S&P 500 Daily Perspective for Thu 6 Jul 2023

Bullish on consolidation above balance zone

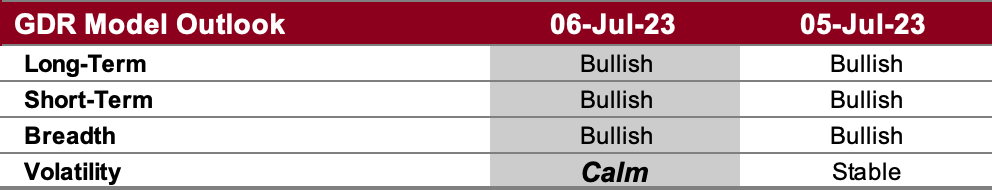

GDR Model Insights for the S&P 500

GDR Model Performance

The model returned 3.39% in June, lagging behind the S&P 500 Total Return’s 6.61%. Q2 was a tough quarter with the model returning 2.12%, notably behind the index’s 8.74%. This year has been challenging for the GDR Model’s style due to low confidence in the market.

GDR Model Outlook

The GDR Model is now back to bullish following some recent stabilization.

GDR Model Position

The GDR Model has re-opened its long position. However, position size is reduced compared to earlier in the year due to deteriorating fundamentals.

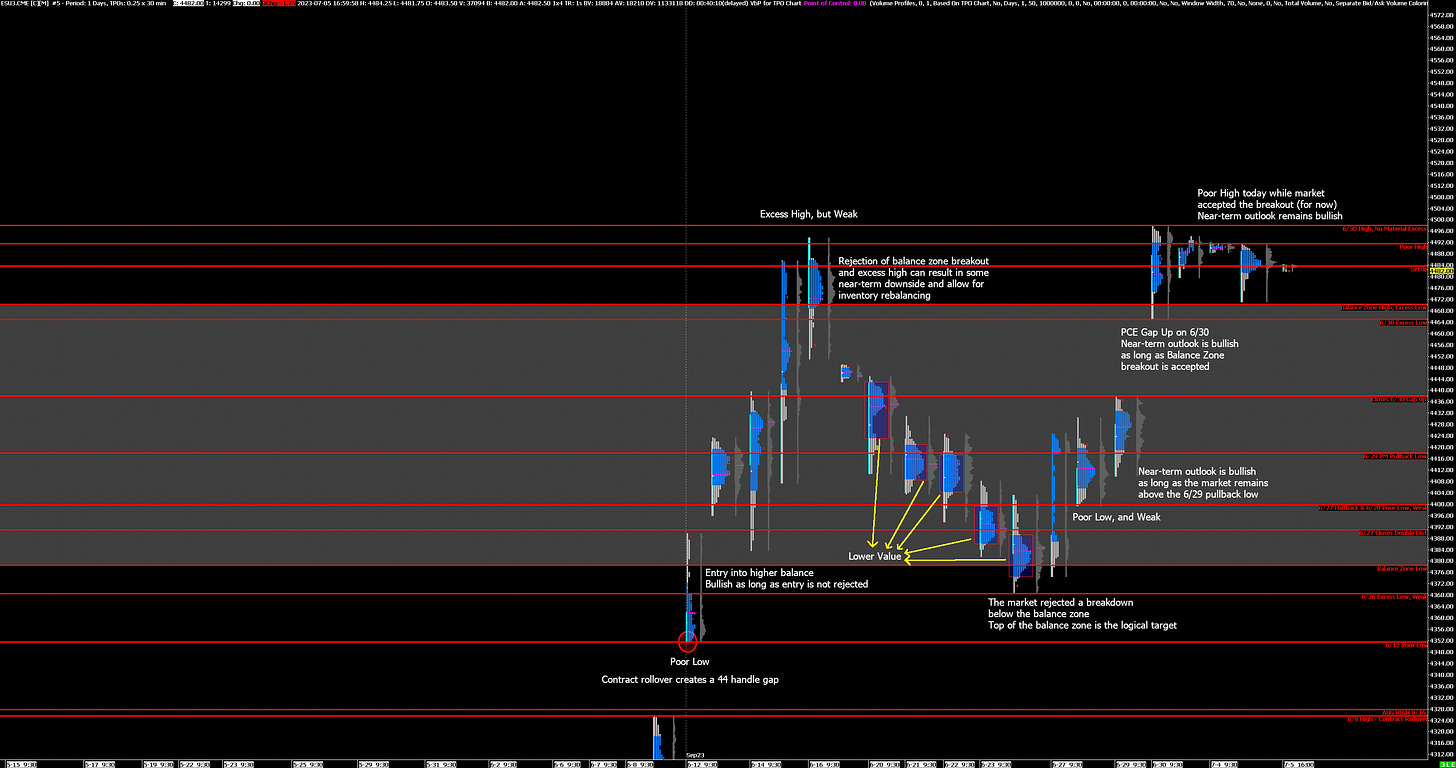

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: bullish on consolidation above balance zone

Alternate Outlook: rejected breakout to repair poor structure below

Key Levels

Bullish: 4492 (Poor High), 4498 (Top of 2-Day Balance), 4589 (April 2022 High)

Bearish: 4470 (Top of Previous Balance Zone), 4438 (Closes Gap Up), 4400 (Poor Low, Weak Low)

Market Narrative

The market’s profile for today suggests short-covering, which can weaken a market. Indeed, this most recent leg of the current 5-day rally is built on fairly weak structure, which I expect would be repaired later on. However, in the near-term the outlook remains bullish as the market is consolidating in a 2-day balance above the previous balance zone. At this point, odds favor another swing higher.

Economic Calendar

8:15am - ADP Nonfarm Employment Change

8:30am - Initial Jobless Claims

9:45am - Markit Services PMI

10:00am - JOLTs Job Openings, ISM Non-Manufacturing PMI

Tomorrow: Nonfarm Payrolls (8:30am)