S&P 500 Daily Perspective for Tue 16 May 2023

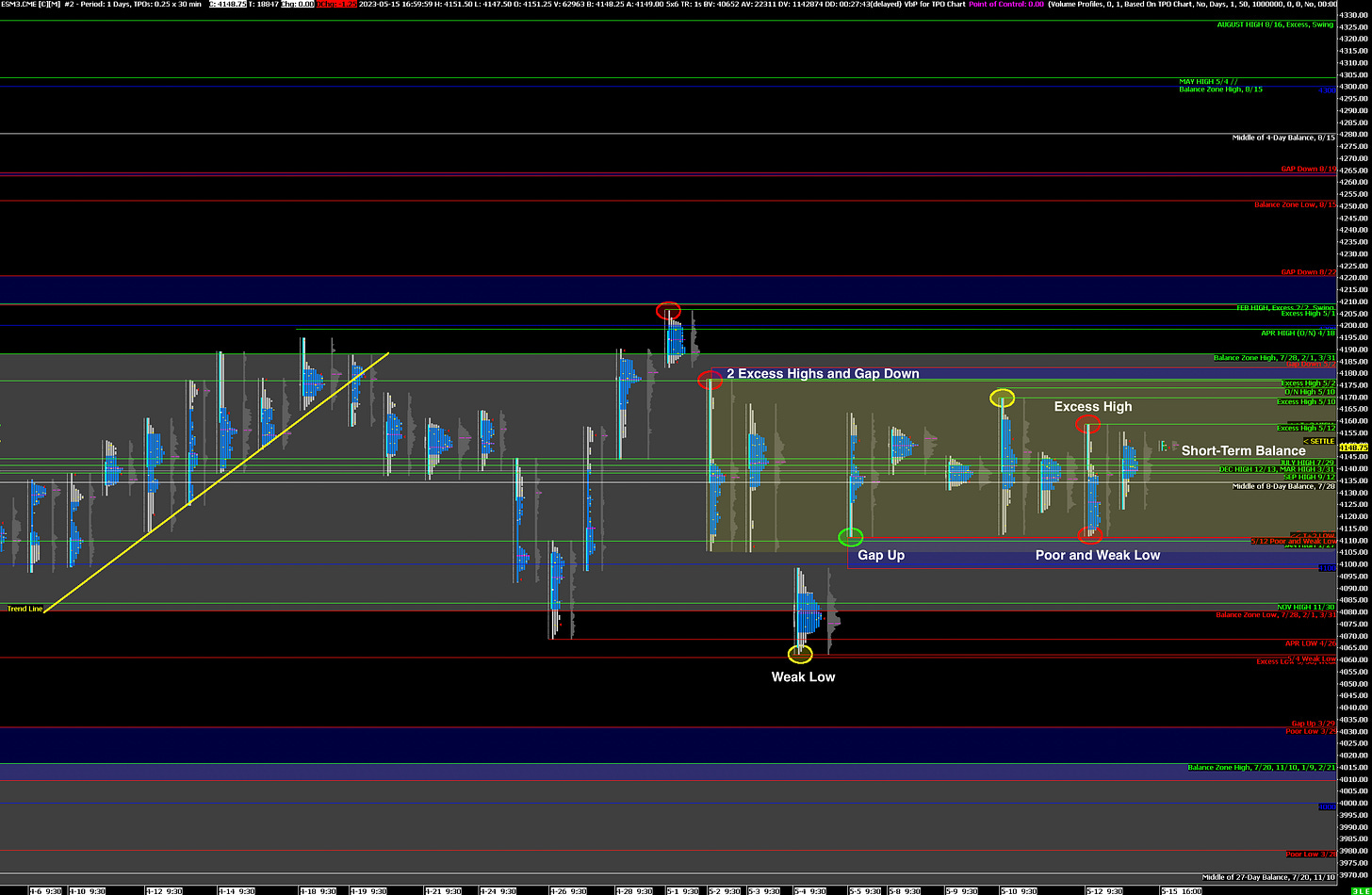

Still in short-term balance with volatility compression

GDR Model Insights for the S&P 500

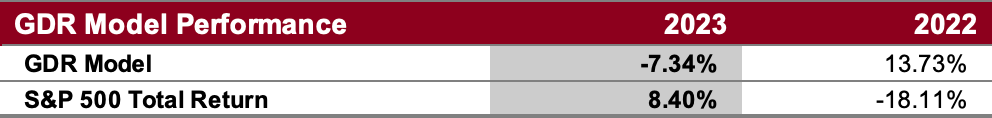

GDR Model Performance

This year has been challenging for the Model’s style due to low confidence in the market.

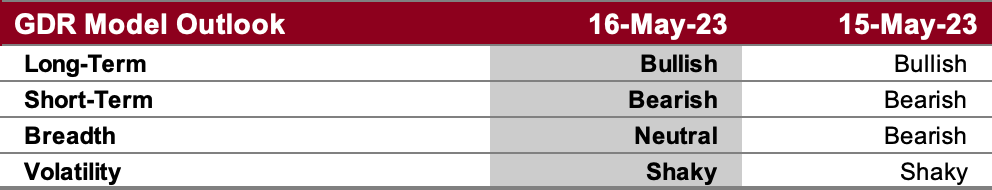

GDR Model Outlook

The overall Model is now Divergent with its components in broad disagreement. This is reflective of an indecisive market with low odds of a sustained trend.

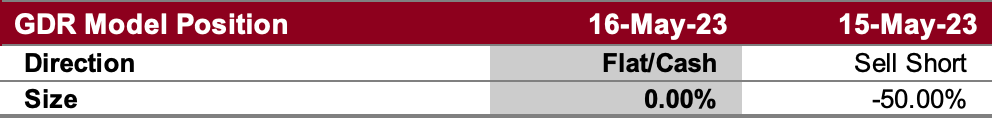

GDR Model Position

The model closed its short position at the close of trading today. As expected this position was quickly closed as soon as market conditions showed the slightest improvement.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: Still in Short-Term Balance, tilt Bearish

Alternate Outlook: N/A

Bullish: 4170 (5/10 High), 4188 (Top of Current Balance Zone), 4221 (Closes Prev Gap Down)

Bearish: 4110 (Poor Low, Weak Low), 4080 (Bottom of Current Balance Zone), 4062 (5/4 Weak Low)

Market Narrative

There is no change in the narrative from yesterday: today was an inside day with a Bullish close, however, the Poor and Weak Low from Monday decrease the odds of meaningful upside from here. Recall that there is still plenty of Poor Structure to be repaired below, but barely any above.

Balance Trading Guidelines are a good guide for how to approach the current market, and remember these are only probabilities - just because the odds favor an occurence, it doesn’t guarantee it will happen. Note the busy Economic Calendar for today.

Economic Calendar

8:15am - FOMC Member Mester Speaks

8:30am - Retail Sales

8:55am - FOMC Member Bostic Speaks

9:15am - Industrial Production

10:00am - Fed Barr Testimony, Business Inventories

12:15pm - FOMC Member Williams Speaks

7:00pm - FOMC Member Bostic Speaks

Later This Week: Fed Chair Powell Speaks (Fri)