S&P 500 Daily Perspective for Mon 31 Jul 2023

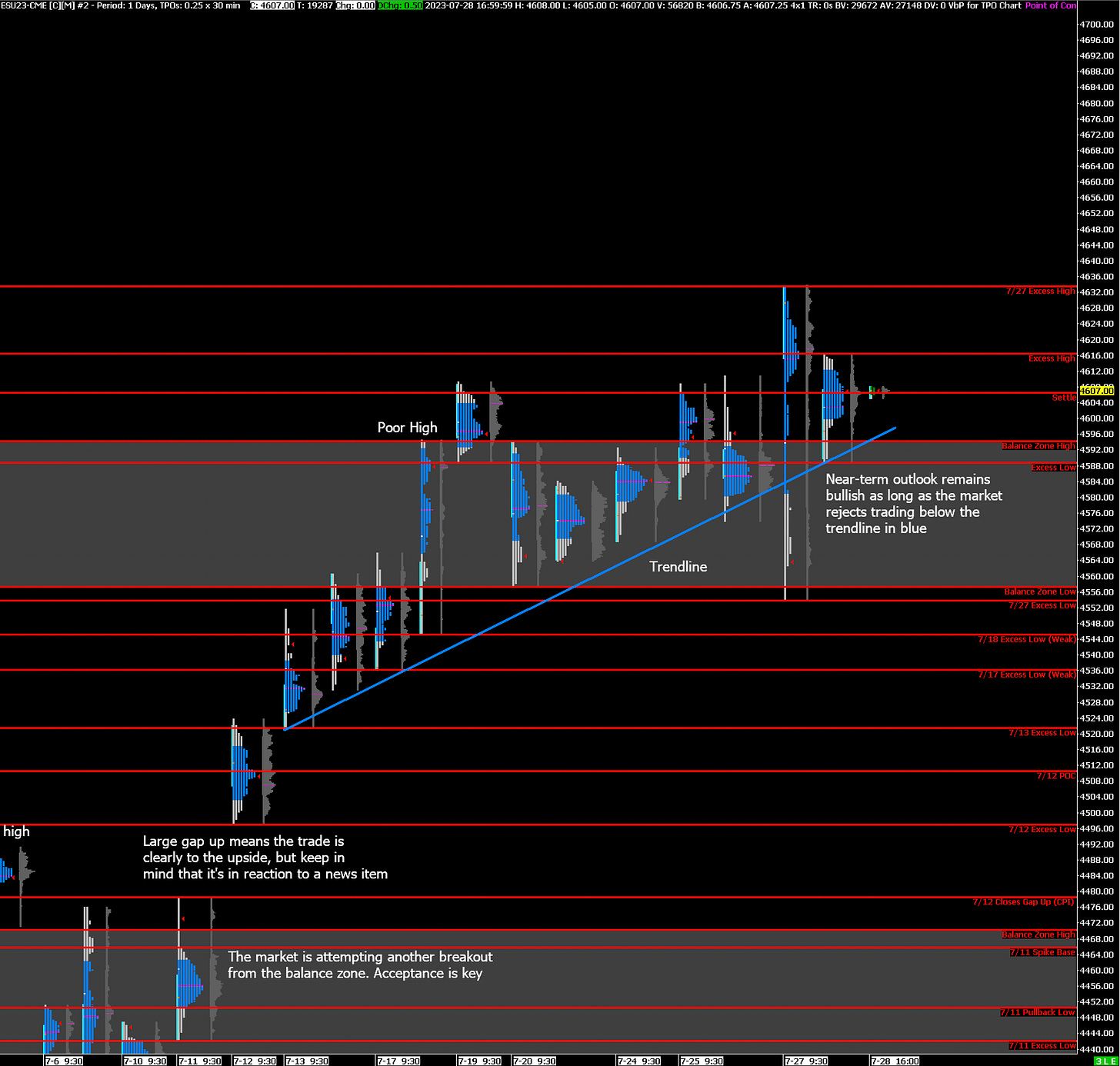

The market remains bullish as it has persistently remained above the current trendline

***ANNOUNCEMENT***

As per the August 2023 announcements, starting with the S&P 500 Daily Perspective for 1 August 2023, the GDR Model will be upgraded. Today’s position still follows the current GDR Model version.

GDR Model Insights for the S&P 500

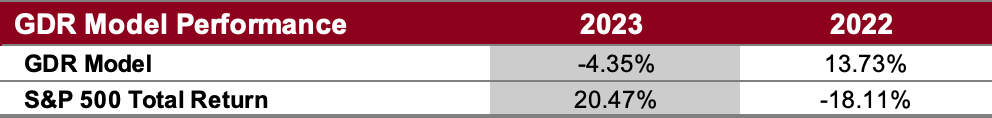

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

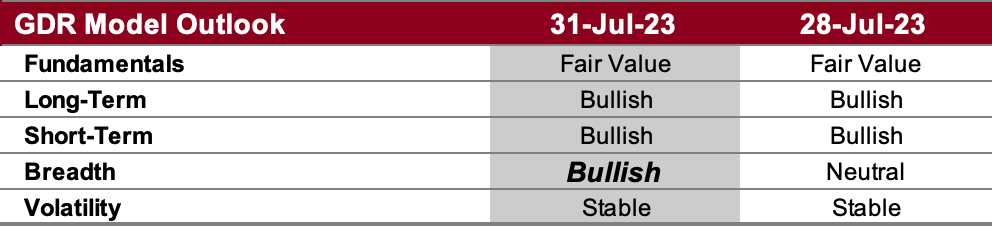

GDR Model Outlook

The GDR Model is bullish and has now maintained this outlook across the board for several weeks.

GDR Model Position

The GDR Model is long.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: bullish as long as the market rejects below the current trendline

Alternate Outlook: N/A

Key Levels

Bullish: 4617 (Y’day Excess High), 4634 (7/27 Excess High), 4740 (1/12/2022 Swing High)

Bearish: 4589 (Y’day Excess Low, Trendline), 4557 (Bottom of Balance Zone), 4545 (7/18 Excess Low, Weak Low)

Market Narrative

Following the liquidation break last Thursday, the market quickly recovered the trendline and closed above balance once again for another attempt at a breakout. While a successful breakout is important, the market will likely remain bullish as long as it maintains the current trendline. For the market to look more bearish, it would likely have to trade and accept below the current balance zone low (4557).