S&P 500 Daily Perspective for Wed 12 Jul 2023

Bullish, spike trading guidelines apply

GDR Model Insights for the S&P 500

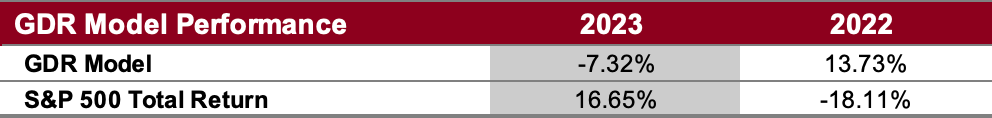

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

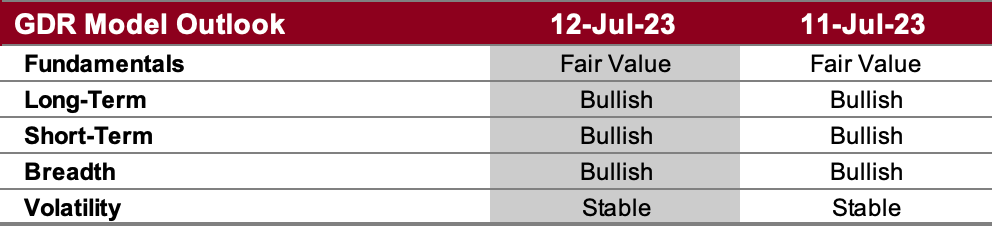

GDR Model Outlook

The GDR Model is bullish.

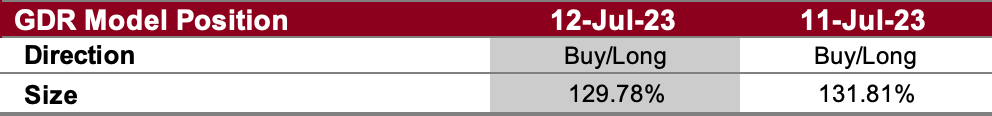

GDR Model Position

The GDR Model has re-opened its long position. However, position size is reduced compared to earlier in the year due to deteriorating fundamentals.

S&P 500 Futures Market Profile Analysis

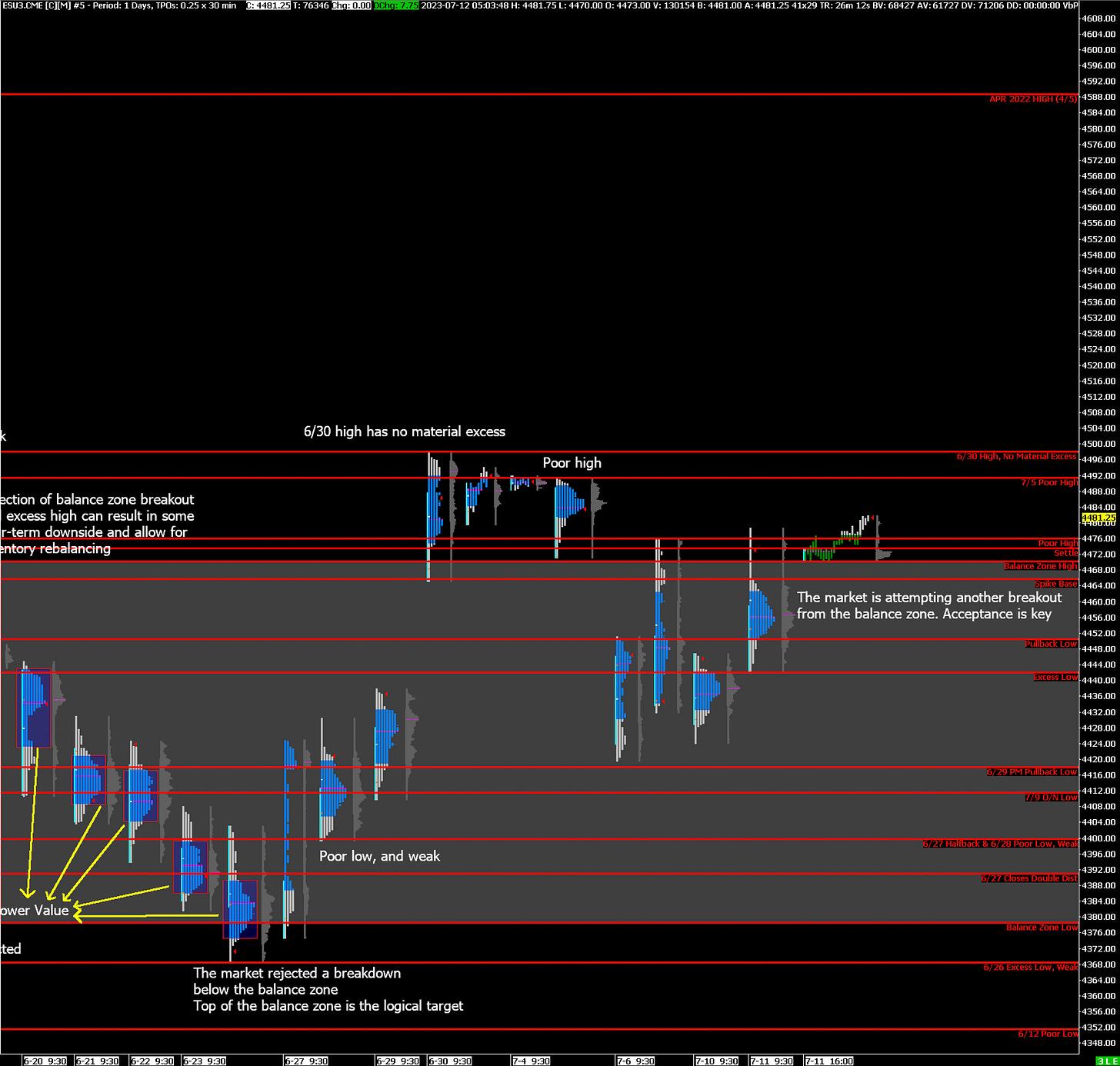

Near-Term Outlook: bullish, spike trading guildeines apply

Alternate Outlook: bearish on rejected breakout from balance zone

Key Levels

Bullish: 4492 (7/5 Poor High), 4498 (6/30 High with No Material Excess), 4589 (April 2022 High)

Bearish: 4466 (Spike Base), 4450 (Pullback Low), 4418 (6/29 Pullback Low)

Market Narrative

Yesterday was a trend day that ended on a spike higher. It also left behind an afternoon pullback low, which together with the spike base provide excellent structural references that can help determine whether the market is turning more bearish. Specifically, spike trading guildeines will likely apply this morning (unless the reaction to CPI at 8:30am is strongly negative) and as long as the market continues to accept above the spike base at 4466 and the afternoon pullback low at 4450, the outlook will remain bullish.

Regardless, do note that the market has already attempted to break out of the current balance zone three times and was rejected, so that still remains a possibility over the next several days.

Economic Calendar

8:30am - CPI

2:00pm - Beige Book

Later this Week: PPI (Thu)