S&P 500 Daily Perspective for Fri 5 May 2023

Short-term balance following multiple breakdown rejections

GDR Model Insights for the S&P 500

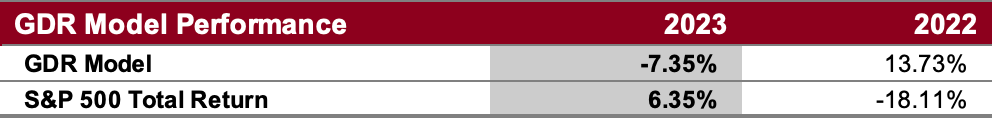

GDR Model Performance

The GDR Model returned 1.82% in April vs the S&P 500’s 1.56%, modestly outperforming the index by 26 basis points. April was marred by possibly the most indecisive market in the last 3 years. Overall this year has been challenging for the Model’s style due to low confidence in the market.

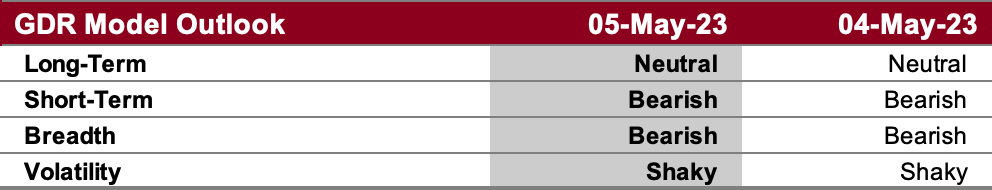

GDR Model Outlook

The overall Model is now well on its way towards Bearish mode following the market’s reaction to the FOMC announcement. Today’s unemployment data reaction has some potential to shift the model.

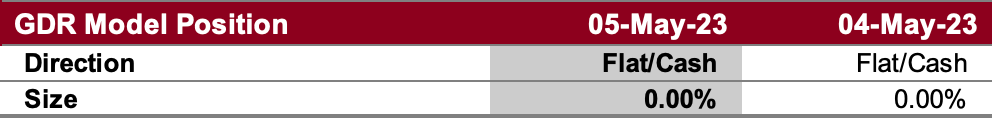

GDR Model Position

Despite the improvement at the end of last week, the model is still not committing to a position as there is not enough conviction. However, the market has clearly deteriorated since the start of the week increasing the likelihood of a Short position.

S&P 500 Futures Market Profile Analysis

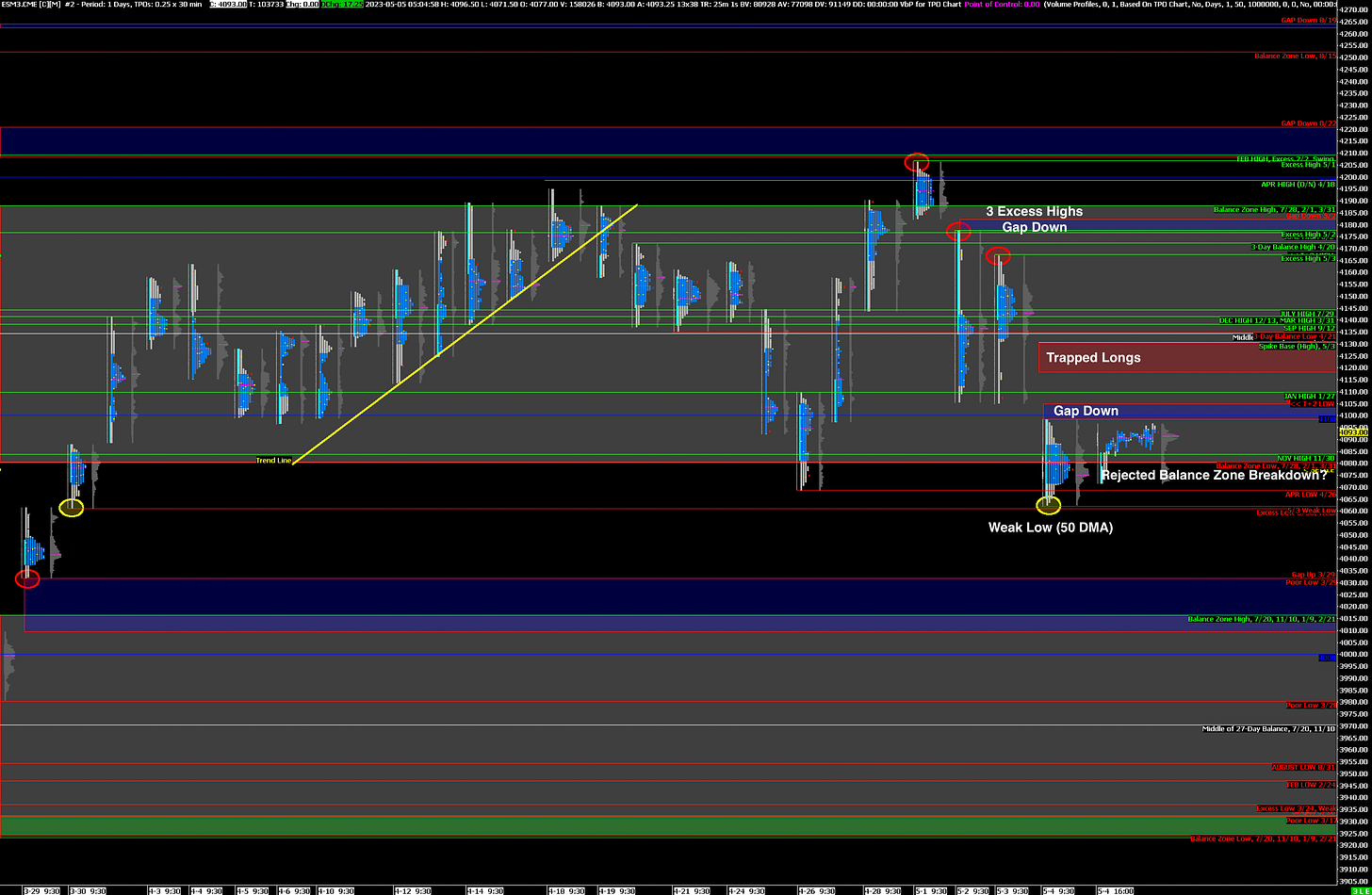

Near-Term Outlook: Balanced, tilt Bullish following rejected breakdown

Alternate Outlook: Unemployment data reaction causes further Bearishness

Key Levels for Today

Bullish: 4105 (Closes Gap Down), 4131 (Prev Spike Base), 4172 (Recent Short-Term Balance High)

Bearish: 4080 (Bottom of Current Balance Zone), 4062 (Y’day Weak Low), 4032 (Prev Poor Low)

Market Narrative

Yesterday the market Gapped Down and continued lower, trading below both the Balance Zone Low and the April Low, though ultimately rejecting the breakdown in what became a Balanced day. Something that I found striking was that each time the breakdown failed, the character of trading when price moved up was identical to that of Short Covering Rallies.

This makes me question the feasibility of any breakdowns because it suggests that short-term weak hands traders are very eager to Short this market. Ultimately, if institutional investors are already underexposed to equities and weak hands traders are this eager to jump on the Short-side then the potential for downside must be limited.

Economic Calendar

Today at 8:30am - Nonfarm Payrolls (8:30am)

Next Week: CPI (Wed), PPI (Thu)