S&P 500 Daily Perspective for Fri 7 Mar 2025

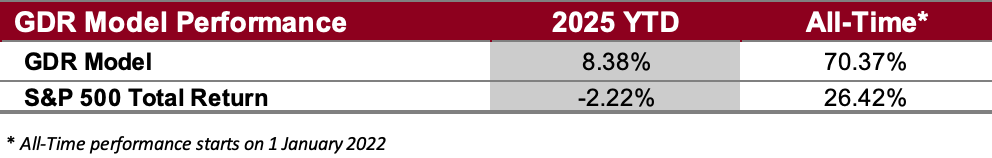

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

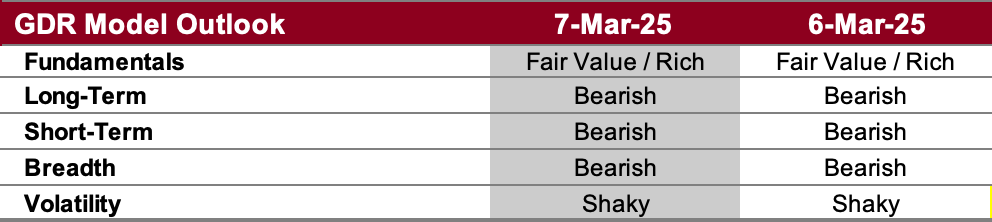

GDR Model Outlook

The GDR Model is bearish as all of the model’s components are pointing towards a more serious sell-off...

Fundamentals Outlook (as of 31 Jan 2025): the valuation portion of the model has stocks as being richly valued (i.e. overpriced) for about 6 months now. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 28 Feb 2025): the long-term outlook remains bearish but showed decent improvement to close the week. There is persistent weakness over the long-term timeframe, however if the strength from the end of last week has followthrough then there is a possibility that the market will get away without a substantial sell-off…

Short-Term Outlook (as of 6 Mar 2025): the short-term outlook is bearish and has had a weak close for several days in a row now. Once again, the market struggled to hold on to any bit of strength that comes in.

Breadth Outlook (as of 6 Mar 2025): breadth has closed bearish multiple days in a row. The model’s components are in line with an overall bearish outlook.

Volatility Outlook (as of 6 Mar 2025): the volatility outlook remains shaky. As long as this component remains shaky or volatile, there won’t be much to stop the market from a significant sell-off (along with nasty short-covering rallies in between).

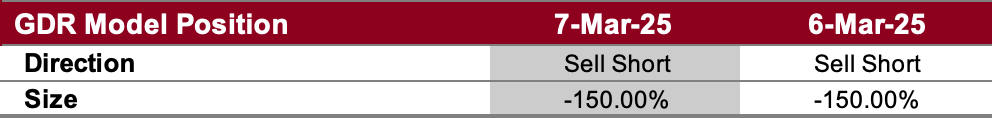

GDR Model Position

The GDR Model has a meaningful short position. This reflects the model’s bearish outlook and the higher odds of a protracted sell-off.