S&P 500 Daily Perspective for Tue 4 Feb 2025

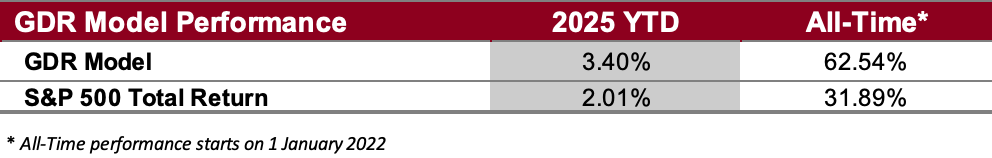

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

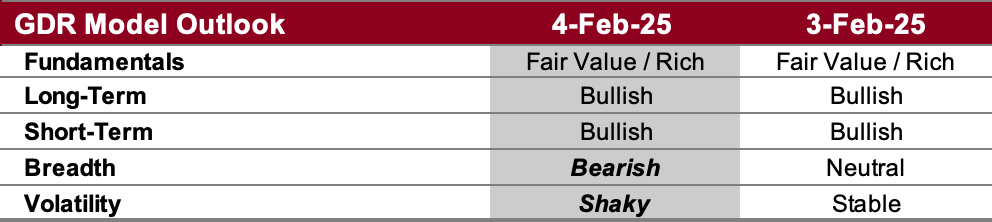

GDR Model Outlook

The GDR Model is bullish, but showing some initial deterioration that threatens to become something serious. At the very least it seems like the market may be returning to indecision.

Fundamentals Outlook (as of 31 Jan 2025): the valuation portion of the model has stocks as being richly valued (i.e. overpriced) for about 6 months now. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 31 Jan 2025): the long-term outlook remains bullish, but the week closed bearish. We may be in for more directional indecision.

Short-Term Outlook (as of 3 Feb 2025): the short-term outlook closed weak despite the strong rally during regular trading hours. Even though the short-term outlook is still bullish, it certainly seems to be weakening…

Breadth Outlook (as of 3 Feb 2025): breadth is bearish. This can portend a shift in market direction.

Volatility Outlook (as of 3 Feb 2025): the volatility outlook deteriorated to shaky. This is a meaningful worsening of market conditions.

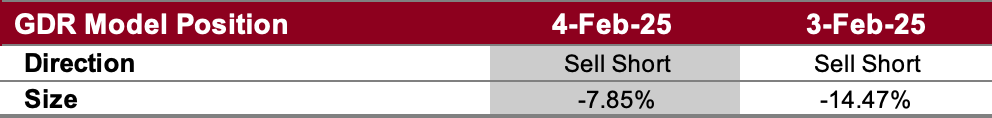

GDR Model Position

The GDR Model has closed its long position in anticipation of a period of market indecision. The model is effectively flat at this point.