S&P 500 Daily Perspective for Mon 17 Jul 2023

Potential reversal in the near-term

GDR Model Insights for the S&P 500

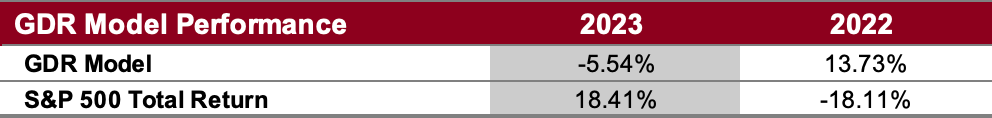

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

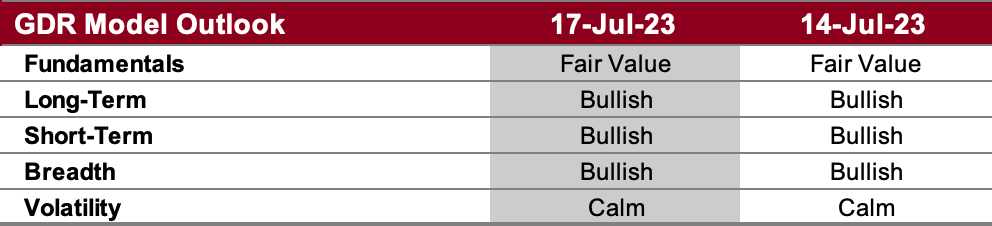

GDR Model Outlook

The GDR Model is bullish.

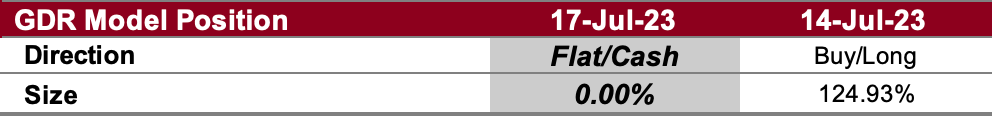

GDR Model Position

Even though the GDR Model remains bullish, it deteced more weakness than prices suggest towards the end of last week. In response, the model has pre-emptively closed its long position. If strength resumes, it would likely reopen the long position.

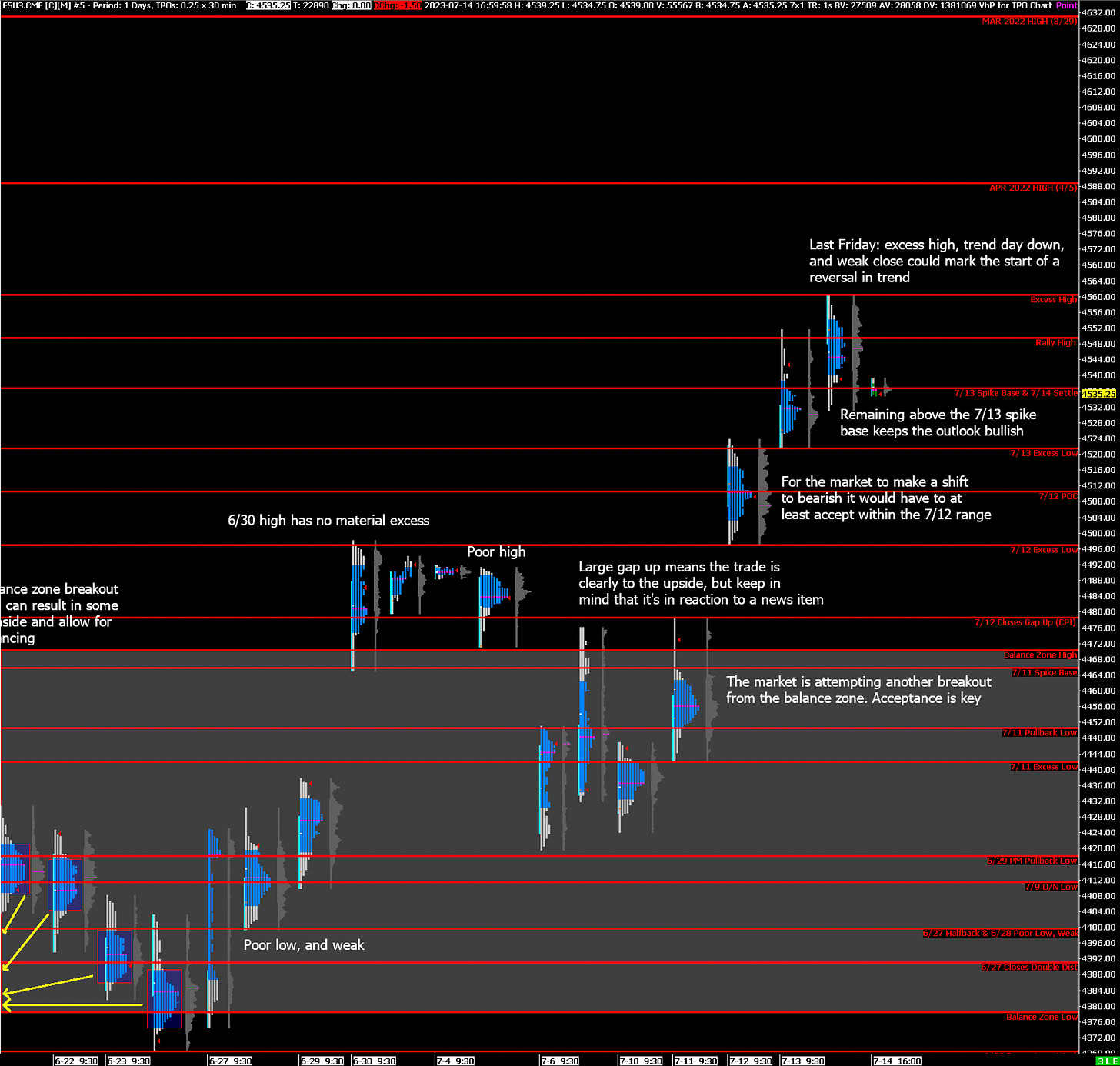

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: reversal of late-stage rally following excess high, weak close

Alternate Outlook: continuation of rally on sustained value trend higher

Key Levels

Bullish: 4550 (Rally High), 4561 (Excess High), 4589 (April 2022 High)

Bearish: 4536 (7/13 Spike Base), 4522 (7/13 Excess Low), 4497 (7/12 Excess Low)

Market Narrative

Last Friday was a trend day down that left behind an excess high and posted a weak close. Structure below is now very weak, which suggests that this last leg of the current rally is late stage and increases the odds of a reversal. Of course it’s critical to note that timing is always extremely difficult to get right when calling for the end of a trend.

Moreover, I would be remiss if I didn’t note that despite the weak aspects of last Friday’s trade, value ended clearly higher. This is an undeniably positive piece of evidence that supports the current rally compared to the previous sessions.

In the midst of this contradicting information, the key going into Monday’s trade will likely be whether the market remains below Friday’s rally high at 4550 (bearish), or if it trades and accepts above it (bullish).

Economic Calendar

8:30am - NY Empire State Manufacturing Index

Later this Week: TSLA 0.00%↑ earnings (Wed)