S&P 500 Daily Perspective for Thu 27 Jul 2023

Still bullish, but a successful breakout of current balance is becoming more important

GDR Model Insights for the S&P 500

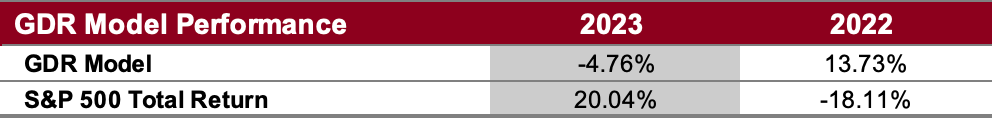

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

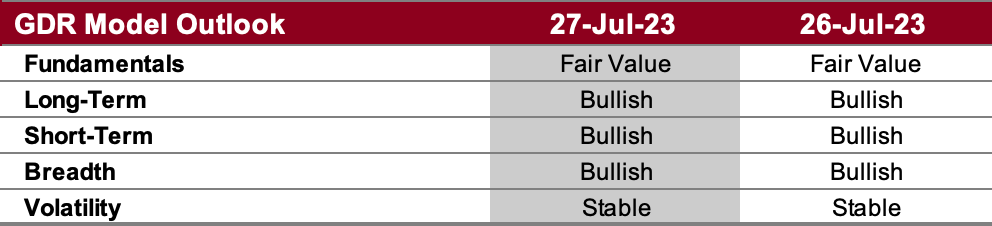

GDR Model Outlook

The GDR Model is bullish. Unless volatility starts to pick up this week, I’ll disregard the recent volatility outlook downgrade from Calm to Stable as it can mostly chalked up to monthly options expiration last Friday.

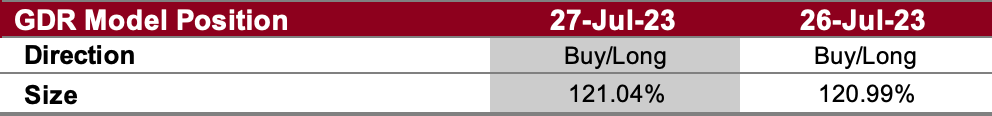

GDR Model Position

After a short break, the GDR Model is back to its long position as its outlook remains bullish across the board. This is a fairly bold position given all the critical data releases coming this week.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: bullish after rejection below trendline

Alternate Outlook: rejected breakout from short-term balance

Key Levels

Bullish: 4594 (Top of Short-Term Balance / Breakout Level), 4611 (Y’day Excess High), 4631 (March 2022 High)

Bearish: 4574 (Y’day Excess Low), 4564 (7/21 Poor Low), 4557 (Bottom of Short-Term Balance)

Market Narrative

The market had a wild afternoon following the Fed interest rate announcement and press conference leaving behind convicing excess high and low. While value ended lower, the close was relatively strong so I would expect the market to at least try to breakout of its short-term balance once more. Whether it fails or succeeds will likely be critical for the current uptrend.

Economic Calendar

8:30am - GDP, Durable Goods, Retail Inventories, Initial Jobless Claims

10:00am - Pending Home Sales

Later this Week: PCE (Fri), XOM -0.05%↓ Earnings (Fri)