S&P 500 Daily Perspective for Thu 1 Jun 2023

Still in bullish consolidation, but caution is required

GDR Model Insights for the S&P 500

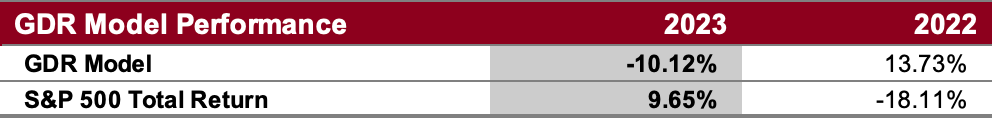

GDR Model Performance

The GDR Model returned -2.99% in May vs the S&P 500’s 0.43%, underperforming the index by 342 basis points. This year has been challenging for the GDR Model’s style due to low confidence in the market.

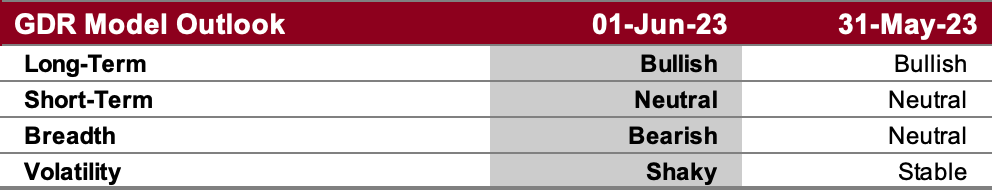

GDR Model Outlook

The GDR Model is back to neutral. Disagreement across timeframes and methodologies reflects how unlikely a sustained trend is right now.

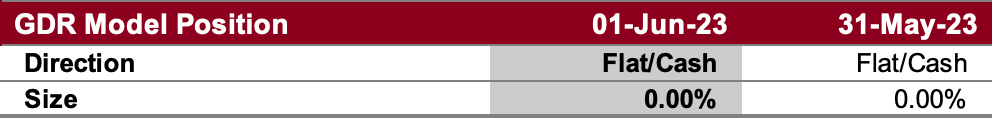

GDR Model Position

The GDR Model is in cash and as long as there is disagreement across its components, it will likely remain so.

S&P 500 Futures Market Profile Analysis

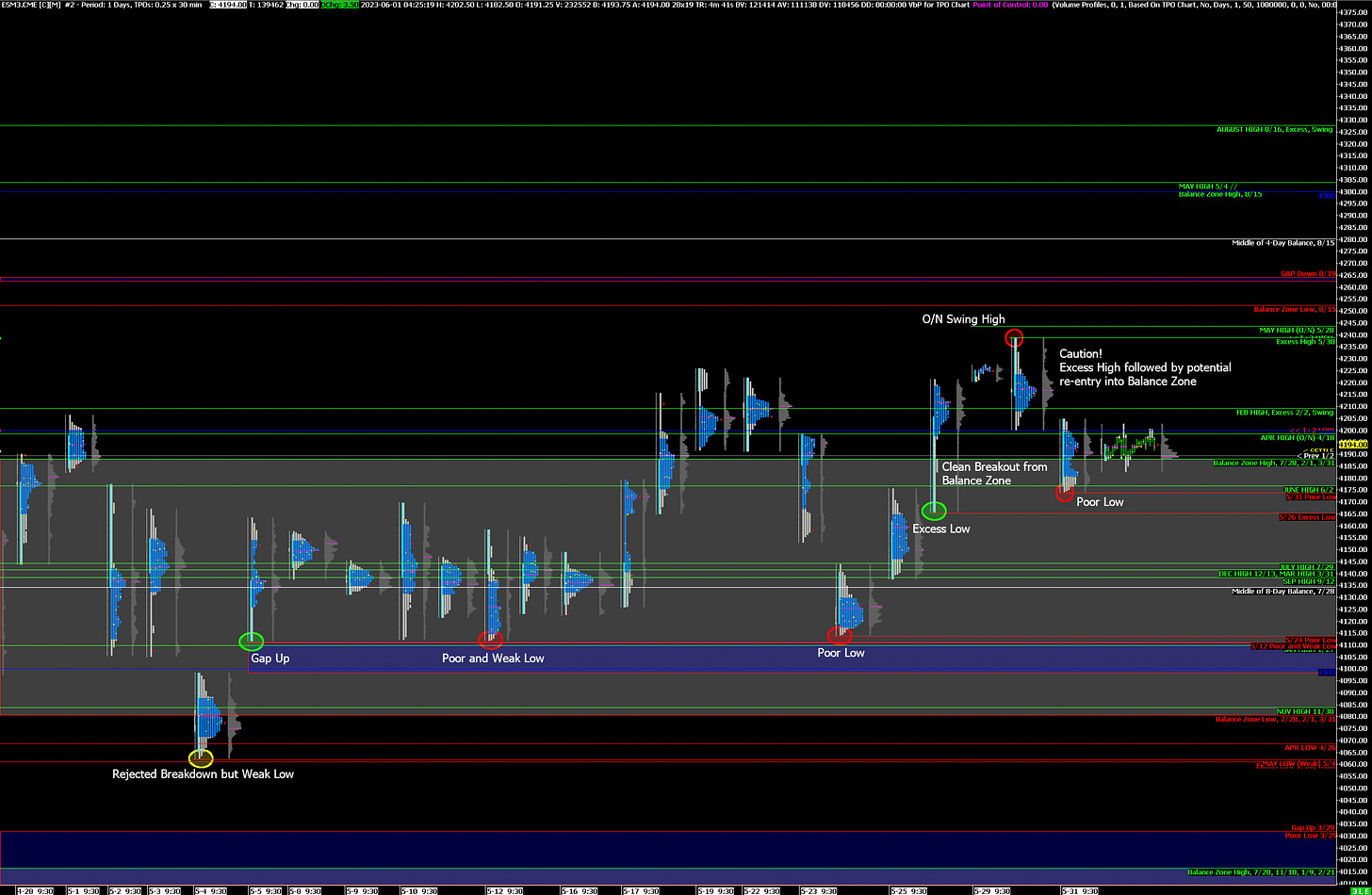

Near-Term Outlook: in consolidation, bullish

Alternate Outlook: re-entry into lower balance zone and another failed breakout

Key Levels

Bullish: 4200 (T+2 Settlement Low, April High), 4244 (5/28 O/N Swing High, May High), 4252 (Bottom of Upper Balance Zone)

Bearish: 4188 (Top of Lower Balance Zone), 4174 (5/31 Poor Low), 4165 (5/26 Excess Low)

Market Narrative

The market consolidated further on Wednesday in what turned out to be a relatively balanced trading day. Thus the near-term outlook for the ES will likely remain bullish unless it breaks below the 5/26 excess low.

However, caution is in order: note that Tuesday’s trading left behind an excess high. This was followed on Wednesday by a re-entry into the lower balance zone (albeit with limited acceptance so far) that left behind a poor low. This confluence of recent references tends to be a recipe for near-term tops.

Economic Calendar

8:15am - ADP Nonfarm Employment Change

8:30am - Unit Labor Costs, Initial Jobless Claims

9:45am - Markit Manufacturing PMI

10:00am - ISM Manufacturing PMI

Tomorrow: Nonfarm Payrolls (8:30am)