S&P 500 Daily Perspective for Thu 13 Jul 2023

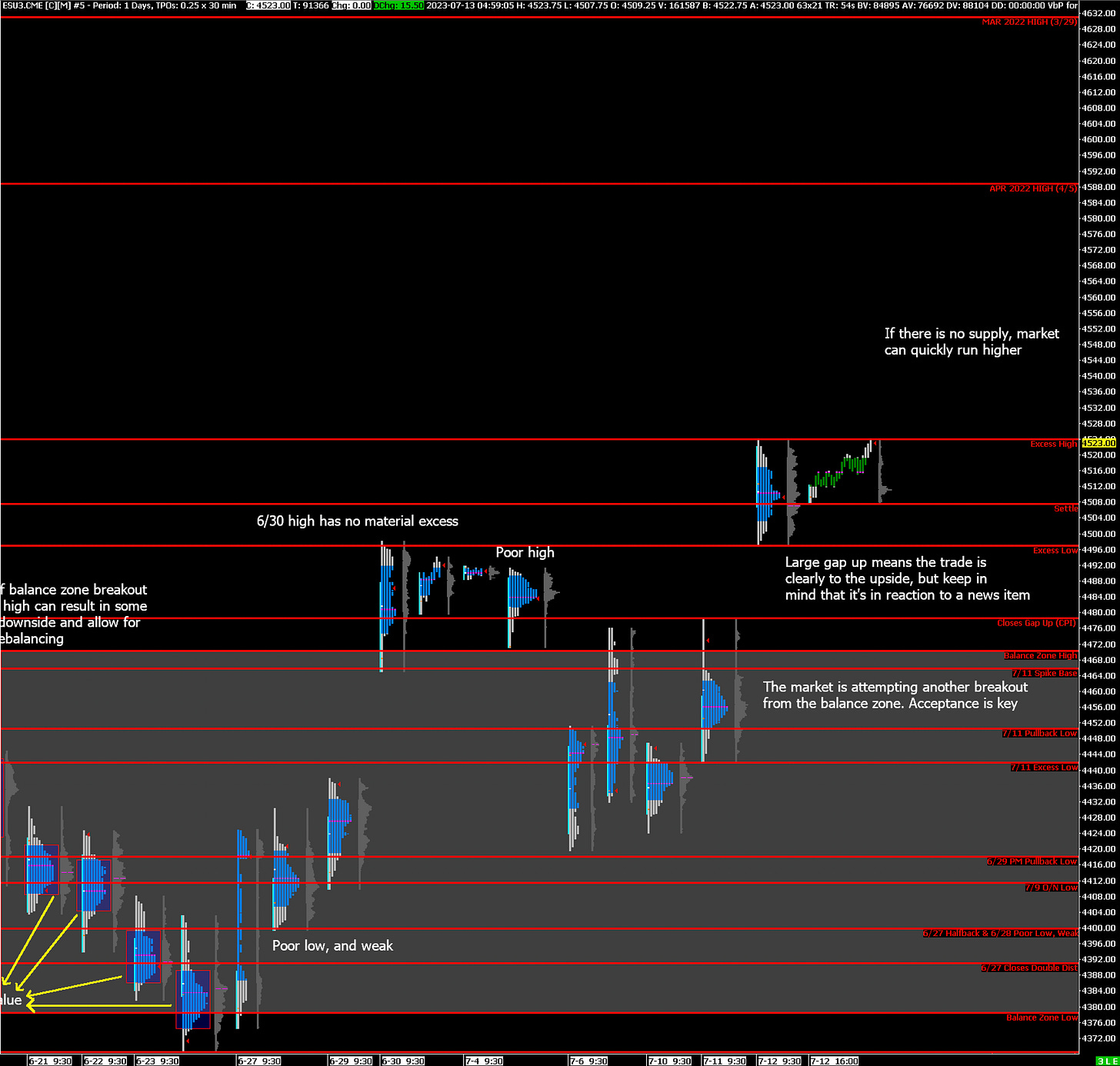

Bullish as long as yesterday's CPI gap up holds

GDR Model Insights for the S&P 500

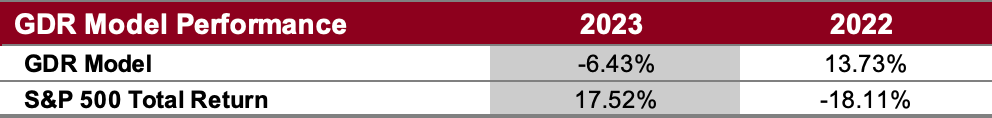

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

GDR Model Outlook

The GDR Model is bullish.

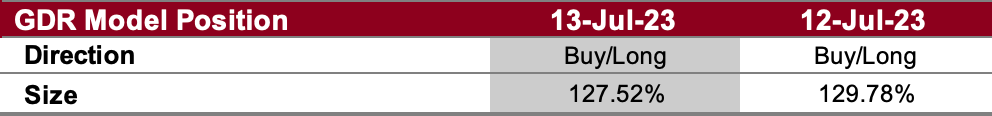

GDR Model Position

The GDR Model has re-opened its long position. However, position size is reduced compared to earlier in the year due to deteriorating fundamentals.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: bullish with potential to run higher quickly

Alternate Outlook: reversal of late-stage rally

Key Levels

Bullish: 4524 (Y’day Excess High), 4589 (April 2022 High), 4631 (March 2022 High)

Bearish: 4497 (Y’day Excess Low), 4478 (Closes Gap Up), 4466 (7/11 Spike Base)

Market Narrative

Yesterday was rotational balanced day following a large gap up. As long as the gap holds the outlook will remain bullish, especially as underinvested institutuonal money managers are forced into the market due to underperformance. However, keep in mind that more and more, this is starting to resemble a late-stage rally with plenty of laggards piling on. Over time this can have a similar effect to short-covering rallies and weaken the market leading to a strong collapse, but as always timing is the most difficult part.

Economic Calendar

8:30am - PPI, Initial Jobless Claims

6:45pm - FOMC Member Waller Speaks

Tomorrow: none notable