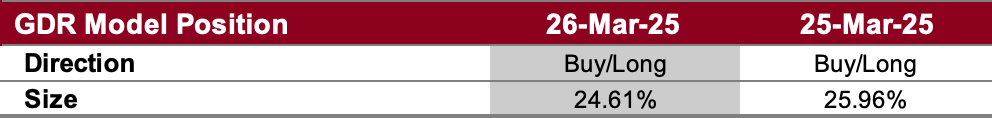

GDR Model Position

The GDR Model has a modest long position. This still falls in the camp of tactical positioning due to market indecision rather than a full-blown change in sentiment - the model certainly doesn’t see the market as strong enough to warrant a more substantial long position.