S&P 500 Daily Perspective for Wed 12 Mar 2025

GDR Model Performance

Please see the Performance page for more detailed performance numbers, how they’re calculated, and a chart.

For the fine print (a.k.a. the lawyer-approved stuff), don’t miss the Disclaimers section—it’s where all the “officially important” bits live!

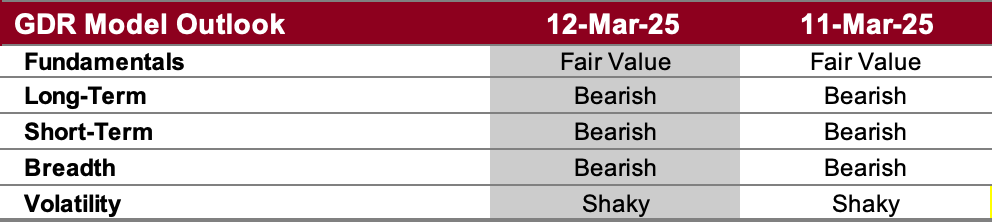

GDR Model Outlook

The GDR Model is bearish and the serious sell-off the model has been pointing towards for several weeks is now well underway.

Fundamentals Outlook (as of 10 Mar 2025): the valuation portion of the model has dropped back down to fair value after many months, which implies valuations are more attractive now. Note that this is just a barometer to help guide longer-term decision-making rather than short-term market timing.

Long-Term Outlook (as of 7 Mar 2025): the long-term outlook remains bearish.There has been persistent weakness over the long-term timeframe and the market is unlikely to fully recover until this weakness gives way to renewed strength.

Short-Term Outlook (as of 11 Mar 2025): the short-term outlook is bearish and has had a weak close for many days in a row now. The market did not show strength at any point today.

Breadth Outlook (as of 11 Mar 2025): breadth remains bearish. This underpins the agreement between all of the model’s components that the market currently has a negative tone.

Volatility Outlook (as of 11 Mar 2025): the volatility outlook remains shaky. As long as this component is shaky or volatile, there won’t be much to stop the market from a significant sell-off (along with nasty short-covering rallies in between).

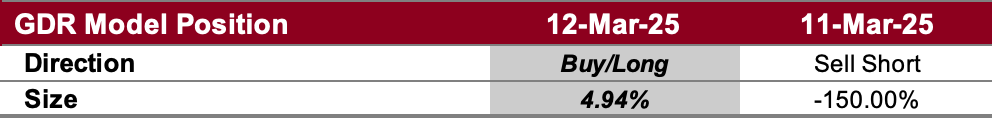

GDR Model Position

The GDR Model has taken profits on its short position. It was a good run. This is more of a tactical shift rather than a change in sentiment - the model still reads the market as being bearish.