S&P 500 Daily Perspective for Wed 3 May 2023

Back to recent Short-Term Balance heading into Fed announcement

GDR Model Insights for the S&P 500

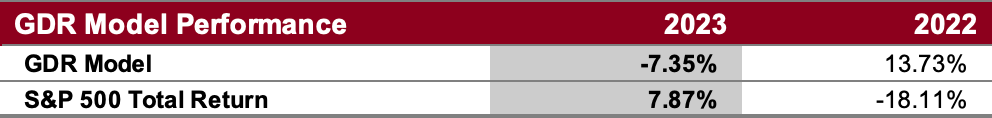

GDR Model Performance

The GDR Model returned 1.82% in April vs the S&P 500’s 1.56%, modestly outperforming the index by 26 basis points. April was marred by possibly the most indecisive market in the last 3 years. Overall this year has been challenging for the Model’s style due to low confidence in the market.

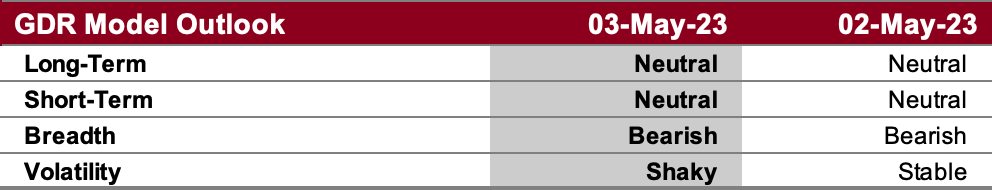

GDR Model Outlook

The overall Model remains Neutral, but Breadth and Volatility have turned more negative ahead of the FOMC announcement today. This can easily change following the Powell Press Conference.

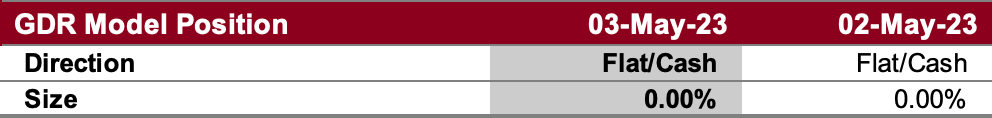

GDR Model Position

Despite the improvement at the end of last week, the model is still not committing to a position as there is not enough conviction.

S&P 500 Futures Market Profile Analysis

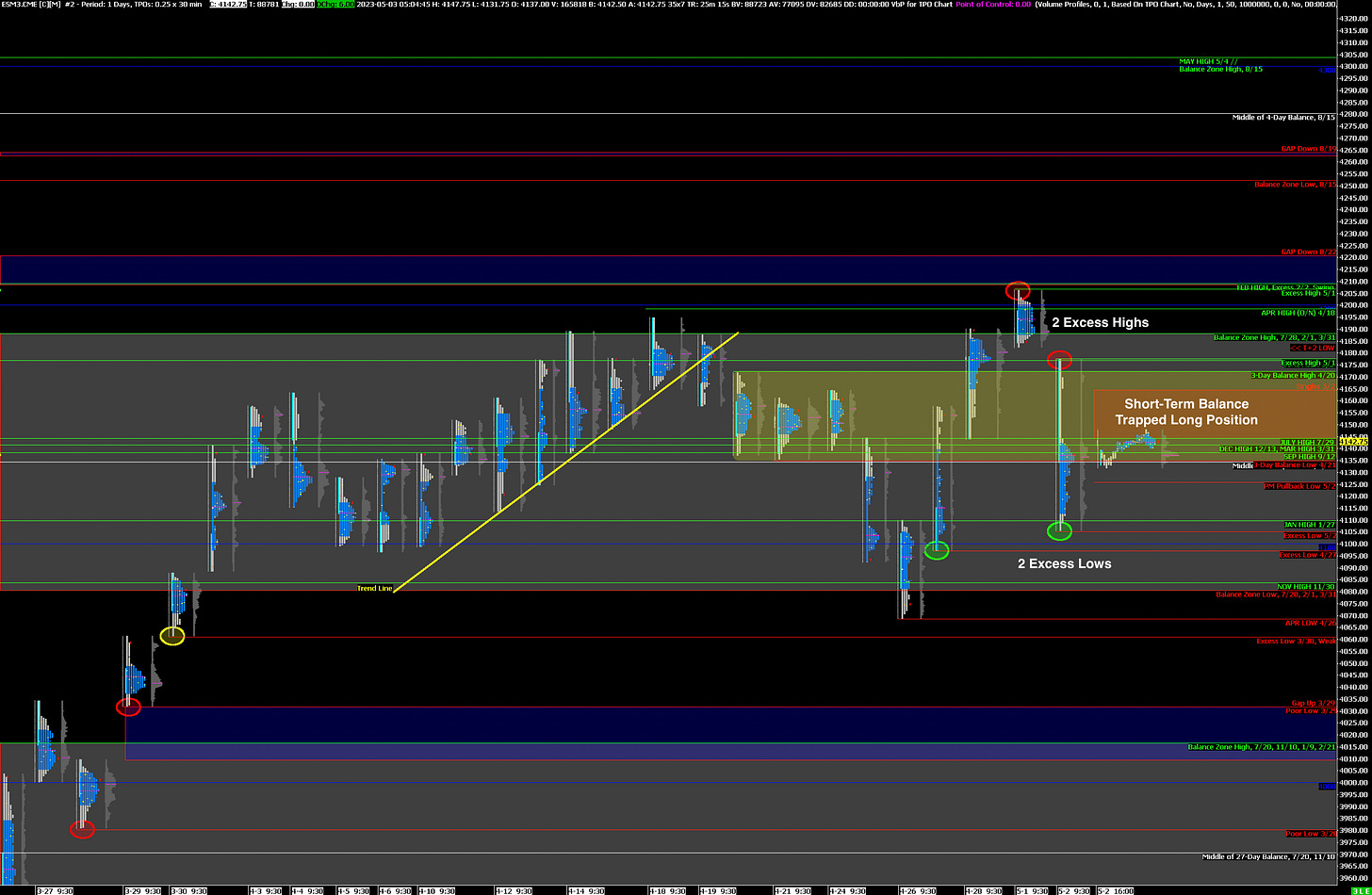

Near-Term Outlook: Back to Short-Term Balance after Liquidation, could go either way

Alternate Outlook: N/A

Key Levels for Today

Bullish: 4172 (Recent Short-Term Balance High), 4188 (Top of Current Balance Zone), 4198 (April High)

Bearish: 4135 (Recent Short-Term Balance Low), 4126 (Y’day Afternoon Pullback Low), 4100 (Go-No-Go Level)

Market Narrative

Yesterday’s the market Liquidated in dramatic fashion before leaving an Excess Low and then retracing all the way back to Halfback. While yesterday was certainly not a Balancing day, the market did end the day back in the 3-day Balance from two weeks ago. Today is the ES is most likely to remain within that Balance up until the Fed’s Interest Rate announcement at 2pm.

Beware of increased Volatility following that interest rate announcement and especially throughout Powell’s Press Conference starting at 2:30pm. Should there be no drastic changes until then, I will be following Balance Trading Guidelines with edges at 4172 and 4135. The market did clean up a lot of Poor Structure below it yesterday but it left Poor Structure above in the process in the form of Single Prints. Again assuming no material changes until the Fed announcement, this creates a slight Bullish edge.

Economic Calendar

Today at 8:15am - ADP Nonfarm Employment

Today at 9:45am - Markit Services PMI

Today at 10:00am - ISM Non-Manufacturing PMI

Today at 2:00pm - Fed Interest Rate Decision

Today at 2:30pm - FOMC Press Conference

Later This Week: AAPL 1.32%↑ (Thu), Nonfarm Payrolls (Fri)