S&P 500 Daily Perspective for Mon 24 April 2023

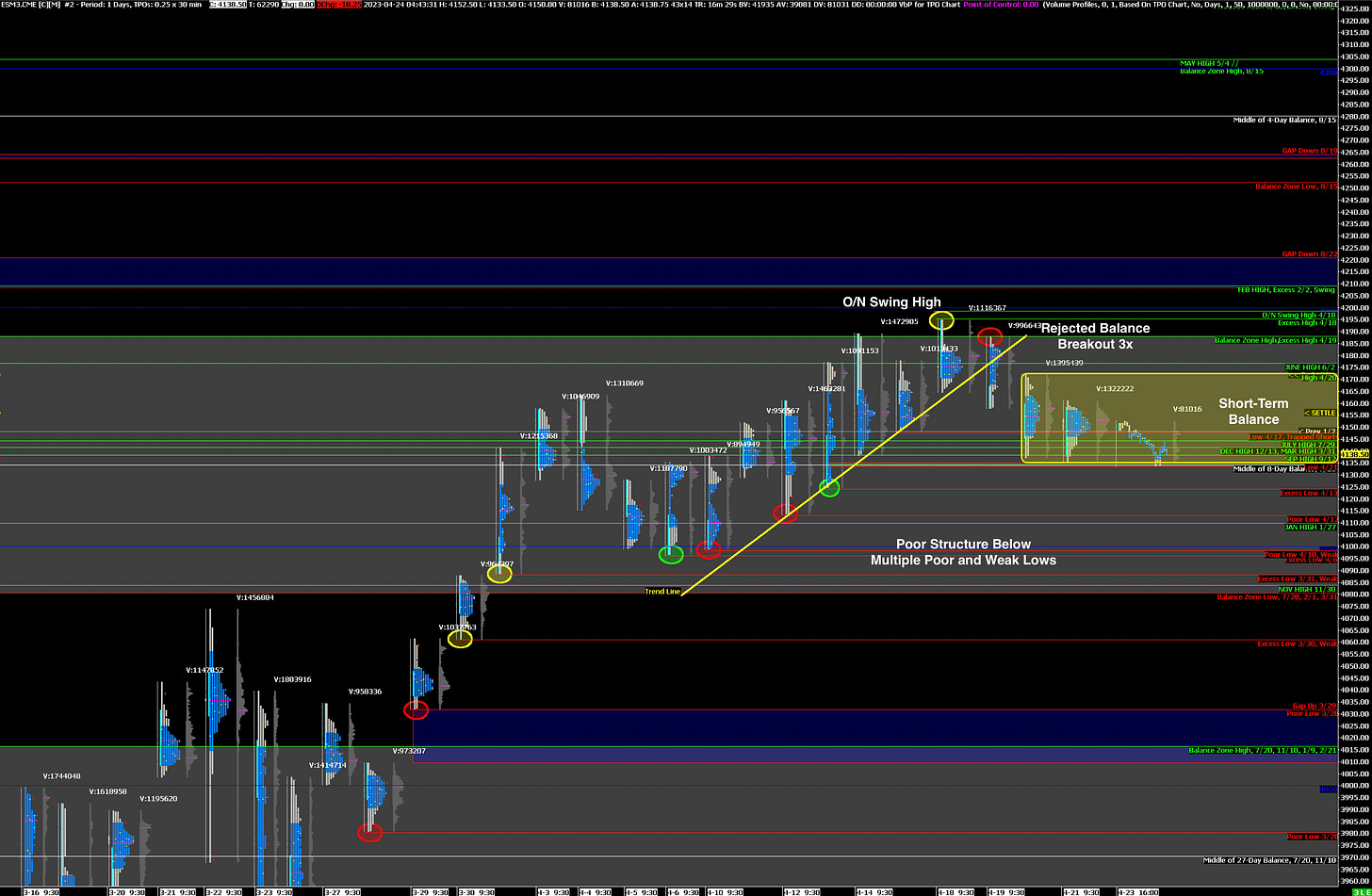

Two-day short-term balance entering the last week of the month

GDR Model Insights for the S&P 500

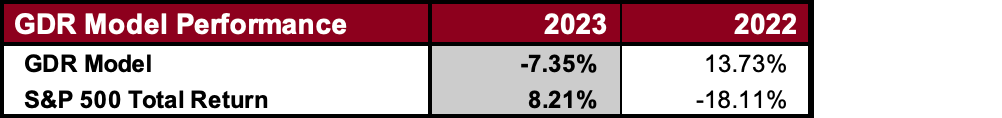

GDR Model Performance

This year has been challenging for the Model’s style due to low confidence in the market.

GDR Model Outlook

The overall Model is Neutral, but it picked up on some weakness towards the end of last week. Breadth is now back to Bearish while the potential for Volatility has increased.

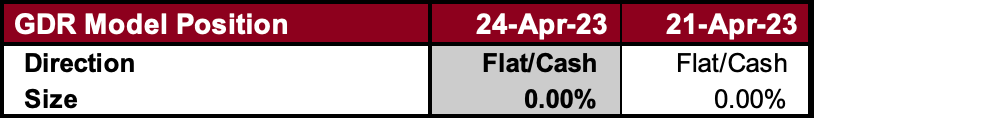

GDR Model Position

Despite the slight deterioration at the end of last week, the model is still not committing to a position as there is not enough conviction.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: Short-Term Balance, could go either way

Alternate Outlook: N/A

Key Levels for Today

Bullish: 4172 (Short-Term Balance High), 4188 (Top of Current Balance Zone), 4221 (Closes Gap Down)

Bearish: 4135 (Y’day Low, Short-Term Balance Low), 4113 (Poor Low), 4098 (Poor Low)

Market Narrative

The market didn’t change much last Friday and it is now in a short-term, two-day Balance. There is Excess on the Low and on the High, but neither is impressive. Assuming nothing changes materially until the RTH Open, I will again approach the day as a short-term Balance using Balance Trading Guidelines. The edges are Thursday’s High (4172) and Friday’s Low (4135).

Keep in mind there’s a lot more Poor Structure below than above…

Economic Calendar

Today - None

Later this Week: MSFT 0.00%↑ (Tue), GOOGL 0.00%↑ (Tue), META 0.00%↑ (Wed), GDP (Thu), AMZN 0.00%↑ (Thu), PCE (Fri), XOM 0.00%↑ (Fri)