S&P 500 Daily Perspective for Thu 5 June 2025

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

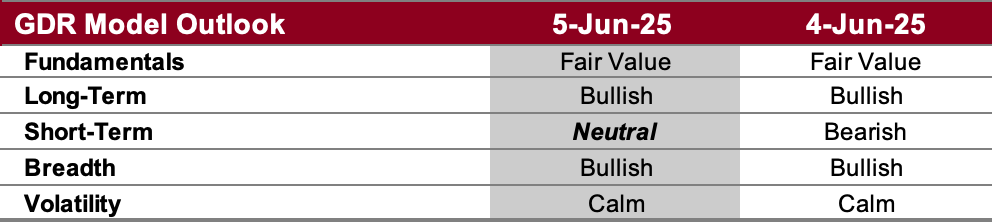

GDR Model Outlook

Overall Outlook (as of 4 Jun 2025): MOSTLY BULLISH. Following a quick break, the market seems to be in the process of lining up another bullish swing.

Fundamentals Outlook (as of 29 May 2025): Fair Value. The model has adjusted valuations slightly downward following the release of new data. Going forward GDR Model positioning should tactically tilt a little less towards the long side, all else equal. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

IMPORTANT NOTE: it’s unknown what the impact of tariffs on valuations (or what the ultimate level of the tariffs themselves) will actually be on valuations. Rather than make tariff-related assumptions to adjust the model accordingly, the Fundamentals Outlook will remain fully data-driven as it’s always been. All other portions of the model are entirely unaffected.

Long-Term Outlook (as of 30 May 2025): Bullish. The market remains strong from a long-term perspective despite the recent back and forth.

Short-Term Outlook (as of 4 Jun 2025): Neutral. The short-term outlook keeps playing hot and cold, but continued to build on yesterday’s improvement today. Perhaps it will soon start to line up with the rest of the model’s components…

Breadth Outlook (as of 4 Jun 2025): Bullish. Breadth remains bullish, which is in line with most of the model’s components.

Volatility Outlook (as of 4 Jun 2025): Calm. If this component of the model continues to sustain at stable or better, the market should drift upwards over time.

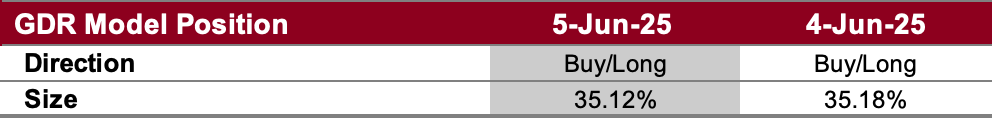

GDR Model Position

The GDR Model has a modest long position as the market remains indecisive on direction.