S&P 500 Daily Perspective for Tue 25 Nov 2025

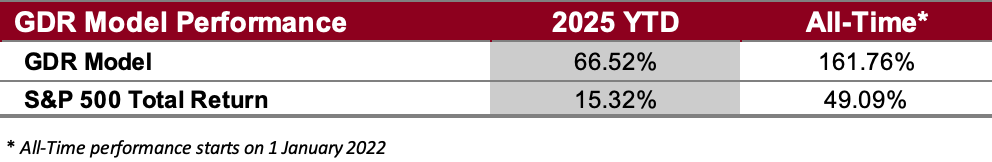

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

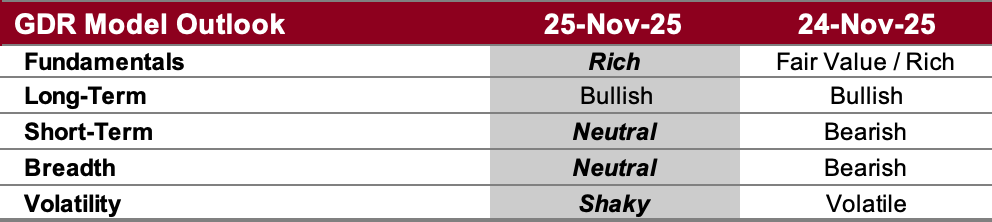

GDR Model Outlook

Overall Outlook (as of 24 Nov 2025): NEUTRAL. There is a fair chance that is recent market weakness is in the process of receding. Let’s see if the market is able to find and keep renewed strength…

Fundamentals Outlook (as of 24 Nov 2025): Rich. The model has adjusted valuations slightly upward following the release of new data. Going forward GDR Model positioning should tactically tilt a little more towards the long side, all else equal. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

IMPORTANT NOTE: it’s unknown what the impact of tariffs on valuations (or what the ultimate level of the tariffs themselves) will actually be on valuations. Rather than make tariff-related assumptions to adjust the model accordingly, the Fundamentals Outlook will remain fully data-driven as it’s always been. All other portions of the model are entirely unaffected.

Long-Term Outlook (as of 21 Nov 2025): Bullish. The long-term outlook showed real strength to end last week, and it remains bullish.

Short-Term Outlook (as of 24 Nov 2025): Neutral. The market has shown strength two days in a row, enough for an upgrade to neutral.

Breadth Outlook (as of 24 Nov 2025): Neutral. In line with the short-term outlook, breadth has also improved to neutral.

Volatility Outlook (as of 24 Nov 2025): Shaky. The volatility outlook also improved, though this is still a negative reading. When negative levels are sustained for a while, ranges tend to widen and nasty short-covering rallies tend to happen almost as often as big down days. On the other hand, if volatility returns to positive readings, the odds of a new swing up would increase significantly.

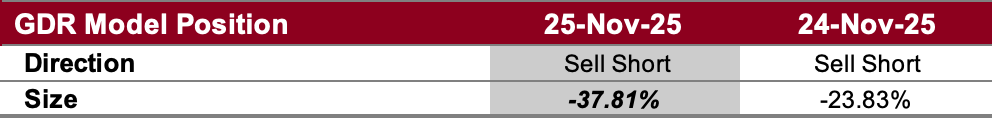

GDR Model Position

Following the notable strength to end last week, the GDR Model has recently opted to reduce its short position to nearly flat.