S&P 500 Daily Perspective for Wed 26 Jul 2023

Bullish but don't underestimate the possibility of a failed breakout

GDR Model Insights for the S&P 500

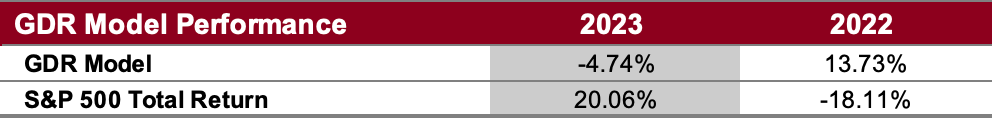

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

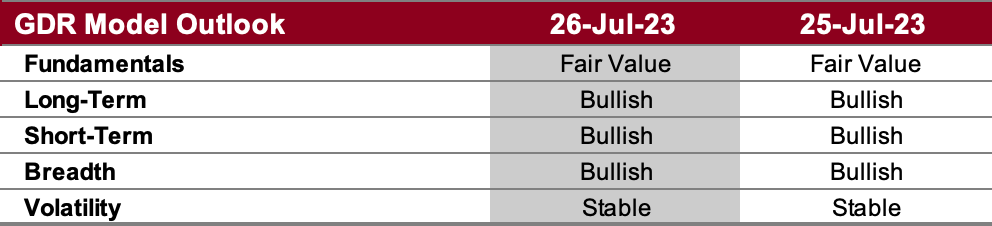

GDR Model Outlook

The GDR Model is bullish. Unless volatility starts to pick up this week, I’ll disregard the recent volatility outlook downgrade from Calm to Stable as it can mostly chalked up to monthly options expiration last Friday.

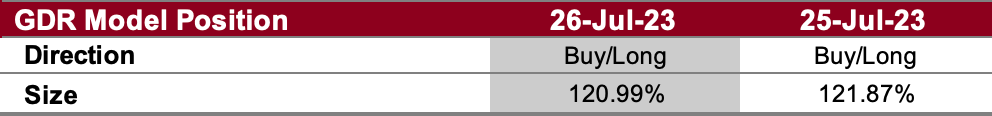

GDR Model Position

After a short break, the GDR Model is back to its long position as its outlook remains bullish across the board. This is a fairly bold position given all the critical data releases coming this week.

S&P 500 Futures Market Profile Analysis

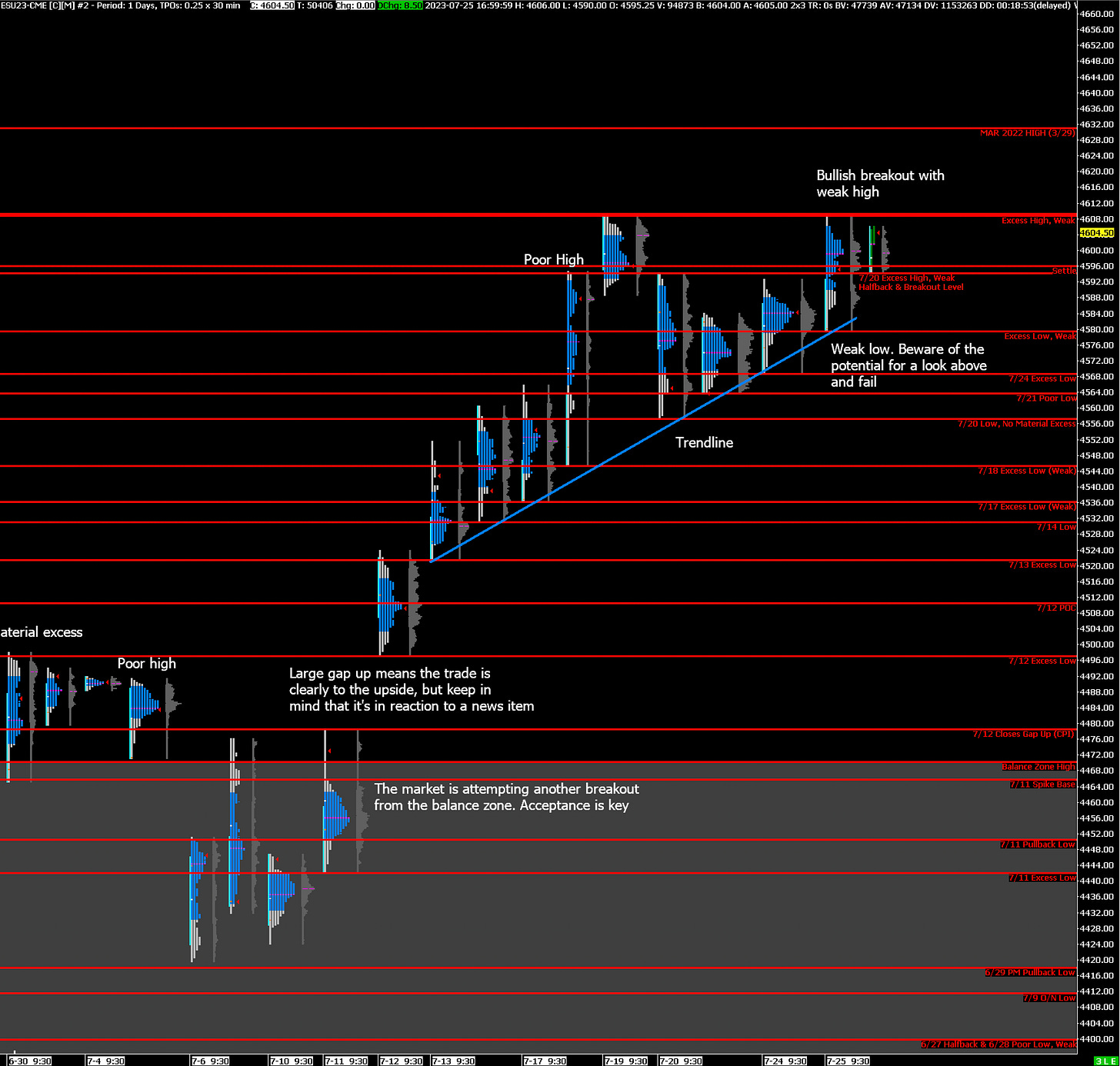

Near-Term Outlook: bullish after breakout of balance with weak high to repair

Alternate Outlook: look above and fail to repair poor structure below

Key Levels

Bullish: 4609 (7/19 Swing High, Y’day Excess High, Weak High), 4631 (March 2022 High), 4740 (1/12/2022 Swing High)

Bearish: 4594 (Top of Short-Term Balance / Breakout Level), 4579 (Excess Low, Weak Low), 4564 (7/21 Poor Low)

Market Narrative

Yesterday the market broke out of short-term balance and left behind a weak high, which makes continuation the more likely scenario at this point. Nonetheless, with the Fed announcement today, don’t underestimate the potential for yesterday’s breakout to fail back into balance if volatility increases significantly. Note how weak the structure is below with the market being bought repeatedly near a perfect trendline. This is the sign of weak-hands traders at work.

Economic Calendar

8:00am - Building Permits

10:00am - New Home Sales

2:00pm - Fed Interest Rate Decision

2:30pm - FOMC Press Conference

Earnings After the Close: META 0.00%↑

Later this Week: GDP (Thu), PCE (Fri), XOM -0.05%↓ Earnings (Fri)