S&P 500 Daily Perspective for Fri 7 Feb 2025

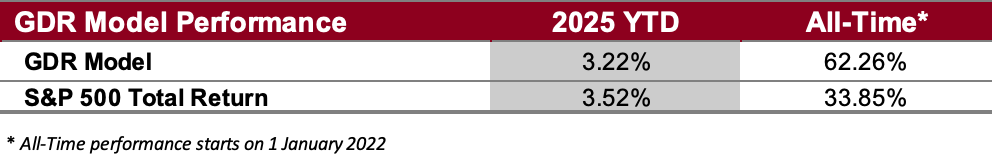

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

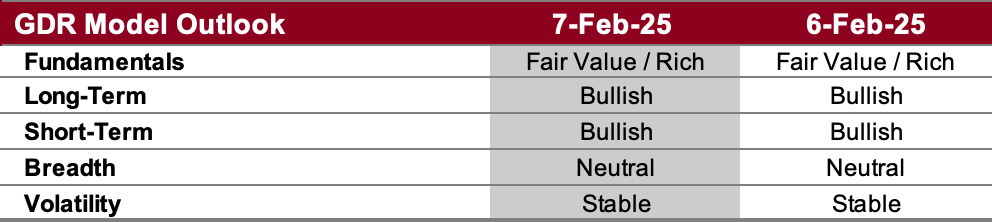

GDR Model Outlook

The GDR Model is bullish, but showing some initial deterioration that threatens to become something serious. At the very least it seems like the market may be returning to indecision.

Fundamentals Outlook (as of 31 Jan 2025): the valuation portion of the model has stocks as being richly valued (i.e. overpriced) for about 6 months now. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 31 Jan 2025): the long-term outlook remains bullish, but the week closed bearish. We may be in for more directional indecision.

Short-Term Outlook (as of 6 Feb 2025): the short-term outlook has shown strength for three days in a row. However, since at this point it’s within the context of a weakening long-term outlook, it implies the market is in a period of directional indecision. A reaction to tomorrow’s employment data release can create meaningful changes.

Breadth Outlook (as of 6 Feb 2025): breadth is neutral, but wasn’t too far from turning bullish again. The contradictory developments in the model point towards indecision.

Volatility Outlook (as of 6 Feb 2025): volatility is stable. If maintained (or improved) this is likely to pin the market in place and prevent major selloffs.

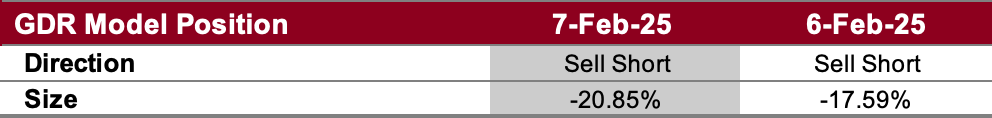

GDR Model Position

The GDR Model closed its long position at the end of last week in anticipation of a period of market indecision. The model is effectively flat at this point.