S&P 500 Daily Perspective for Thu 21 Nov 2024

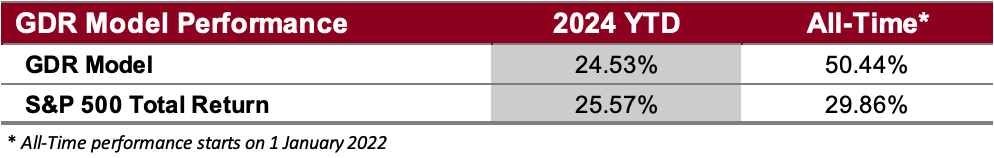

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated and a chart.

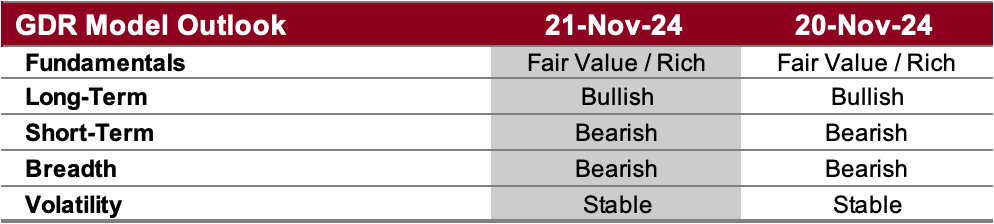

GDR Model Outlook

The late day rally into the close didn’t make much of a difference; the GDR Model still sees the market as short-term weak, which has persisted for several days and is keeping the model neutral to bearish. While conditions can change in a single day, the volatility outlook will likely be the deciding factor in whether the market liquidates further or rallies back up to all-time highs.

Note on the Fundamentals Outlook (as of 17 June 2024):

for the first time in a while the model showed stocks as being richly valued (i.e. overpriced). Note that this is just a barometer to help guide longer-term decision-making.

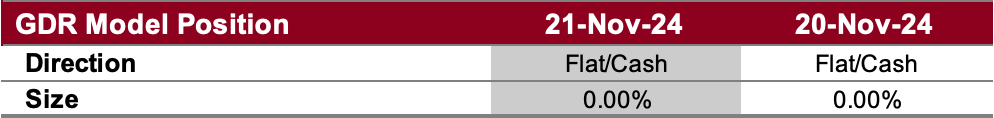

GDR Model Position

The GDR Model is flat as it has continued to pick up on near-term weakness in the market.