S&P 500 Daily Perspective for Tue 30 Dec 2025

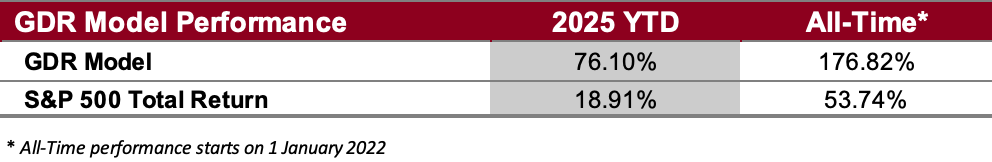

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

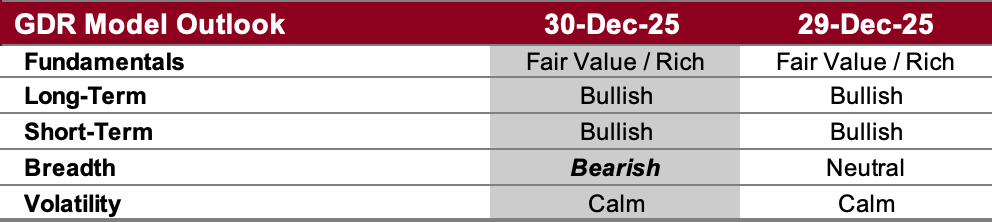

GDR Model Outlook

Overall Outlook (as of 29 Dec 2025): BULLISH. The model is bullish, which means that, according to its framework, the odds of continued upside are relatively high.

Fundamentals Outlook (as of 24 Dec 2025): Fair Value/Rich. The model has adjusted valuations slightly upward following the release of new data. Going forward GDR Model positioning should tactically tilt a little more towards the long side, all else equal. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 26 Dec 2025): Bullish. The market remains strong on the long-term timeframe.

Short-Term Outlook (as of 29 Dec 2025): Bullish. The market remains strong on the short-term timeframe, but today’s trading showed some limited weakness.

Breadth Outlook (as of 29 Dec 2025): Bearish. Breadth has worsened further and is now bearish. There is a possibility this is a canary in the coal mine so it’s worth bearing it in mind for now.

Volatility Outlook (as of 29 Dec 2025): Calm. The volatility outlook has improved to calm. Even though the recent back and forth has been entirely within positive categories, it’s still something to note…

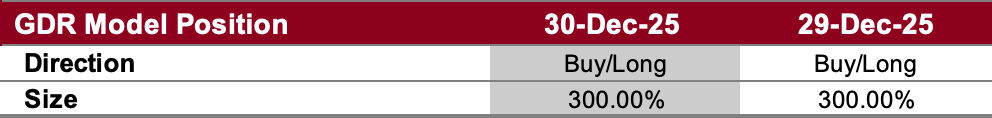

GDR Model Position

The market has been strong for several week and as such, the GDR Model is holding a significant long position.