S&P 500 Daily Perspective for Mon 22 Dec 2025

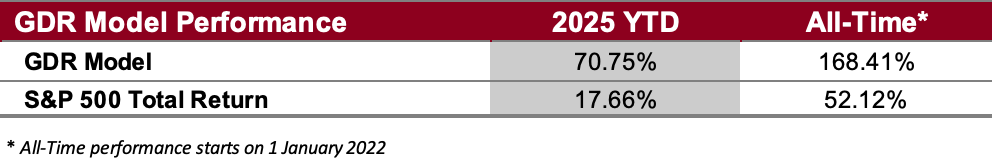

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

GDR Model Outlook

Overall Outlook (as of 19 Dec 2025): BULLISH. The model is bullish, which means that, according to its framework, the odds of continued upside are relatively high.

Fundamentals Outlook (as of 24 Nov 2025): Rich. The model has adjusted valuations slightly upward following the release of new data. Going forward GDR Model positioning should tactically tilt a little more towards the long side, all else equal. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

IMPORTANT NOTE: it’s unknown what the impact of tariffs on valuations (or what the ultimate level of the tariffs themselves) will actually be on valuations. Rather than make tariff-related assumptions to adjust the model accordingly, the Fundamentals Outlook will remain fully data-driven as it’s always been. All other portions of the model are entirely unaffected.

Long-Term Outlook (as of 19 Dec 2025): Bullish. The market remains strong on the long-term timeframe.

Short-Term Outlook (as of 19 Dec 2025): Bullish. The market remains strong on the short-term timeframe, though weaker than two or three weeks ago.

Breadth Outlook (as of 19 Dec 2025): Neutral. Breadth is neutral, but given that the overall model is broadly positive, this isn’t very important for now. If it dips further to bearish it may turn into something.

Volatility Outlook (as of 19 Dec 2025): Stable. The volatility outlook is stable. Even though the recent back and forth has been entirely within positive categories, it’s still something to note…

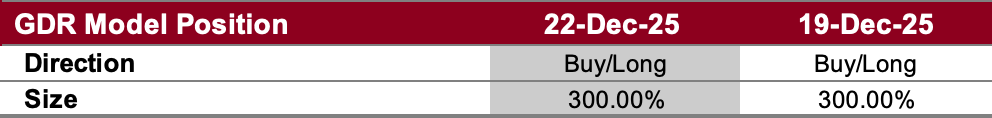

GDR Model Position

The market has been strong for several week and as such, the GDR Model is holding a significant long position.