S&P 500 Daily Perspective for Wed 10 May 2023

Short-term balance coming into key inflation data releases today and tomorrow

GDR Model Insights for the S&P 500

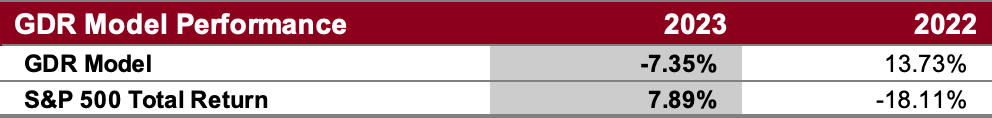

GDR Model Performance

Overall this year has been challenging for the Model’s style due to low confidence in the market.

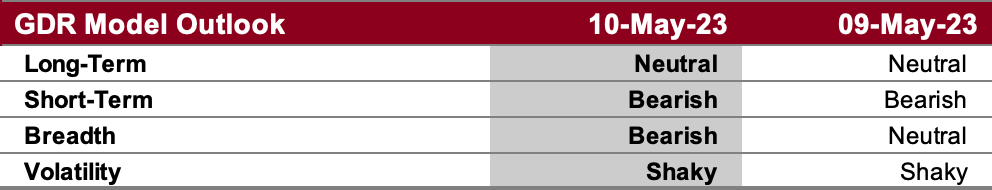

GDR Model Outlook

The overall Model deteriorated a bit and is not leaning Bearish. However, keep in mind that inflation data coming out today and tomorrow can swiftly change the picture.

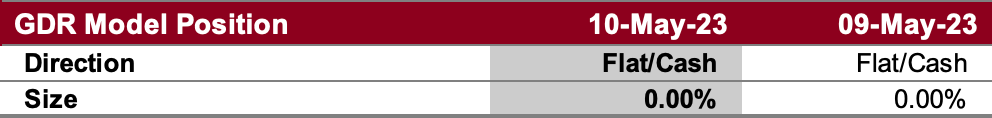

GDR Model Position

The model is still not committing to a position as there is not enough conviction. To say the market has been choppy would be an understatement, but the model is doing what it’s meant to do: stay out of the market when there is no clear established trend.

S&P 500 Futures Market Profile Analysis

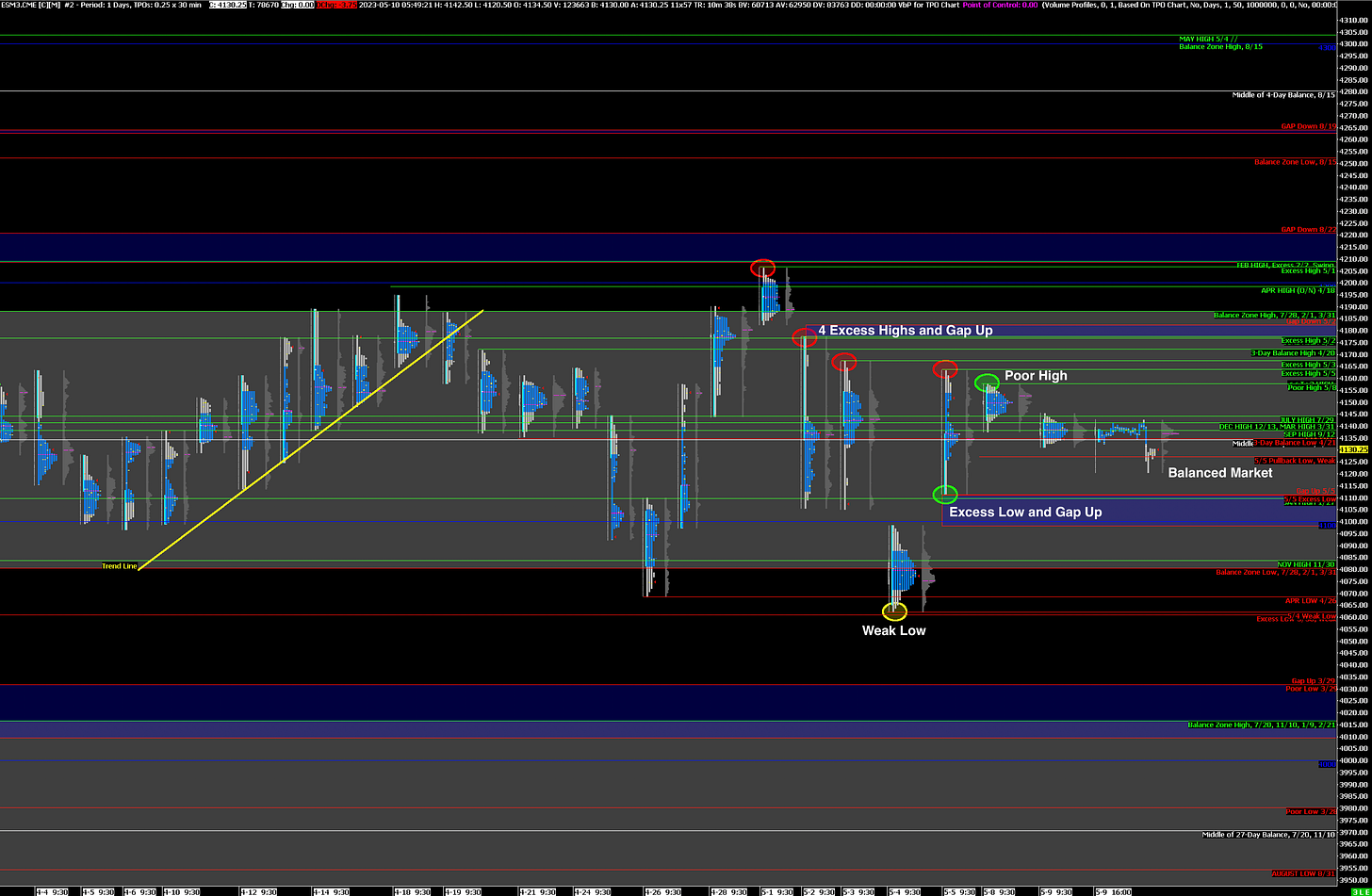

Near-Term Outlook: Short-Term Balance, could go either way

Alternate Outlook: N/A

Bullish: 4158 (Monday Poor High), 4188 (Top of Current Balance Zone), 4221 (Closes Prev Gap Down)

Bearish: 4127 (Pullback Low, Weak), 4098 (Closes Gap Up), 4080 (Bottom of Current Balance Zone)

Market Narrative

Nothing much changed yesterday - as suspected the market seems to have been waiting for inflation data coming out today and tomorrow. Monday’s Weak Low was corrected, but the Poor High remains. Odds favor increased Volatility tomorrow, but that’s not a guarantee. Given that the market seems Balanced, it can break in either direction.

Economic Calendar

Today at 8:30am - CPI

Today at 2:00pm - Federal Budget Balance

Later This Week: PPI (Thu)