S&P 500 Daily Perspective for Tue 24 Dec 2024

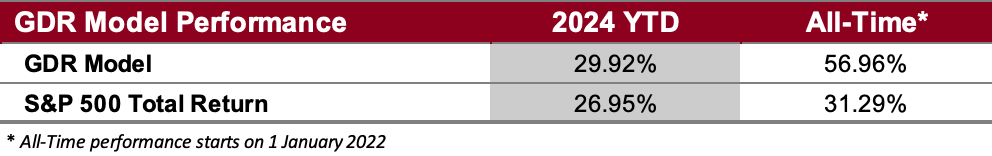

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated and a chart.

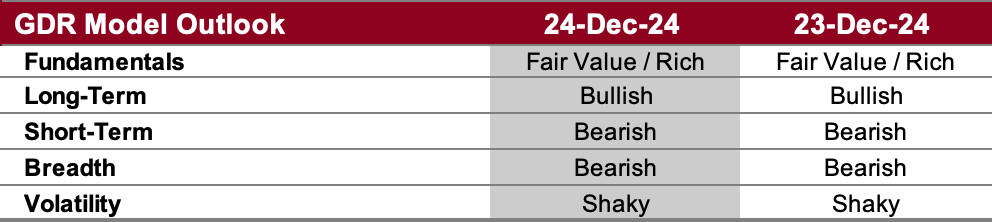

GDR Model Outlook

The GDR Model is mostly bearish. However, while the model has continued to pick up on underlying weakness in the market, there was a marked improvement today, especially in the Volatility Outlook. Ordinarily this could mark the end of a sell-off, but with the reduced trading that the holiday will almost certainly bring, that’s probably best taken with a grain of salt.

Note on the Fundamentals Outlook (as of 17 June 2024):

for the first time in a while the model showed stocks as being richly valued (i.e. overpriced). Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

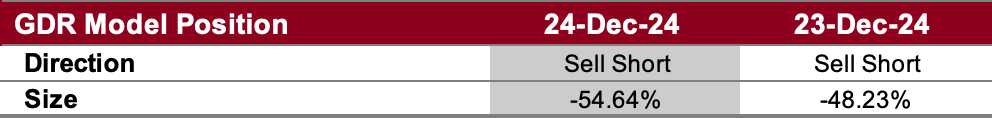

GDR Model Position

The GDR Model is keeping its modest short position. It will probably won’t add to the short unless the market weakens materially on the Long-Term timeframe. On the other hand, the model would likely need to see a lot more underlying strength in the market before closing its short.