S&P 500 Daily Perspective for Fri 10 Jan 2025

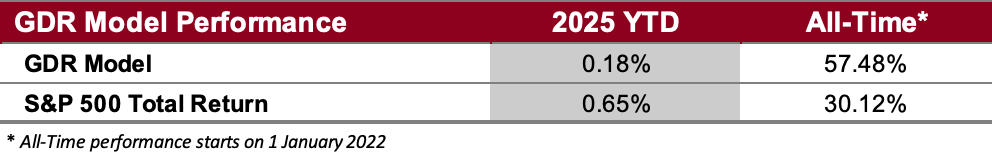

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated and a chart.

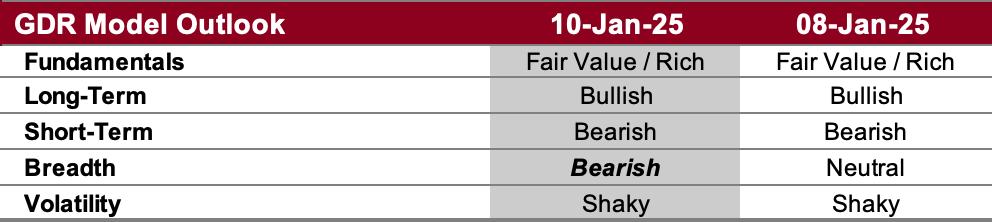

GDR Model Outlook

The GDR Model is neutral to bearish. Overall it has been inching towards bearish all week, but there still seems to be some indecision in the market at this point.

Fundamentals Outlook (as of 17 Jun 2024): for the first time in a while the model showed stocks as being richly valued (i.e. overpriced). Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 3 Jan 2025): the market found strength again last week. The probability of a significant long-term sell-off has materially decreased.

Short-Term Outlook (as of 8 Jan 2025): the market continued to show weakness on Wednesday. It will be interesting to see what the upcoming employment (Friday) and inflation data (Tuesday, Wednesday) might do…

Breadth Outlook (as of 8 Jan 2025): breadth has declined further to bearish. This additional evidence of growing weakness in the market.

Volatility Outlook (as of 8 Jan 2025): volatility showed some signs of stabilization today, but overall no change in the outlook.

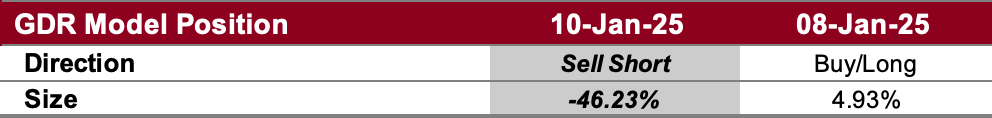

GDR Model Position

The GDR Model has opened a modest short position as the market continues to weakness. However, there is still broad indecision on direction, which means the model is unlikely to meaningfully increase its short position unless the Long-Term Outlook starts to decisively deteriorate.