S&P 500 Daily Perspective for Tue 13 Jun 2023

Bullish but careful with overly long inventories heading into key data releases

GDR Model Insights for the S&P 500

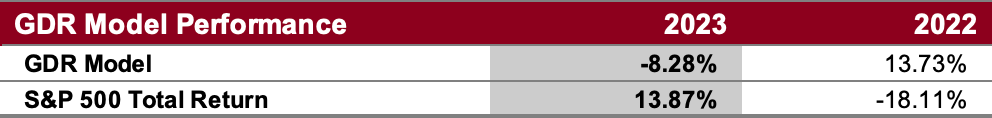

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

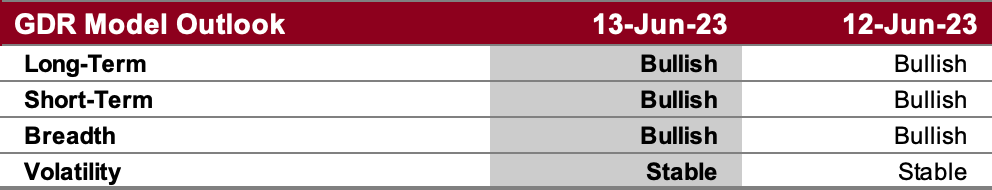

GDR Model Outlook

The GDR Model is now bullish following the recent breakout from consolidation.

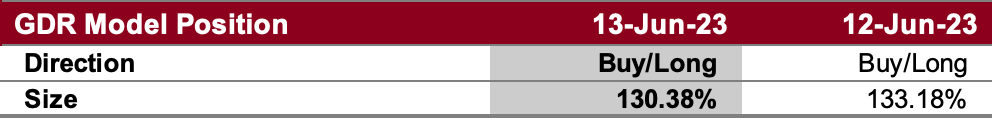

GDR Model Position

The GDR Model is currently holding a long position on the market’s strength.

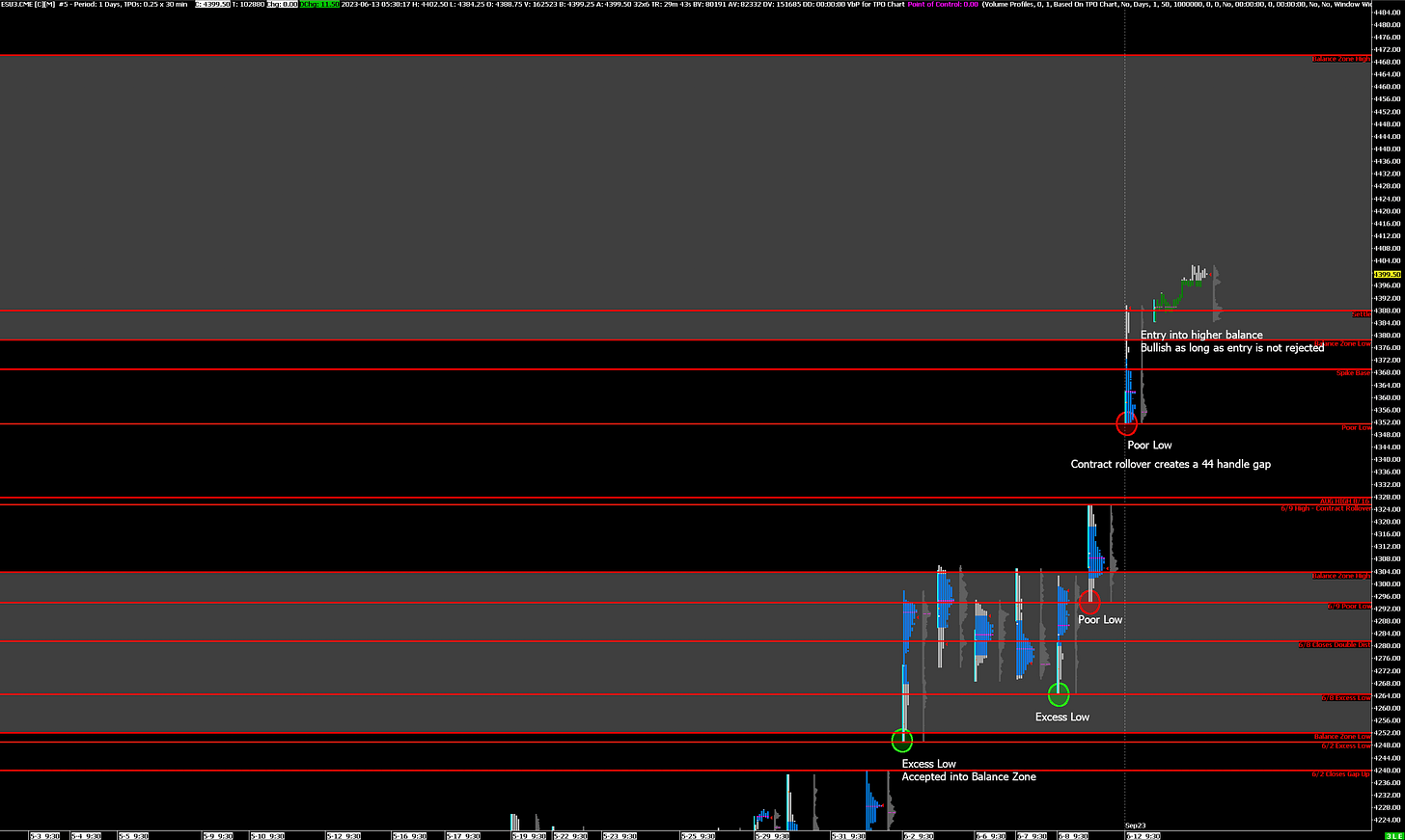

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: bullish on entry into higher balance zone

Alternate Outlook: liquidation break on overly long inventories

Key Levels

Bullish: 4470 (Top of Current Balance Zone), 4588 (April 2022 High), 4632 (March 2022 High)

Bearish: 4378 (Bottom of Current Balance Zone), 4369 (Spike Base), 4352 (Poor Low)

Market Narrative

Yesterday the market re-entered a balance zone that had not been revisited since May 2022. If this is not rejected then the bullish near-term outlook remains. Moreover, there aren’t very many references above so there is some potential for the market to move quickly higher. Since yesterday closed on a spike, spike trading guidelines apply today.

However, it’s critical to note that the structure from yesterday is terrible. This suggests that inventories are getting overly long and the potential for at least a liquidation break is relatively high. This is definitely something to keep in mind as we await CPI today and the Fed’s interest rate decision tomorrow afternoon.

Economic Calendar

8:30am - CPI

Later this Week: Fed Interest Rate Decision (Wed), FOMC Press Conference (Wed)