S&P 500 Daily Perspective for Thu 18 May 2023

Attempting breakout from Short-Term Balance, monitor for continuation

***ANNOUNCEMENT***

The S&P 500 Futures Market Profile Analysis will not be available for Friday 19 May 2023. It will return for Monday 22 May 2023.

The GDR Model and Economic Calendar will be provided as usual.

GDR Model Insights for the S&P 500

GDR Model Performance

This year has been challenging for the Model’s style due to low confidence in the market.

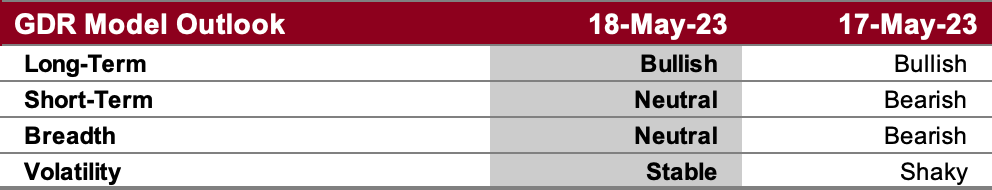

GDR Model Outlook

The overall Model is tentatively becoming more Bullish. This could signal the potential of a new uptrend.

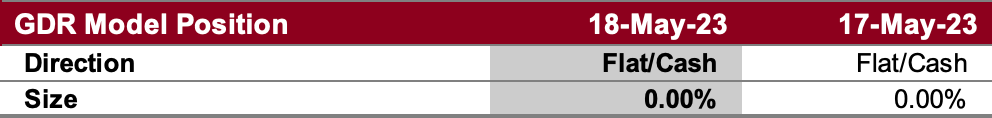

GDR Model Position

The model is flat, but if market conditions continue improving the way they did today then it’s likely it will open a meaningful Long position soon.

S&P 500 Futures Market Profile Analysis

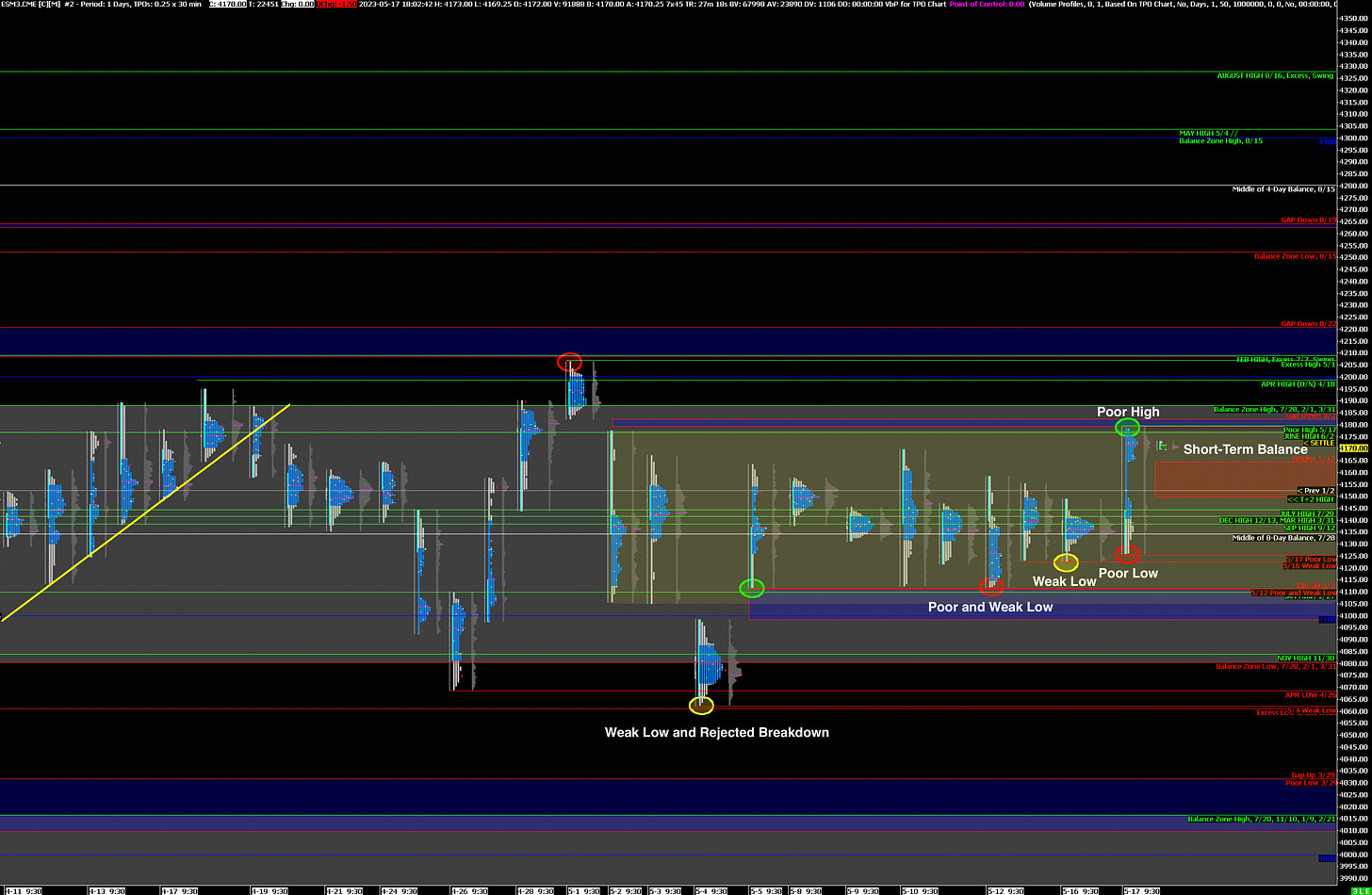

Near-Term Outlook: Tentative Breakout from Balance, Monitor for Continuation

Alternate Outlook: N/A

Key Levels

Bullish: 4180 (Poor High), 4188 (Top of Current Balance Zone), 4221 (Closes Prev Gap Down)

Bearish: 4149 (Closes Double Distribution), 4126-4123 (Poor Low and Weak Low), 4110 (Poor Low, Weak Low)

Market Narrative

The market attempted to breakout from Short-Term Balance but it was tentatively rejected. The key for tomorrow will be to monitor for continuation - if the ES tries to breakout again and it’s accepted then there’s meaningful potential for further upside.

On the other hand, if a breakout is rejected again, then rotation all the way back down to the bottom of Short-Term Balance at around 4110 is the target trade. Keep in mind that there is meaningful evidence that today’s trade on both sides was dominated by Weak Hands Traders who left a Poor Low and a Poor High behind to be repaired.

Economic Calendar

8:30am - Philly Fed Manufacturing Index, Initial Jobless Claims

9:30am - Fed Barr Testimony

10:00am - Existing Home Sales

Later This Week: Fed Chair Powell Speaks (Fri)