S&P 500 Daily Perspective for Fri 14 Nov 2025

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

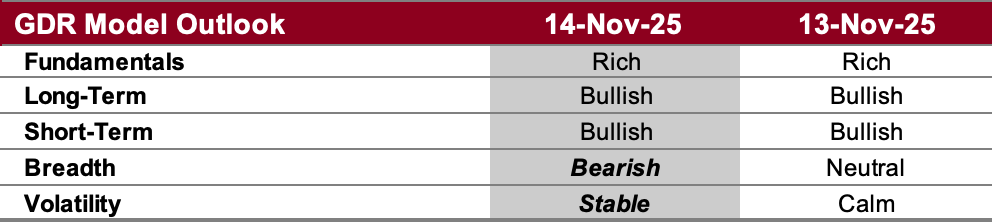

GDR Model Outlook

Overall Outlook (as of 13 Nov 2025): BULLISH TO NEUTRAL. The GDR Model has (mostly) flipped bullish. At this point the only component at odds with the rest of the model is breadth.

Fundamentals Outlook (as of 20 Oct 2025): Rich. The model has adjusted valuations slightly upward following the release of new data. Going forward GDR Model positioning should tactically tilt a little more towards the long side, all else equal. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

IMPORTANT NOTE: it’s unknown what the impact of tariffs on valuations (or what the ultimate level of the tariffs themselves) will actually be on valuations. Rather than make tariff-related assumptions to adjust the model accordingly, the Fundamentals Outlook will remain fully data-driven as it’s always been. All other portions of the model are entirely unaffected.

Long-Term Outlook (as of 7 Nov 2025): Bullish. The long-term outlook improved again this week and has now improved to bullish. It is notable that the long-term outlook seems to be at odds with short-term and breadth, and this may well suggest buy and hold interest popping up in the market.

Short-Term Outlook (as of 13 Nov 2025): Bullish. The market couldn’t hold on to the strength at the start of the trading day. Following that, it showed plenty of weakness from mid-morning through the close. For now the short-term outlook remains bullish, but it won’t last if weakness persists.

Breadth Outlook (as of 13 Nov 2025): Bearish. Breadth dropped back to bearish in line with today’s selloff. For now this data point isn’t very significant given that the rest of the model is bullish, but it shouldn’t be completely ignored.

Volatility Outlook (as of 13 Nov 2025): Stable. The volatility outlook has dropped back down to stable. This is still a positive reading, but it’s notable that it couldn’t stay at calm for more than one day.

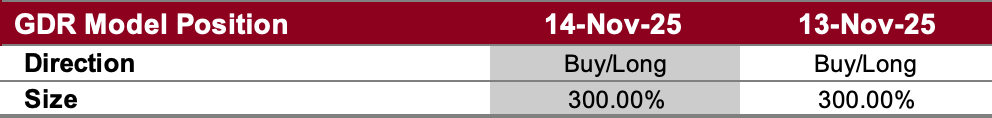

GDR Model Position

The GDR Model is keeping its significant long position for now despite the sell-off. However, if today’s weakness is sustained the model will likely not waste much time before closing out this position.