S&P 500 Daily Perspective for Wed 17 May 2023

More balancing...

GDR Model Insights for the S&P 500

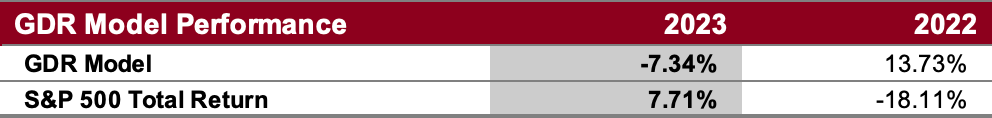

GDR Model Performance

This year has been challenging for the Model’s style due to low confidence in the market.

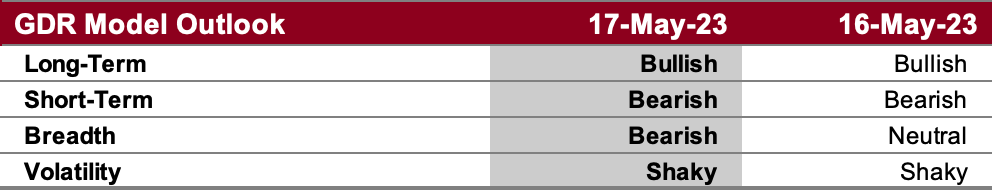

GDR Model Outlook

The overall Model is now Divergent with its components in broad disagreement. This is reflective of an indecisive market with low odds of a sustained trend.

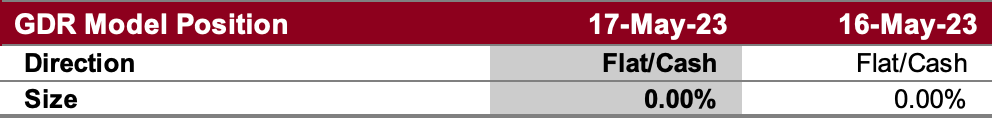

GDR Model Position

The model is now back to flat, but if the market continues deteriorating it will likely re-open a Short position.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: Still in Short-Term Balance, tilt Bearish

Alternate Outlook: N/A

Bullish: 4144 (PM Rally High), 4170 (5/10 High), 4188 (Top of Current Balance Zone), 4221 (Closes Prev Gap Down)

Bearish: 4123 (Weak Low), 4110 (Poor Low, Weak Low), 4080 (Bottom of Current Balance Zone), 4062 (5/4 Weak Low)

Market Narrative

There have been few changes to the narrative from the beginning of the week: today, like yesterday, was yet another inside day though this time with a Bearish close near the day’s low which is Weak. The odds of further downside keep increasing and there is still plenty of Poor Structure to be repaired below, but barely any above.

Balance Trading Guidelines are a good guide for how to approach the current market, and remember these are only probabilities - just because the odds favor an occurence, it doesn’t guarantee it will happen. Finally, while the day ended on a Spike Down, I will ignore it as it’s a relatively small and Balance is the most important narrative right now.

Economic Calendar

8:30am - Building Permits and Housing Starts

Later This Week: Fed Chair Powell Speaks (Fri)