S&P 500 Daily Perspective for Mon 6 Jan 2025

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated and a chart.

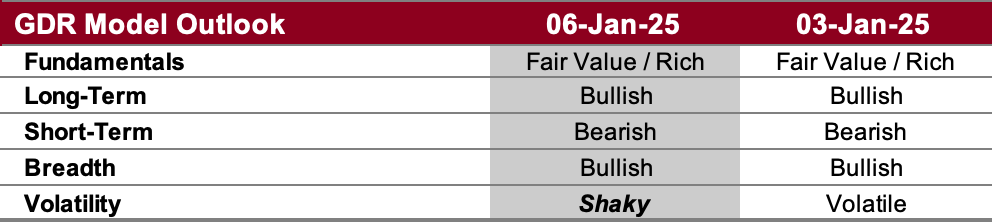

GDR Model Outlook

The GDR Model is neutral, however odds of a new leg up have increased.

Fundamentals Outlook (as of 17 Jun 2024): for the first time in a while the model showed stocks as being richly valued (i.e. overpriced). Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 3 Jan 2025): the market found strength again last week. The probability of a significant long-term sell-off has materially decreased.

Short-Term Outlook (as of 3 Jan 2025): unlike the previous two days, the market found strength early on in Friday and was able to hold onto it.

Breadth Outlook (as of 3 Jan 2025): breadth is bullish, if the model returns to bullish on both the long and short-term timeframes, the odds of positive daily returns will be materially higher.

Volatility Outlook (as of 3 Jan 2025): the model’s volatility outlook improved a notch on Friday. If this improvement continues that would imply high odds of a market that steadily heads higher.

GDR Model Position

The GDR Model is effectively flat at this point. However, if the market continues to strengthen the model will likely open a new long position.