S&P 500 Daily Perspective for Tue 20 Jun 2023

Slight bearish edge heading into shortened trading week

GDR Model Insights for the S&P 500

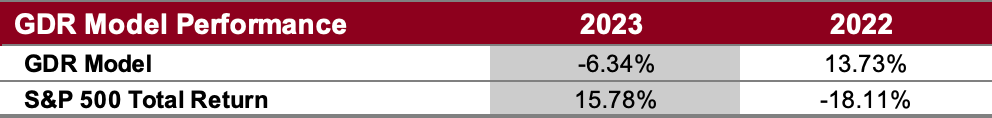

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

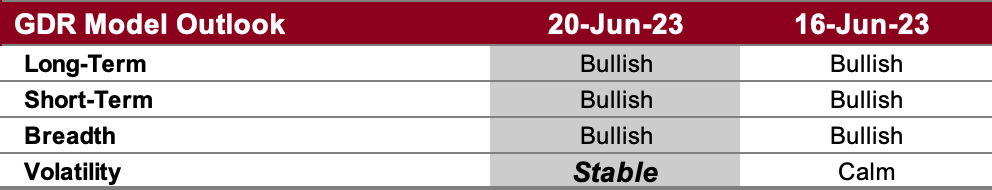

GDR Model Outlook

The GDR Model is now bullish following the recent breakout from consolidation. For the time being, you can take the Volatility Outlook downgrade to Stable with a pinch of salt as monthly OpEx (which happened last Friday) tends to shift this data materially.

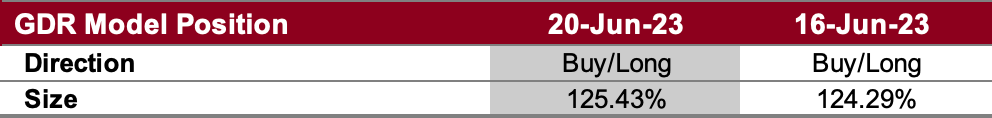

GDR Model Position

The GDR Model is currently holding a long position on the market’s strength.

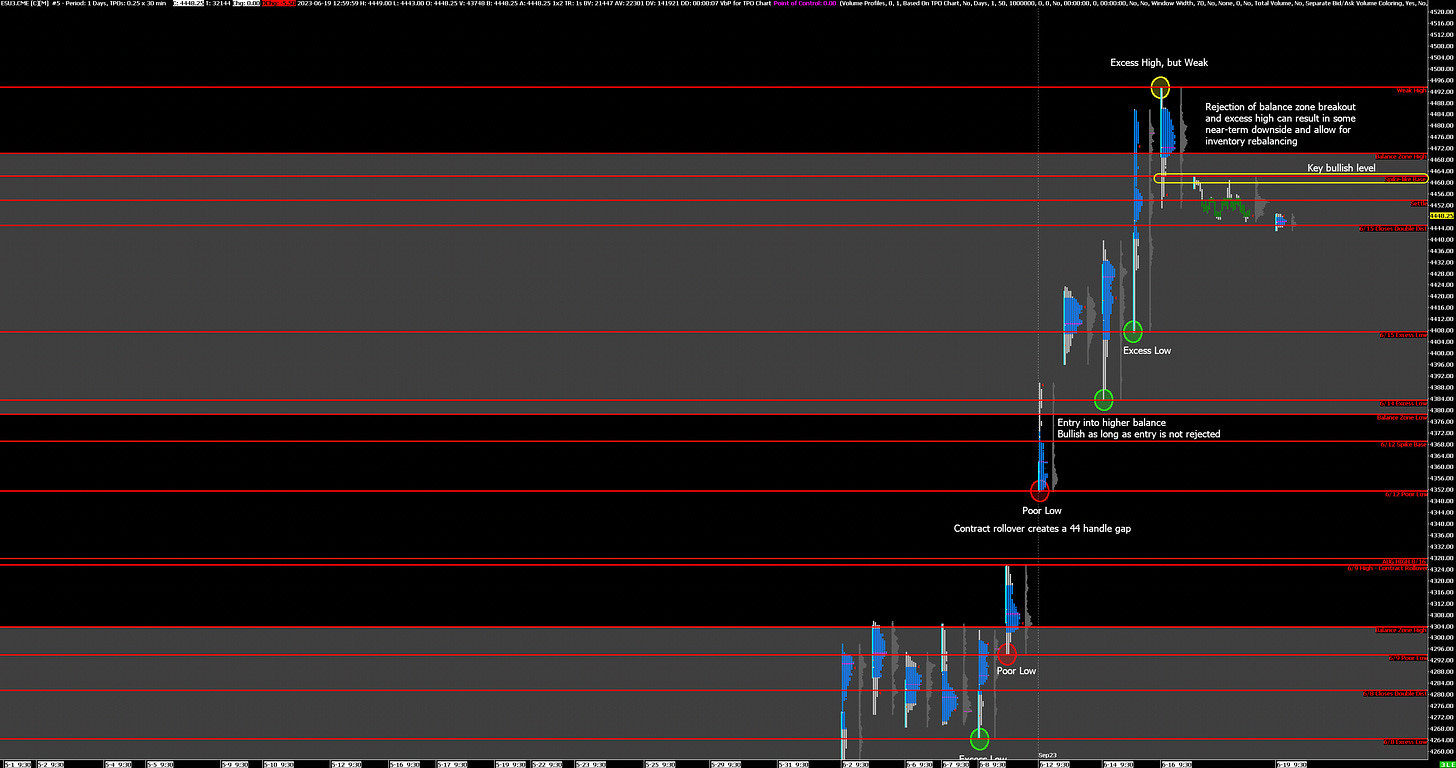

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: consolidation after rejected breakout, tilt bearish

Alternate Outlook: second attempt at breakout from balance zone

Key Levels

Bullish: 4462 (Spike-like Base), 4470 (Top of Current Balance Zone), 4494 (Weak High)

Bearish: 4445 (Closes Double Distribution), 4408 (6/15 Excess Low), 4378 (Bottom of Current Balance Zone)

Market Narrative

Last Friday the market rejected the first attempt at breaking out of the current balance zone, leaving behind an excess high that is also weak. The close was weak and while technically it wasn’t on a spike lower, it’s similar enough that it’s possible to apply spike trading guidelines with the base at around 4462.

While the alternate outlook for tomorrow is for a re-attempt at a breakout, the ES is looking a bit stretched as the market continues to try and squeeze underinvested institutional managers back in. Continued sustained upside is looking unlikely for now, but it’s definitely possible that the current bullish trend is not yet done.

Economic Calendar

8:30am - Building Permits, Housing Starts

Later this Week: Fed Chair Powell Testifies on Monetary Policy (Wed, Thu)