S&P 500 Daily Perspective for Thu 24 Oct 2024

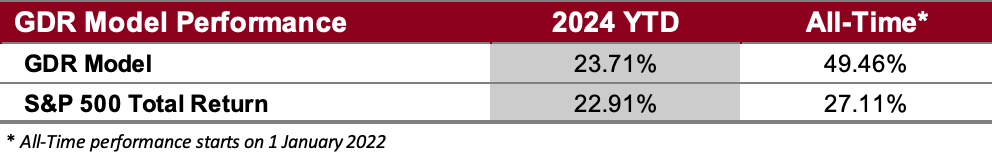

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated and a chart.

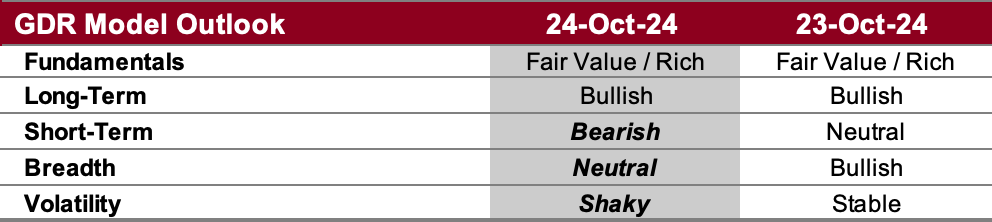

GDR Model Outlook

The GDR Model may be in the process of flipping from bullish to bearish - it would be interesting and probably unusual if this happens ahead of the US election next month. The market has shown significant weakness in the last three consecutive days and volatility has picked up materially.

Note on the Fundamentals Outlook (as of 17 June 2024):

for the first time in a while the model is showing stocks as being richly valued (i.e. overpriced). Note that this is just a barometer to help guide longer-term decision-making.

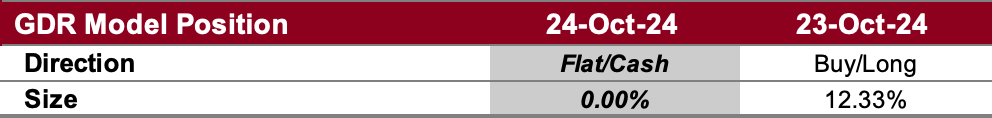

GDR Model Position

The GDR Model is flat. This follows yesterday’s drastic reduction to nearly flat as the model picked up on the market’s weakness as well as the volatility increase. Time will tell if this is the start of a liquidation or if the market will resume its uptrend shortly.