S&P 500 Daily Perspective for Thu 20 Jul 2023

Consolidation likely, focus on value

GDR Model Insights for the S&P 500

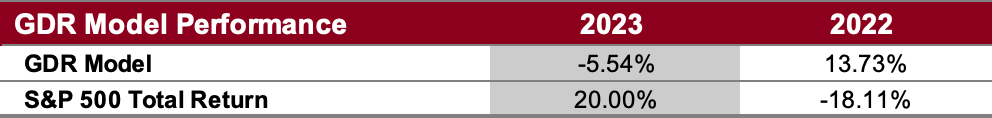

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

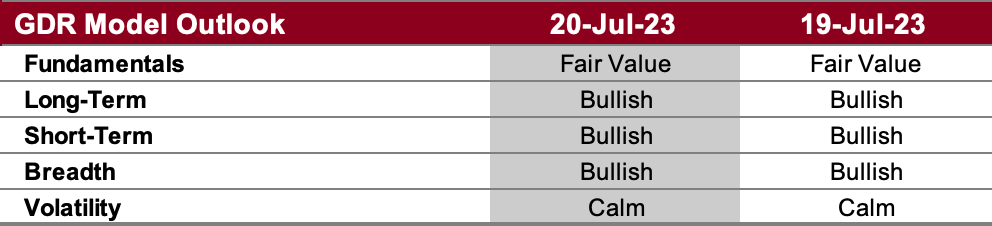

GDR Model Outlook

The GDR Model is bullish.

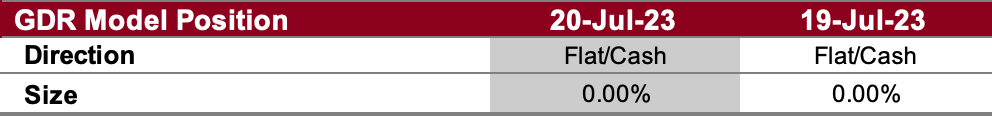

GDR Model Position

Even though the GDR Model remains bullish, it deteced more weakness than prices suggest towards the end of last week. In response, the model has pre-emptively closed its long position. If strength resumes, it would likely reopen the long position.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: consolidate into short-term balance, potentially repairing some poor structure below

Alternate Outlook: N/A

Key Levels

Bullish: 4609 (Y’day High), 4631 (March 2022 High), 4740 (1/4/2022 Swing High)

Bearish: 4588 (Y’day Excess Low), 4581 (Closes 7/18 Double Dist), 4566 (7/17 Excess High, Y’day Pullback Low), 4545 (7/18 Excess Low, Weak Low)

Market Narrative

Yesterday the market repaired Tuesday’s poor high and built value clearly higher. However, the day itself was a rotational day. As inventories may be a bit stretched, it’s more likely that we will we see some form of balance in the near-term. As such, it will likely pay to focus on value rather than expect another trend day.

Economic Calendar

8:30am - Philly Fed Manufacturing Index, Initial Jobless Claims

10:00am - Existing Home Sales

Later this Week: none notable