S&P 500 Daily Perspective for Fri 28 Jul 2023

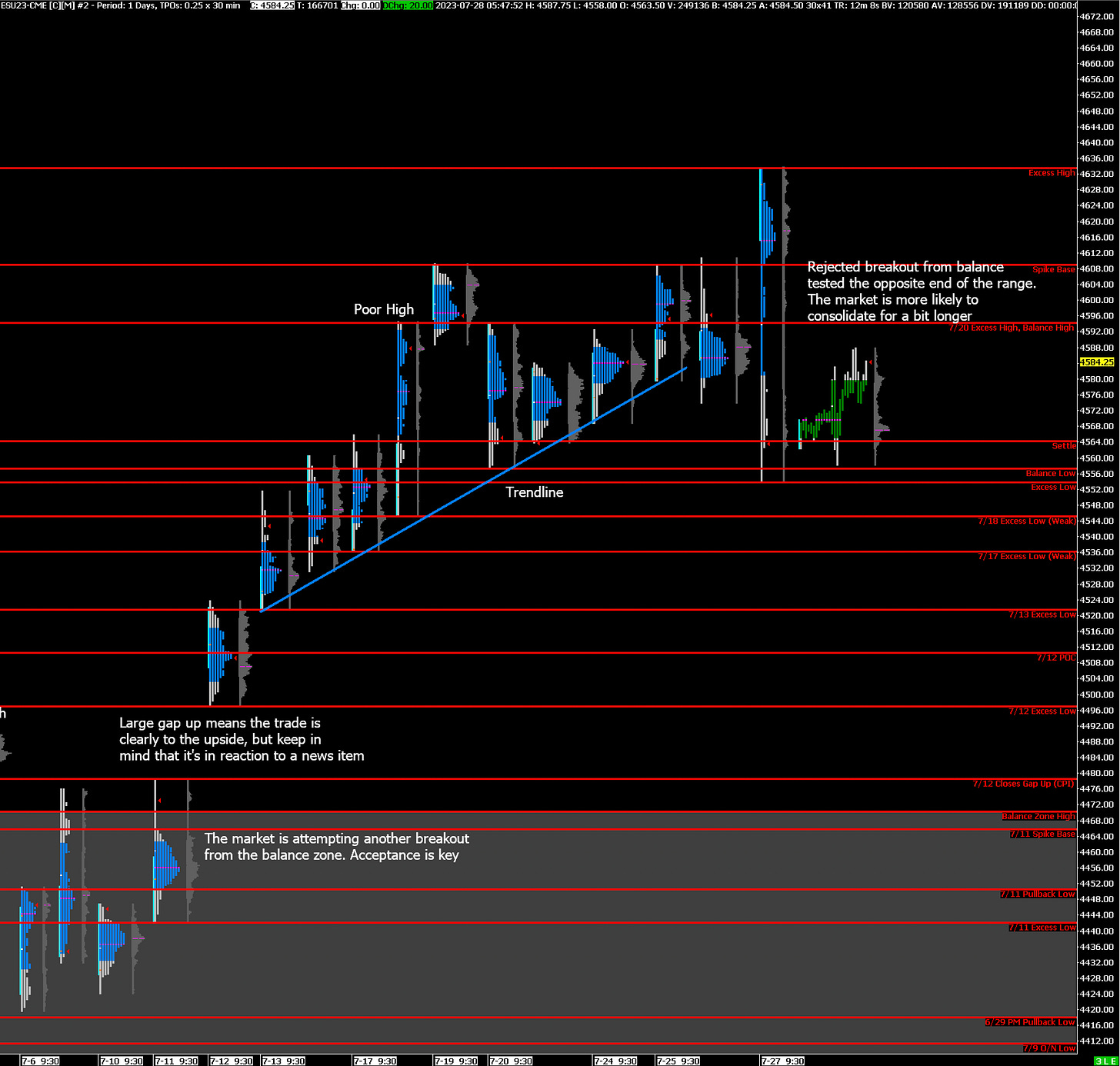

Back in balance, spike trading guidelines apply

GDR Model Insights for the S&P 500

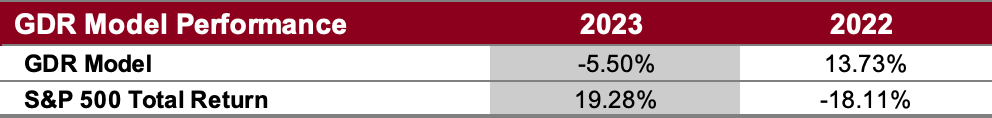

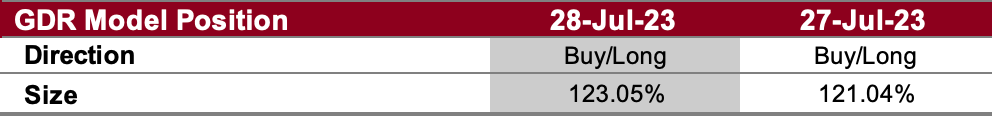

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

GDR Model Outlook

The GDR Model is bullish but has deteriorated slightly. Some caution may be warranted.

GDR Model Position

After a short break, the GDR Model is back to its long position as its outlook remains bullish across the board. This is a fairly bold position for this week given all the critical data releases.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: short-term balance, spike trading guidelines apply

Alternate Outlook: N/A

Key Levels

Bullish: 4594 (Top of Short-Term Balance), 4609 (Spike Base), 4634 (Excess High)

Bearish: 4557 (Bottom of Short-Term Balance), 4545 (7/18 Excess Low, Weak Low), 4536 (7/17 Excess Low, Weak Low)

Market Narrative

The market rejected a breakout from the current balance zone following a gap higher. It then went on to test the opposite edge of the balance zone, which it seems to have (preliminarily) rejected. The more likely near-term outcome at this point is for further balance. You can apply balance trading guidelines to the current balance zone in conjunction with spike trading guidelines relative to yesterday.

Economic Calendar

Earnings Before the Open: XOM 0.00%↑

8:30am - PCE

10:00am - Michigan Consumer Sentiment

Next Week: AAPL 0.00%↑ Earnings (Thu), AMZN 0.00%↑ Earnings (Thu) , Nonfarm Payrolls (Fri)