S&P 500 Daily Perspective for Tue 23 May 2023

The market remains bullish after a balancing day

GDR Model Insights for the S&P 500

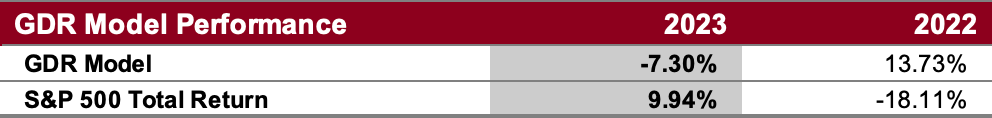

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

GDR Model Outlook

The overall GDR Model is bullish. This could signal potential for a new uptrend, but it’s still not strong enough to confirm.

GDR Model Position

The GDR Model is now long following the market’s additional strength at the end of last week. I would take this as a higher risk position than usual for the model, but process is process - you follow it because over the long-term the odds are favorable.

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: bullish on breakout from balance zone

Alternate Outlook: return to balance zone to repair poor structure below

Key Levels

Bullish: 4226 (Poor High), 4252 (Bottom of Upper Balance Zone), 4264 (Closes Prev Gap Down)

Bearish: 4188 (Top of Lower Balance Zone), 4164 (Weak Low), 4149 (Closes Double Distribution), 4126-4123 (Poor Low and Weak Low)

Market Narrative

Monday’s trading was balanced and therefore not much has changed. The previous market narrative still largely applies and the ES remains in bullish mode. This will remain true as long as the market is able to hold above the top of the balance zone at 4188.

Do carry forward that structure below has deteriorated even further and is very poor. This can hold for a long time before it’s corrected, and keeping in mind that it’s there will help us not be caught off-guard when/if the market sells-off to repair.

Economic Calendar

8:00am - Building Permits

9:45am - Markit Services PMI

10:00am - New Home Sales

Later This Week: Treasury Secretary Yellen Speaks (Wed), FOMC Meeting Minutes (Wed), NVDA -0.94%↓ (Wed), PCE (Fri)