S&P 500 Daily Perspective for Mon 10 Jul 2023

Slight bullish edge coming into inflation week, but could go either way

GDR Model Insights for the S&P 500

GDR Model Performance

This year has been challenging for the GDR Model’s style due to low confidence in the market.

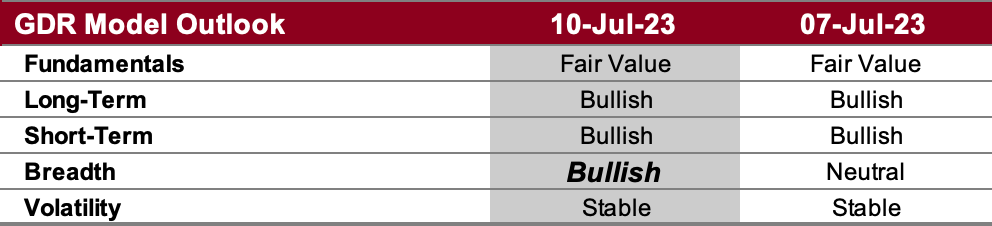

GDR Model Outlook

The GDR Model is bullish.

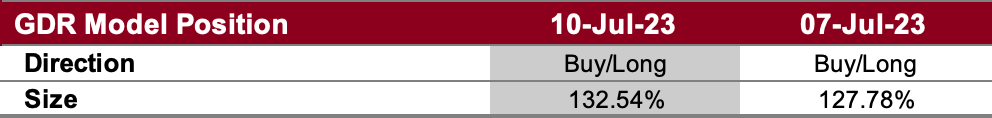

GDR Model Position

The GDR Model has re-opened its long position. However, position size is reduced compared to earlier in the year due to deteriorating fundamentals.

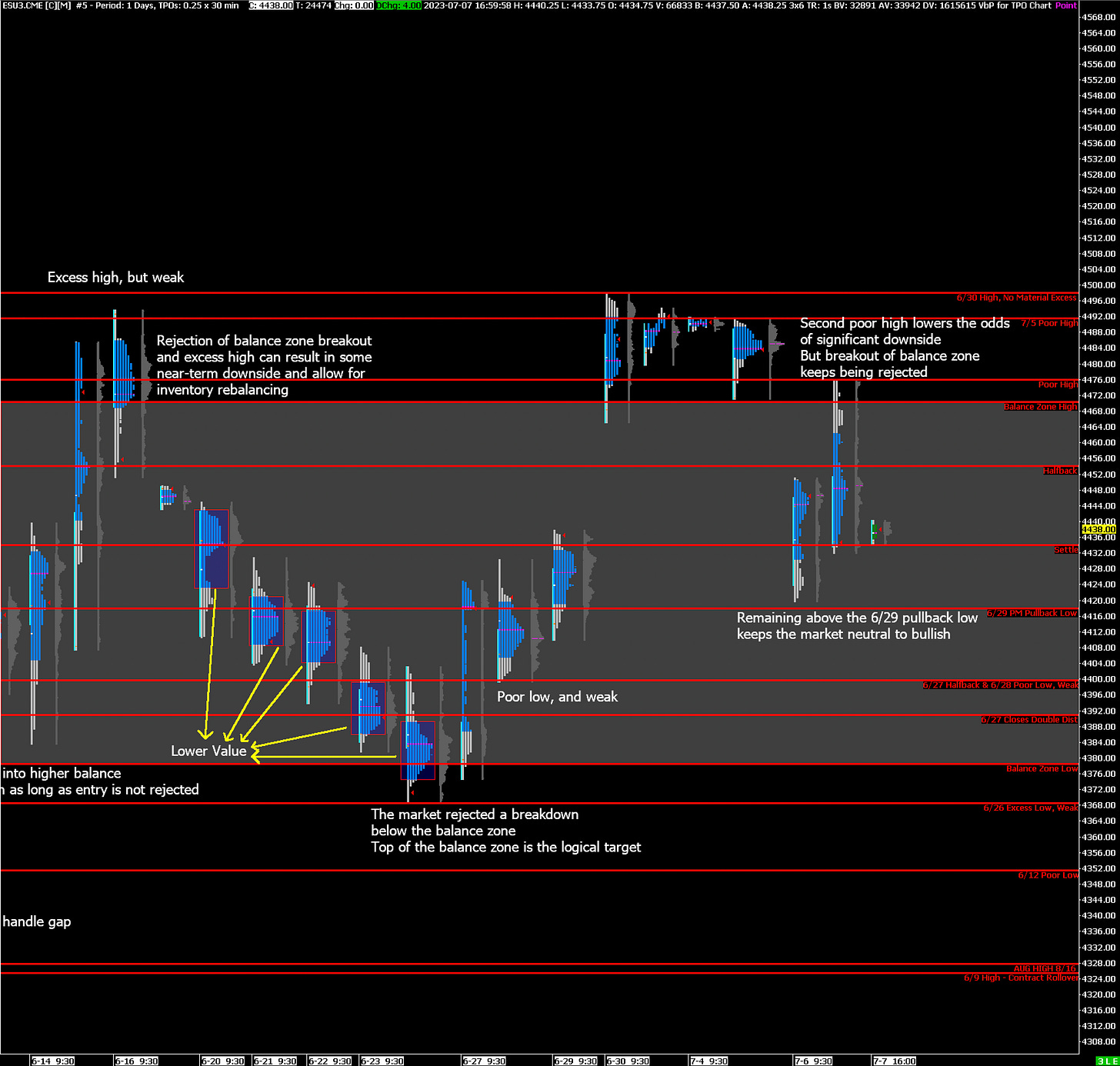

S&P 500 Futures Market Profile Analysis

Near-Term Outlook: bullish following end of week liquidation

Alternate Outlook: retest of balance zone low following third rejected breakdown

Key Levels

Bullish: 4454 (Halfback), 4470 (Top of Current Balance Zone), 4476 (Poor High), 4492 (7/5 Poor High)

Bearish: 4418 (6/29 Pullback Low), 4400 (Poor Low, Weak Low), 4391 (Closes 6/27 Double Distribution), 4378 (Bottom of Current Balance Zone)

Market Narrative

Last Friday the market opened into a short-covering rally that attracted momentum weak-hands traders to go long. As short-term inventories got too long, the market went into liquidation before the end of the trading week. The day ended with an unrepaired poor high, which lowers the odds of significant downside in the near-term.

On the other hand, yesterday the market rejected a third breakout from the current balance zone. In these situations, the next logical target is the balance zone low (4378). Indeed, while there have been wide daily ranges recently, the market has been trading mostly within the current balance zone (gray box in the chart above) for the last 17 trading days.

Economic Calendar

10:00am - FOMC Member Barr Speaks

Later this Week: CPI (Wed), PPI (Thu)