S&P 500 Daily Perspective for Fri 28 April 2023

Back to Short-Term Balance, could go either way

GDR Model Insights for the S&P 500

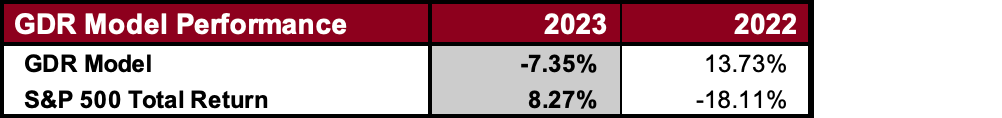

GDR Model Performance

This year has been challenging for the Model’s style due to low confidence in the market.

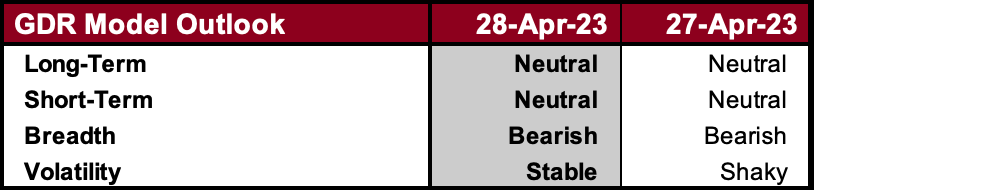

GDR Model Outlook

The overall Model is Neutral, but it’s steadily headed towards Bearish. The Short-Term Outlook deteriorated to Neutral. Breadth is solidly Bearish and the potential for increased Volatility has also been steadily increasing further.

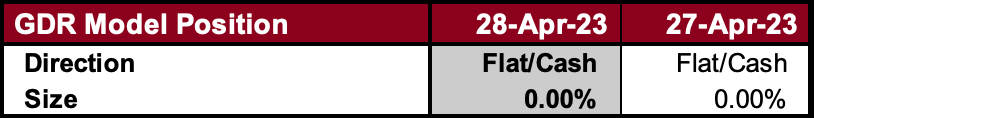

GDR Model Position

Despite the slight deterioration, the model is still not committing to a position as there is not enough conviction.

S&P 500 Futures Market Profile Analysis

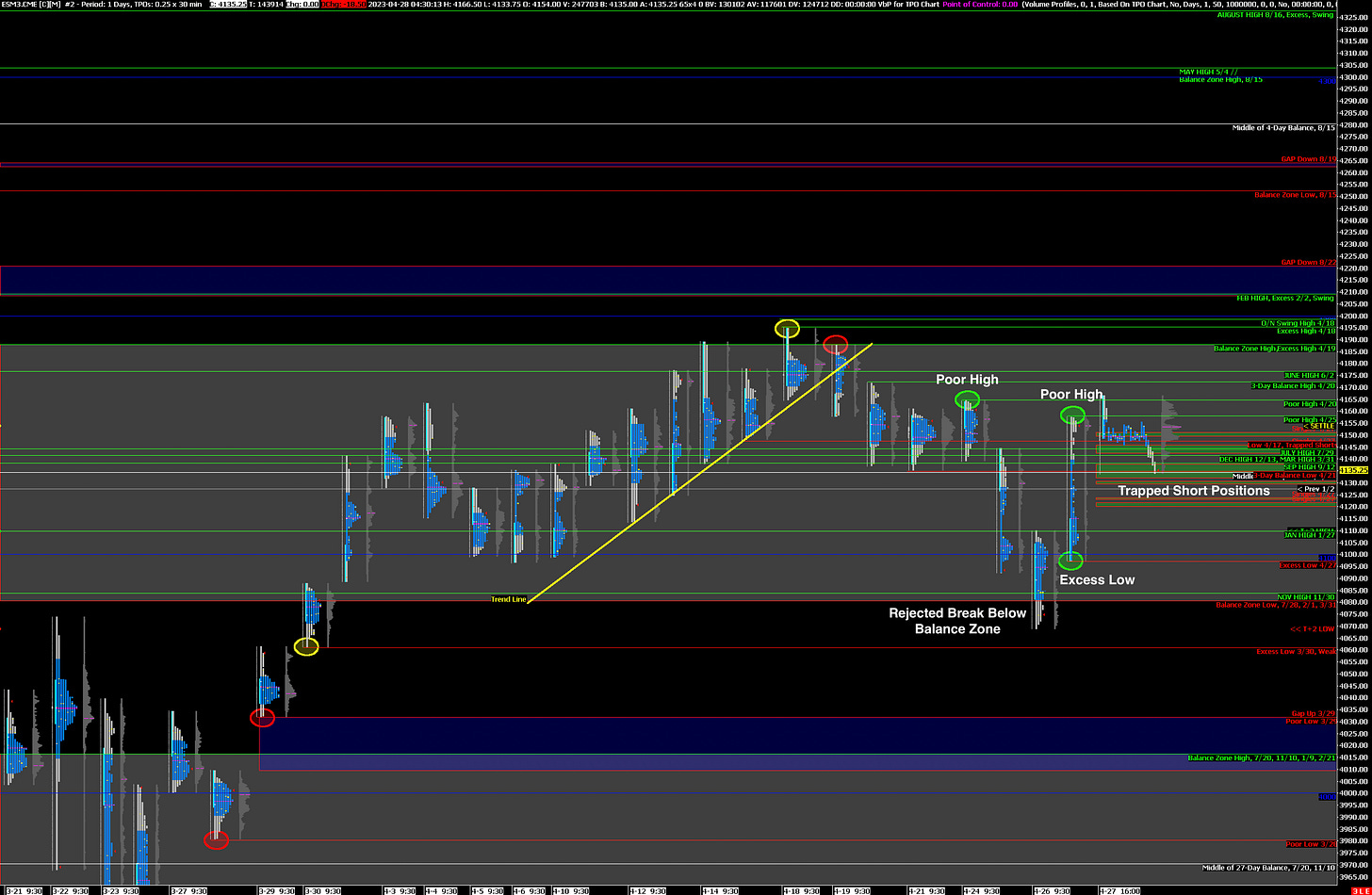

Near-Term Outlook: Back to previous Short-Term Balance, could go either way

Alternate Outlook: N/A

Key Levels for Today

Bullish: 4158 (Poor High), 4172 (Short-Term Balance High), 4188 (Top of Current Balance Zone)

Bearish: 4135 (Short-Term Balance Low), 4100 (Go-No-Go Level), 4080 (Bottom of Current Balance Zone)

Market Narrative

Yesterday was likely a furious Short-Covering Rally that left behind plenty of Poor Structure in the form of Single Prints. These are Trapped Short Positions. The market is now back to the recent Short-Term Balance and could break either direction. Short-Covering typically weakens the market, but yesterday ended with a Poor High, which may imply that the rally is not over yet.

Economic Calendar

Earnigs Before the Open: XOM 0.00%↑

Today at 8:30am - PCE

Next Week: Fed Interest Rate Decision (Wed), Nonfarm Payrolls (Fri)