S&P 500 Daily Perspective for Fri 24 Jan 2025

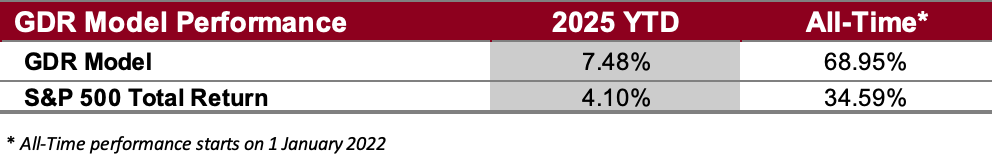

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

GDR Model Outlook

The GDR Model is mostly bullish. The recent indecision is mostly gone and the market looks to be turning bullish at this point. The only blemish is the long-term outlook.

Fundamentals Outlook (as of 17 Jun 2024): for the first time in a while the model is showing stocks as being richly valued (i.e. overpriced). Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 17 Jan 2025): the market has continued to recover but not enough just yet for the long-term outlook to be upgraded to bullish. It seems headed that way though…

Short-Term Outlook (as of 23 Jan 2025): the market has consistently shown strength for several days on the short-timeframe.

Breadth Outlook (as of 23 Jan 2025): the breadth outlook is neutral, but by a small margin. Nothing to worry about at this point.

Volatility Outlook (as of 23 Jan 2025): the volatility outlook has been upgraded to calm. Having a few days of calm markets would likely support a market regime where price mostly goes up without many serious sell-offs.

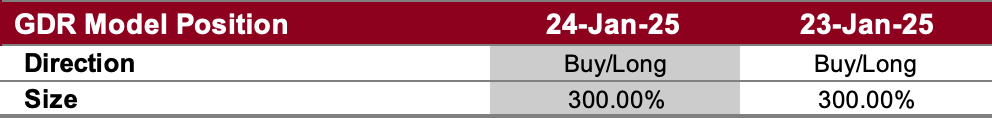

GDR Model Position

The GDR Model is 3x long as the market has restrengthened and sustained that new strength for several days now.