S&P 500 Daily Perspective for Tue 2 May 2023

Sustained Balance is raising the odds of a strong break in either direction

GDR Model Insights for the S&P 500

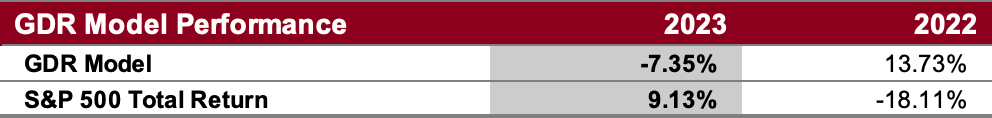

GDR Model Performance

The GDR Model returned 1.82% in April vs the S&P 500’s 1.56%, modestly outperforming the index by 26 basis points. April was marred by possibly the most indecisive market in the last 3 years. Overall this year has been challenging for the Model’s style due to low confidence in the market.

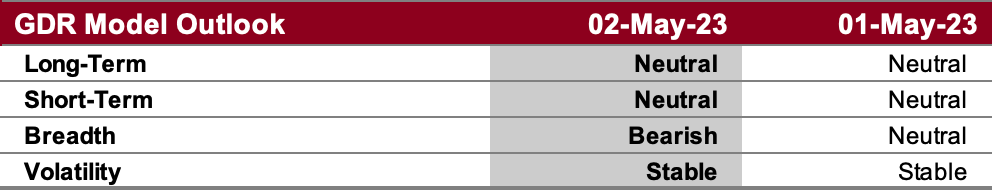

GDR Model Outlook

The overall Model is Neutral despite the strength it picked up on at the end of last week. Should it continue, it will likely enter a Long position soon.

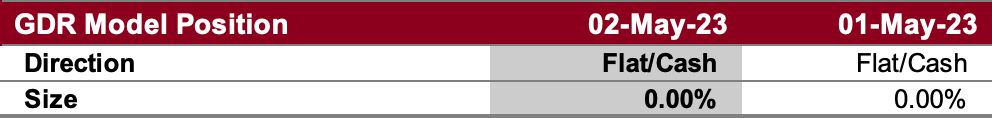

GDR Model Position

Despite the improvement at the end of last week, the model is still not committing to a position as there is not enough conviction.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: Balance after Rejected Breakout

Alternate Outlook: N/A

Key Levels for Today

Bullish: 4188 (Top of Current Balance Zone), 4198 (April High), 4221 (Closes Gap Down)

Bearish: 4172 (Recent Short-Term Balance Low), 4135 (Recent Short-Term Balance Low), 4120 (Closes Recent Single Prints)

Market Narrative

Yesterday’s market traded higher in the morning to repair the O/N Swing High set in mid-April, but then traded back down into the current Balance Zone, rejecting the breakout again yet again. Given the Fed’s Interest Rate announcement tomorrow, a Balancing day is the most likely scenario for today. Probably the best sign of that would be re-entering the recent 3-day Short-Term Balance between 4172 and 4135, marked in yellow on the chart above.

It’s not impossible that the market breaks materially higher or lower today. Should that happen, the character of trade and Market Structure should be carefully analyzed to discern the odds of the market’s reaction to the Fed tomorrow. Note that the April trading range is an unusually tight range that is just slightly greater than that of the current Balance Zone. This area has been working like a magnet, attracting two-way trade, however the longer it’s sustained and the tighter the range, the greater the odds of a strong break in either direction.

Economic Calendar

Today at 10:00am - JOLTs Job Openings, Factory Orders

Later This Week: Fed Interest Rate Decision (Wed), FOMC Press Conference (Wed), AAPL 1.32%↑ (Thu), Nonfarm Payrolls (Fri)