S&P 500 Daily Perspective for Wed 19 Jul 2023

Bullish on breakout from short-term balance

GDR Model Insights for the S&P 500

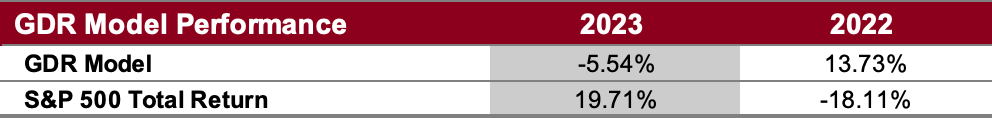

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

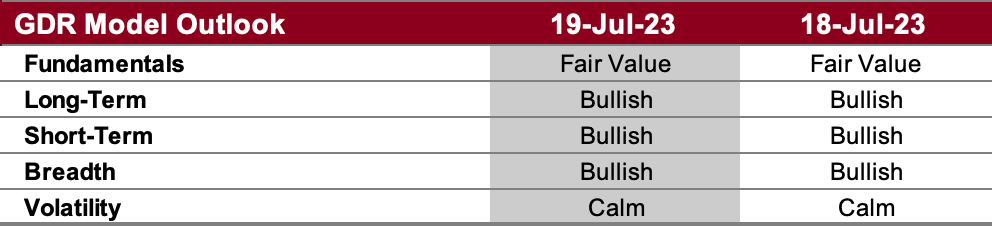

GDR Model Outlook

The GDR Model is bullish.

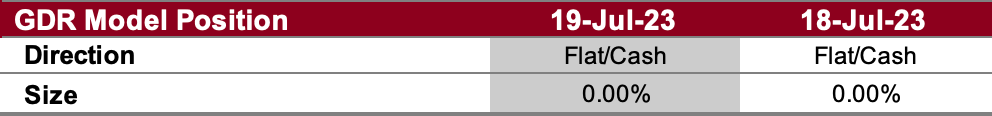

GDR Model Position

Even though the GDR Model remains bullish, it deteced more weakness than prices suggest towards the end of last week. In response, the model has pre-emptively closed its long position. If strength resumes, it would likely reopen the long position.

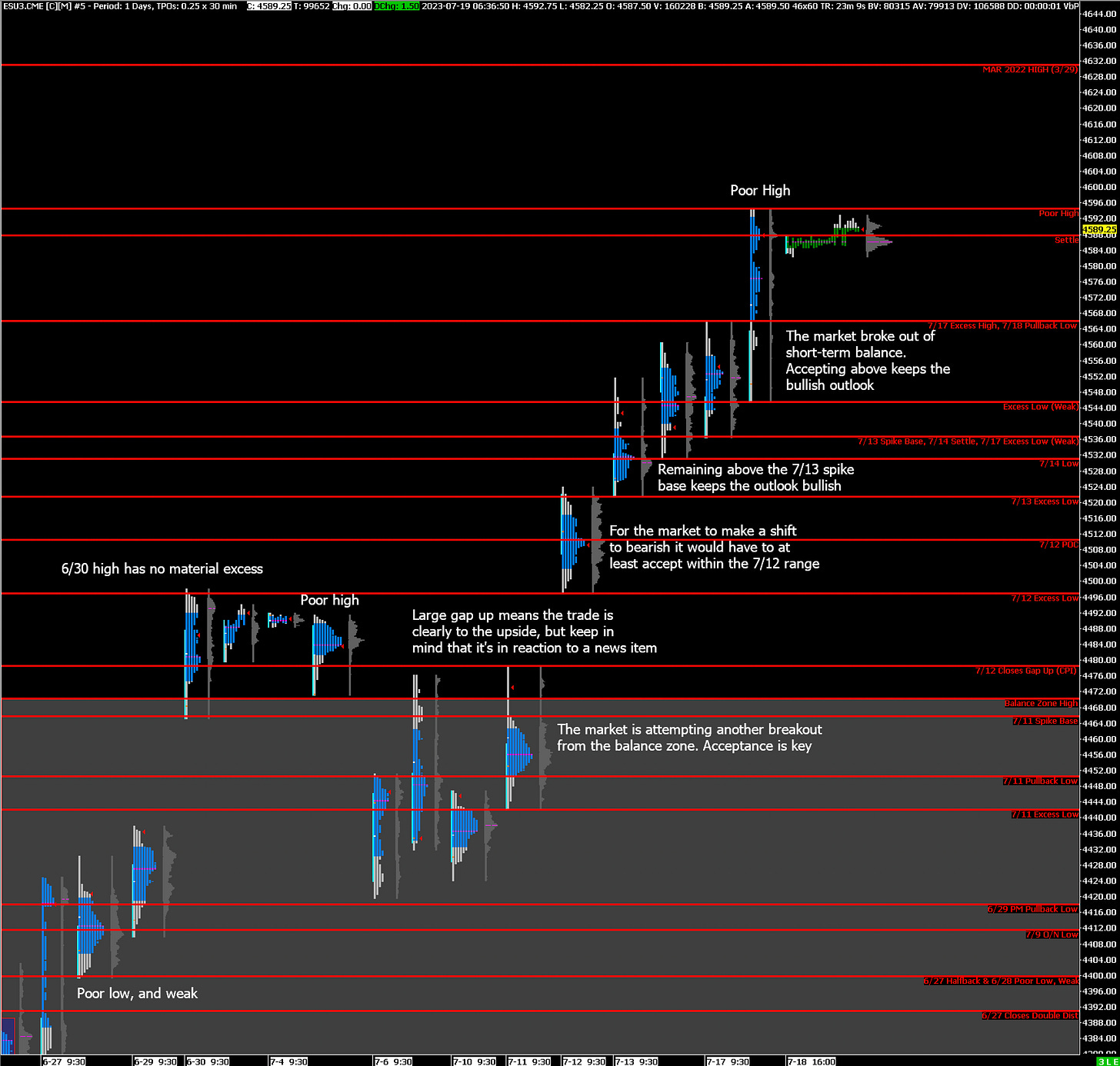

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: short-term balance, could go either way

Alternate Outlook: N/A

Key Levels

Bullish: 4595 (Poor High), 4631 (March 2022 High), 4740 (1/4/2022 Swing High)

Bearish: 4566 (7/17 Excess High, Y’day Pullback Low), 4545 (Y’day Excess Low, Weak Low), 4537 (7/17 Excess Low, Weak Low)

Market Narrative

Yesterday the market broke out of short-term balance, and continued aggressively higher. The trade remains clearly to the upside, however poor structure continues to build up below. While no-one knows when the market will turn back down to repair it, it’s certainly more prudent to not get too carried away on the long side as the risk for long positions continues to grow.

Economic Calendar

8:30am - Building Permits, Housing Starts

Earnings After the Close: TSLA 0.00%↑

Later this Week: none notable